“`html

The S&P 500: Heavyweights Driving Market Gains

The S&P 500 (SNPINDEX: ^GSPC) consists of 500 companies across 11 sectors, making it the most diversified major stock market index in the U.S. However, its market capitalization weighting means that the largest firms significantly shape its performance. Currently, five companies dominate the index with a combined market cap of $14.9 trillion, accounting for 28.8% of the index’s total value:

Start Your Mornings Smarter! Subscribe to Breakfast News delivered to your inbox every market day. Sign Up For Free »

- Apple (NASDAQ: AAPL), $3.8 trillion.

- Nvidia (NASDAQ: NVDA), $3.3 trillion.

- Microsoft (NASDAQ: MSFT), $3.2 trillion.

- Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), $2.3 trillion.

- Amazon (NASDAQ: AMZN), $2.3 trillion.

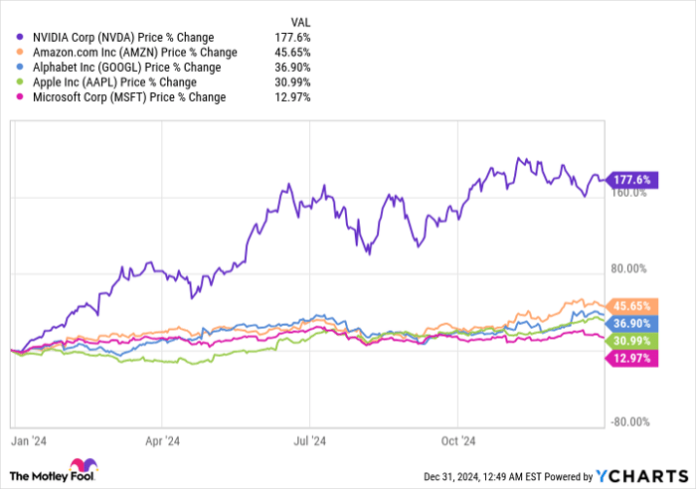

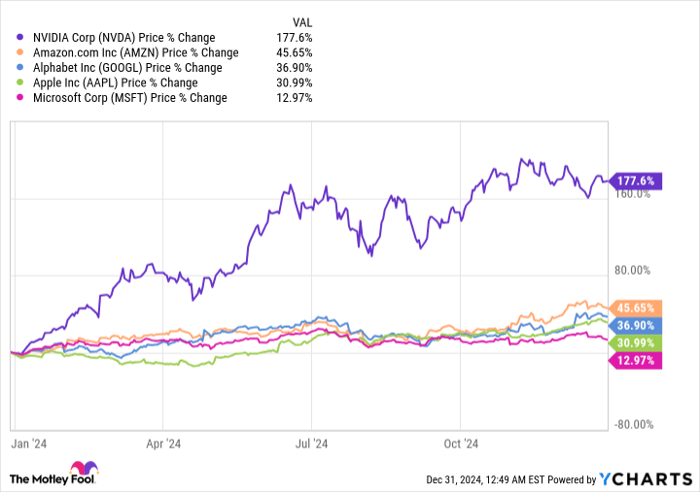

In 2024, the S&P 500 achieved a remarkable return of 25%. In contrast, the S&P 500 Equal Weight index—which treats all stocks equally regardless of size—only returned 10%. This gap can largely be attributed to the stellar average gain of 61% among the five major companies.

NVDA data by YCharts

The value generated by these five firms in 2024 is fueled by their significant investments in artificial intelligence (AI). Together, they are expected to invest hundreds of billions of dollars this year to advance their AI technologies, which may further elevate their status within the S&P 500.

1. Apple: 7.6% of the S&P 500

Apple has recently unveiled its Apple Intelligence software designed for the latest iPhones, iPads, and Mac computers. This suite of AI-powered tools can summarize communications and generate responses instantly. Additionally, it tailors notification priorities based on user preferences.

Even the Siri voice assistant has seen enhancements, incorporating capabilities from OpenAI’s ChatGPT.

Apple Intelligence leverages the company’s advanced chips—the A18 Pro for iPhones, and the M3 and M4 for iPads and Macs—tailored for on-device AI processing. This technology positions Apple to be a leader in AI distribution to consumers, given the 2.2 billion devices in use globally.

2. Nvidia: 6.6% of the S&P 500

In 2016, Nvidia CEO Jensen Huang delivered the first AI supercomputer to OpenAI, and since then, it has emerged as the primary supplier of graphics processors (GPUs) critical for AI development. Tech companies are vigorously seeking Nvidia’s latest chips for their data centers.

The recent introduction of Blackwell GB200 GPUs signifies a major leap in performance. The Blackwell-based GB200 NVL72 system can now perform AI inference at speeds up to 30 times greater than the previous H100 system, enabling the deployment of the most complex AI models.

With demand vastly exceeding supply for these chips, Nvidia aims to achieve record revenues—anticipated at $128.6 billion for fiscal 2025, concluding this month, and nearing $200 billion for fiscal 2026.

Nvidia’s stock has soared 800% over the past two years, yet it may still offer value, possibly increasing its footprint in the S&P 500 this year and beyond.

3. Microsoft: 6.3% of the S&P 500

At the beginning of 2023, Microsoft made headlines by announcing a $10 billion investment in OpenAI. This partnership has fostered the development of its own AI virtual assistant, Copilot, which is now integrated into key applications like Windows, Edge, and Bing.

Copilot can also be added to the 365 productivity suite, providing users with tools to create content quickly in Word and PowerPoint, streamlining workflows. With more than 400 million employees using 365, just a small uptake could lead to substantial recurring revenue.

Additionally, Microsoft has implemented a suite of AI services on its Azure cloud platform, catering to developers looking for advanced infrastructure and large language models to build their applications. For fiscal 2024, the company allocated $55.7 billion in capital expenditures, focusing heavily on AI chip and data center investments.

4. Alphabet: 4.1% of the S&P 500

Alphabet, Google’s parent company, commands a 90% share in the internet search industry. The rise of AI chatbots, like ChatGPT, is reshaping information access and putting pressure on traditional search methods. In response, Alphabet has introduced its AI model family, Gemini, along with a chatbot sharing the same name. These innovations aim to transform Google Search’s functionality.

Instead of merely generating lists of links, Google now often provides direct text responses to queries, thanks to AI. The new AI Overviews feature enhances this further by integrating text, images, and links for more comprehensive answers. Early results show these Overviews generate more user engagement, crucial since Google Search drives the majority of Alphabet’s revenues.

5. Amazon: 4.1% of the S&P 500

Amazon stands at the forefront of global e-commerce and is seamlessly integrating AI into its customer experience…

“`

Amazon’s Innovations: Revolutionizing E-Commerce and Cloud Capabilities

Virtual Assistants and Advanced AI Technology

Amazon offers a virtual shopping assistant named Rufus, designed to help customers find the right products. In its fulfillment centers, the company uses a tool called Project Private Investigator. This system employs AI and computer vision to detect defective products prior to shipping, aiming to reduce the costly issue of returns.

AWS Expands Its AI Footprint

Amazon Web Services (AWS) stands as the world’s leading provider of cloud services. The company seeks to establish dominance across three vital areas of AI: data center infrastructure, large language models (LLMs), and software. To support this ambition, AWS has developed its own proprietary chips, a range of models named Titan, and an AI virtual assistant called Q.

Strong Financial Performance in 2024

In the third quarter of 2024, AWS reported total revenues amounting to $27.4 billion, reflecting a 19% increase compared to the same period last year. Moreover, AWS’s AI revenue experienced remarkable growth, exceeding triple-digit percentages. Amazon notes that this segment is expanding at three times the rate of its cloud business during a similar developmental phase.

The company has committed approximately $75 billion to AI capital expenditures in 2024 and is poised to invest even more in 2025 to solidify its leadership position in the market.

Seize the Opportunity with “Double Down” Stocks

Do you feel like you’ve missed out on investing in top-performing stocks? There’s good news for you.

Our team of analysts occasionally identifies a “Double Down” stock—companies they believe are on the verge of significant growth. If you’re concerned about missing your investment chance, now may be the optimal time to act, supported by impressive data:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $348,216!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $47,425!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $480,681!*

Currently, we are providing “Double Down” alerts for three exciting companies, and the window of opportunity may close soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool invests in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein represent the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.