“`html

Growth Stocks Shine Amid Concerns of Overextension

2024 proved to be an exceptional year for many mega-cap growth stocks, contributing to the rise of broader indexes like the S&P 500 (SNPINDEX: ^GSPC). Despite this success, some investors are beginning to question whether the current rally is sustainable.

In a market filled with optimism, even underperforming companies can experience stock price increases. However, over the long term, the top-performing stocks are typically those that meet or exceed investor expectations while continually pushing for innovation. Therefore, as the S&P 500 hits new heights, it is crucial to prioritize investments in quality companies.

Start Your Mornings Smarter! Subscribe to Breakfast news for daily market insights. Sign Up For Free »

Investing in dividend stocks can provide a way to secure passive income regardless of market fluctuations. Here’s a closer look at why Broadcom (NASDAQ: AVGO), Visa (NYSE: V), Salesforce (NYSE: CRM), Meta Platforms (NASDAQ: META), and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) are positioned as leaders in their fields, capable of increasing their dividends even through economic challenges.

Image source: Getty Images.

Dividend Leaders Showing Strong Growth

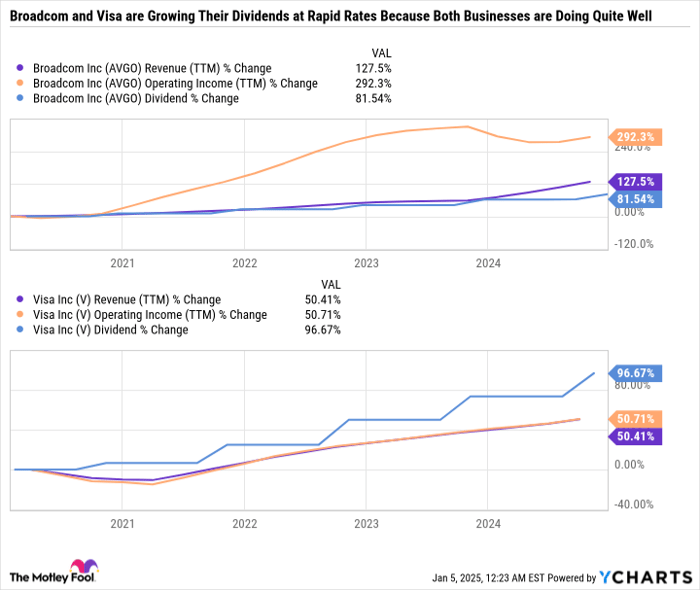

Recently, Broadcom and Visa reported impressive increases to their dividends for 2025. Broadcom raised its payout by 11%, while Visa increased its dividend by 13%. Analysts anticipate both companies will announce further hikes of at least 10% later this year.

These two companies exemplify successful dividend-paying growth stocks. Broadcom thrives in network connectivity and artificial intelligence (AI), whereas Visa operates a vast payment processing network for debit and credit transactions.

With both Broadcom and Visa experiencing notable growth in sales and income, they can afford to distribute a portion of their profits back to shareholders through dividends. Over the last five years, Broadcom’s dividend has surged by 81.5%, while Visa’s payout has nearly doubled. Notably, these dividends remain manageable and do not deplete too much of their available capital.

AVGO Revenue (TTM) data by YCharts

Long-term investors appreciate Broadcom’s focus on expanding its AI product range over issuing large dividends, while Visa prioritizes buybacks in its capital return strategy. Over the past five years, Visa has successfully reduced its share count by 11%, enhancing its earnings per share at a faster rate than its net income and maintaining a favorable valuation.

With current yields of 1.2% for Broadcom and 0.8% for Visa, these lower percentages reflect the significant appreciation in their stock prices rather than a lack of commitment to dividend growth.

Emerging Dividend-Paying Growth Companies

Meta Platforms, Salesforce, and Alphabet began offering dividends in 2024, marking a new chapter in their financial strategies.

Meta announced its dividend on February 1, coinciding with its fourth-quarter and full-year 2023 results. Similarly, Salesforce declared its dividend on February 28, alongside its own quarterly performance report.

Alphabet unveiled its first dividend on April 25 after releasing its first-quarter 2024 results. It’s anticipated that all three companies will follow regular schedules for annual dividend increases in sync with their initial announcements.

Each of these companies currently offers dividends yielding 0.5% or less, but they are expected to deliver substantial annual percentage increases in the upcoming years, evolving into reliable dividend-growth stocks like Broadcom and Visa.

All three firms boast strong profitability and significant free cash flow (FCF), despite increased investment in AI. FCF yield measures the potential payout based on cash flow available for dividends to shareholders.

Similar to dividend yield, FCF yield is calculated as FCF per share divided by the share price. As with dividend yield, rising stock prices decrease the FCF yield. In 2024, each of Salesforce, Meta, and Alphabet surpassed the S&P 500, resulting in reduced FCF yields. Nevertheless, they maintain solid FCF yields even amid their record spending on research and development.

CRM Free Cash Flow Yield data by YCharts

Each of these companies is in a position to enhance their dividends substantially without compromising their long-term growth goals.

Five Balanced Opportunities for 2025

While Broadcom, Visa, Salesforce, Meta, and Alphabet may not initially attract income-focused investors, the growth potential in their payouts could surprise many.

At present, these dividends simply add extra value to their already solid investment propositions.

Investors prioritizing income for retirement might prefer stocks with higher yields and a long track record of growing payouts. However, those emphasizing total returns—capital gains plus dividends—should consider a company’s growth potential as a predictor of future dividend increases rather than focusing on today’s yields.

With ample opportunities for growth ahead, Broadcom, Visa, Salesforce, Meta, and Alphabet present compelling dividend-growth options as we head into 2025.

Potential Investment Opportunities Await

Have you ever felt like you missed the opportunity to invest in major success stories? Here’s your chance to catch up.

Our team of analysts occasionally identifies “Double Down” stocks, which they believe are about to experience significant growth. If you’re concerned you’ve missed your opportunity, now is a strategic time to consider investing before the market shifts.

- Nvidia: if you had invested $1,000 when we issued a “Double Down” in 2009, you’d have $363,307!*

- Apple: if you had invested $1,000 when we doubled down in 2008, you’d have $45,963!*

- Netflix: if you had invested $1,000 when we doubled down in 2004, you’d have $471,880!*

Currently, we’re identifying three exceptional “Double Down” stocks, and this opportunity may not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Randi Zuckerberg, the sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also on the board. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool recommends and holds positions in Alphabet, Apple, Meta Platforms, Microsoft, Salesforce, and Visa, and recommends long and short options on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`