“`html

Earnings Season Brings Promising Prospects for Key Stocks

The fourth-quarter 2024 earnings season begins this week with several banking sector companies set to reveal their financial results. The overall outlook is optimistic, signaling resilience and steady improvement across various sectors.

While many stocks are projected to exceed expectations this earnings season, we have identified a few standout performers likely to surprise investors with their results. These stocks—Vertiv Holdings Co (VRT), The Goldman Sachs Group (GS), ResMed (RMD), Ralph Lauren Corp (RL), and Amazon.com (AMZN)—are expected to gain value as the earnings reports roll in.

Looking Ahead to Q4 Earnings

The latest Earnings Trends report indicates that total S&P 500 earnings are predicted to rise by 7.4% compared to the same period last year, supported by a 4.8% increase in revenues. While estimates have generally trended upward, the extent of estimate reductions has notably decreased compared to previous quarters.

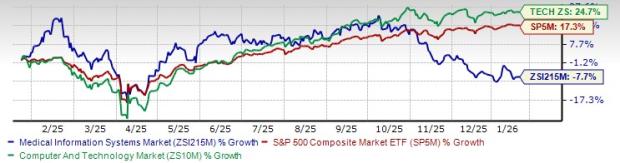

Out of the 16 Zacks sectors, nine are forecasted to deliver significant earnings growth in the fourth quarter. The strongest growth is anticipated in the Technology sector (14.9%), followed by Finance (12.7%), Medical (12.3%), Consumer Discretionary (8.1%), Retail (7.2%), and Business Services (7.2%).

The Technology sector has emerged as a key driver of growth lately, with expectations for continued success in the fourth quarter and beyond. Earnings from the Technology sector are expected to rise by 14.9% year-over-year, accompanied by 10.4% higher revenues. This marks the sixth consecutive quarter of double-digit earnings growth.

Additionally, the earnings of the “Magnificent 7,” which constitute a large portion of the S&P 500 Index, are projected to increase by 20.9% from last year, helped by a 12.3% rise in revenues.

Keep track of all quarterly releases:Check out the Zacks Earnings Calendar.

Tips for Picking Stocks

Beating earnings estimates can boost investor confidence and drive stock prices higher. To identify strong candidates, we utilize a proprietary method based on a combination of a positive Earnings ESP (Expected Surprise Prediction) and a favorable Zacks Rank—specifically, Zacks Ranks of #1 (Strong Buy), #2 (Buy), or #3 (Hold). You can access the full list of today’s Zacks #1 Rank stocks here.

Earnings ESP identifies potential surprises by focusing on the latest analyst revisions. When analysts adjust their estimates just before earnings announcements, it often indicates they have new insights that can provide a more accurate forecast compared to earlier estimations.

Stocks that have both a positive Earnings ESP and a Zacks Rank of #3 or better have historically achieved earnings surprises 70% of the time. Over a 10-year backtest, investors using these selections have recorded annual returns averaging 28.3%. Users can find top stock picks ahead of their earnings reports using our Earnings ESP Filter.

Spotlight on Technology

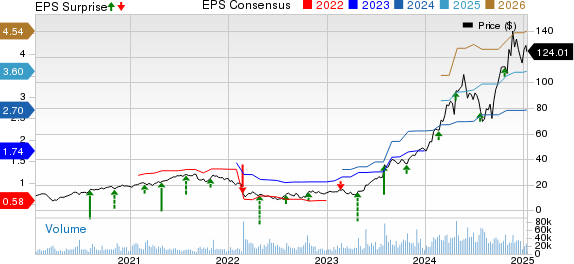

Vertiv Holdings specializes in digital infrastructure and continuity solutions, offering a diverse range of hardware, software, analytics, and services. It currently holds an Earnings ESP of +1.60% and a Zacks Rank of #2.

As a significant player in the data center equipment market, Vertiv benefits from the increasing demand fueled by artificial intelligence advancements. Key growth factors include strong partnerships with chip manufacturers and innovations to meet the rising energy needs of servers.

Analysts are optimistic about Vertiv’s outlook, with an average brokerage recommendation (ABR) of 1.25 from 16 firms. Fourteen of those firms rate it as a Strong Buy, giving it an approval rate of 87.5%. The average price target for Vertiv is $145.07, with predictions ranging between a low of $131.00 and a high of $161.00. Presently, shares of VRT are trading below the lowest price target—indicating a potential 5.3% upside.

The consensus estimate for the upcoming quarter has been revised upward by a penny in the past week, suggesting a 50% earnings growth. Revenues are also expected to rise by 15.2% compared to last year. Vertiv achieved an average earnings surprise of 10.13% over the last four quarters. It is scheduled to announce earnings on February 19.

Vertiv Holdings Co. Price, Consensus and EPS Surprise

Vertiv Holdings Co. price-consensus-eps-surprise-chart | Vertiv Holdings Co. Quote

Focusing on Finance

Goldman Sachs, a prominent global financial institution, offers a variety of services, including investment banking, securities, investment management, and consumer banking. The company has an Earnings ESP of +1.98% and a Zacks Rank of #2.

The stock has increased nearly 6% in the last three months, driven by strong activity from institutional clients and improved fee income. Recent cuts in interest rates have also enhanced the company’s margins, particularly as the Federal Reserve has lowered rates by 100 basis points since September, helping to stabilize funding and deposit costs.

Goldman Sachs carries an ABR of 1.91, a slight rise from 1.83 a month ago. Of the 23 brokerage firms covering the stock, 12 recommend Strong Buy and one suggests Buy, accounting for 52.17% and 4.35%, respectively, of all recommendations. The average price target from analysts stands at $616.45, with estimates ranging from $491.00 to $736.00.

In the past week, Goldman has seen a positive earnings estimate revision of three cents for the forthcoming quarter. Analysts expect earnings to grow by 45.8% and revenues by 7.8%. Historically, Goldman has outperformed earnings estimates in five of the last eight quarters, achieving an average earnings surprise of 29.33% over the previous four quarters. Goldman Sachs is scheduled to announce earnings on January 21.

The Goldman Sachs Group, Inc. Price, Consensus and EPS Surprise

The Goldman Sachs Group, Inc. price-consensus-eps-surprise-chart | The Goldman Sachs Group, Inc. Quote

Healthcare Insights

ResMed is a leading designer and manufacturer of devices and accessories used to treat sleep-disordered breathing (SDB) and other respiratory issues. The company currently holds an Earnings ESP of +0.14% and a Zacks Rank of #2.

ResMed is experiencing solid growth thanks to strong mask sales and a successful range of respiratory care products, alongside an emphasis on international expansion. This trend is expected to bolster the company’s future earnings as well.

Analysts have a moderately positive outlook for ResMed, with an ABR of 2.33 among 15 brokerage firms, of which six are rated as Strong Buy, comprising 40% of all recommendations. The average target price sits at $253.10, with estimates varying between a low of $190.00 and a high of $283.00.

The stock has recently enjoyed a positive revision in earnings estimates…

“`

ResMed, Ralph Lauren, and Amazon: Earnings Growth and Future Prospects

ResMed’s Earnings Forecast Shows Positive Growth

ResMed Inc. expects a 21.8% increase in earnings for the upcoming quarter. Revenue growth is projected at 8.5%, while the company has surprised analysts by an average of 6.41% in the last four quarters. Earnings are scheduled to be announced on January 30.

ResMed Inc. Price, Consensus and EPS Surprise

ResMed Inc. price-consensus-eps-surprise-chart | ResMed Inc. Quote

Ralph Lauren’s Strategic Moves Aimed at Growth

Ralph Lauren is a prominent designer, marketer, and distributor of high-end lifestyle products across North America, Europe, and Asia. With an Earnings ESP of +0.30% and ranked #2 by Zacks, Ralph Lauren remains optimistic about its future.

The company is currently advancing its “Next Great Chapter: Accelerate Plan.” This initiative focuses on refining its global structure and enhancing technological capabilities. As part of this strategy, Ralph Lauren recently transitioned its Chaps brand to a licensed business to better align its portfolio.

The firm’s commitment to improving product offerings, personalized marketing, efficient inventory management, and targeting a favorable mix of markets fuels its growth. Currently, it holds an ABR of 1.69, with 11 of the 16 brokerage firms recommending a Strong Buy and one advising Buy, making those two categories 68.75% and 6.25% of all assessments, respectively. The average price target for Ralph Lauren stands at $245.44, with estimates varying from $150.00 to $300.00.

In the latest week, earnings estimates for Ralph Lauren increased by one penny for the upcoming quarter, with an expected growth rate of 7.4% and revenue growth projected at 4.37%. The company has delivered an earnings surprise of 9.13% on average over the last four quarters, with earnings expected to be released on February 13.

Ralph Lauren Corporation Price, Consensus and EPS Surprise

Ralph Lauren Corporation price-consensus-eps-surprise-chart | Ralph Lauren Corporation Quote

Amazon: A Giant in E-commerce and AI

Amazon is recognized as one of the largest e-commerce companies, expanding its reach significantly in North America and globally. With an Earnings ESP of +13.45% and a Zacks Rank of #1, Amazon continues to impress analysts.

Driving this growth are its cloud computing and advertising sectors, along with a remarkable expansion of its AI business, which is experiencing triple-digit growth. A strong performance during the holiday season is anticipated to boost the company’s fourth-quarter revenues and earnings. Investments in data centers and technology to support AI functions are rapidly increasing.

Recently, Amazon constructed an AI supercomputer using its Trainium chips and developed a new server for AI startup Anthropic. This positions Amazon to compete against NVIDIA (NVDA) in the lucrative graphics processing unit market. Furthermore, Amazon invested an additional $4 billion into Anthropic, which has created the Claude chatbot, a competitor to OpenAI’s ChatGPT.

Analysts have a positive outlook on Amazon, reflected in its ABR of 1.10. Of the 50 brokerage firms, 46 recommend a Strong Buy while three suggest a Buy, indicating that 92% recommend Strong Buy and 6% recommend Buy. The average price target for Amazon is $248.12, with estimates ranging between $197.00 and $290.00.

Over the past seven days, Amazon’s earnings estimate revised positively by three cents for the quarter, with earnings growth expected at 51.49%. Revenue growth is also anticipated to be in double digits. The company has achieved an average earnings surprise of 25.85% over the last four quarters and is set to announce its earnings on February 6.

Amazon.com, Inc. Price, Consensus and EPS Surprise

Amazon.com, Inc. price-consensus-eps-surprise-chart | Amazon.com, Inc. Quote

Opportunity Awaits: Infrastructure Spending on the Rise

With trillions of dollars allocated for infrastructure upgrades across America, significant investments will flow into not just roads and bridges, but also AI data centers and renewable energy projects.

Markets are gearing up for this spending surge, so it is vital to identify which stocks are strategically positioned to benefit from this trend.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” for insights on five surprising stocks that stand to gain the most from this growing financial wave.

Stay updated with the latest recommendations from Zacks Investment Research. You can download our report on the “7 Best Stocks for the Next 30 Days” for free today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

ResMed Inc. (RMD): Free Stock Analysis Report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.