Investing Smart: Top Picks from the Vanguard Value ETF

With $186 billion in net assets and a low 0.04% expense ratio, the Vanguard Value ETF (NYSEMKT: VTV) stands as one of the largest low-cost exchange-traded funds (ETFs) available. With a modest minimum investment of just $1, this fund allows investors to gradually build their portfolio. It features 336 holdings from various sectors and offers a yield of 2.3%, surpassing the 1.3% yield of the Vanguard S&P 500 ETF.

This ETF provides an excellent opportunity for passive investment in leading value stocks. Nonetheless, some investors may seek to further capitalize on standout opportunities within the fund.

Strong Passive Income Stocks

Within the Vanguard Value ETF, selecting just five stocks to buy until 2025 includes Coca-Cola (NYSE: KO), PepsiCo (NASDAQ: PEP), and Chevron (NYSE: CVX) for passive income. In contrast, Broadcom (NASDAQ: AVGO) and Oracle (NYSE: ORCL) are chosen for their growth potential. Let’s explore these selections.

Image source: Getty Images.

Coca-Cola and PepsiCo are recognized as Dividend Kings, having paid and raised dividends for 62 and 52 consecutive years, respectively. These companies prioritize returning profits via dividends. However, both have recently faced sell-offs due to weaker consumer spending and pricing pressures.

Despite a strong annual performance, Coca-Cola’s stock has dropped 8.7% in the last month following disappointing earnings. Conversely, PepsiCo’s growth remains modest, up under 4% over three years as the company contends with declining volumes across its beverage brands and its Frito-Lay and Quaker Oats segments.

Yet, both Coca-Cola and PepsiCo have strong product lines, and their current challenges may be manageable, presenting a worthwhile buying opportunity for long-term investors.

Chevron operates in a different sector but shares similar appeal. The company has increased its dividend for 37 consecutive years and offers an attractive 4.3% yield, exceeding the average in the Vanguard Value ETF.

Pressure from falling oil prices affects energy companies, yet Chevron’s efficient and diversified portfolio, along with its significant refining and marketing operations, provides resilience.

Chevron’s business model is designed to thrive in various oil price scenarios, predicting stability even if prices fall to $50 per barrel. Currently, West Texas Intermediate crude oil prices hover around $67, marking their lowest levels for 2024.

Tech Growth Opportunities

Choosing Broadcom and Oracle from the Vanguard Value ETF might come as a surprise as they seem more suited for a growth-focused investment. However, both companies have demonstrated significant revenue growth recently and have seen their market caps rise substantially.

Broadcom produces hardware and software solutions spanning cloud infrastructure and other tech applications, making it an essential player in global connectivity and crucial infrastructure support.

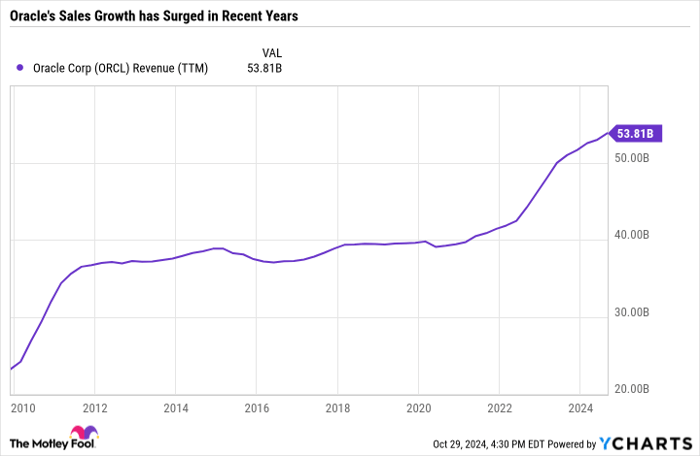

Oracle has shifted its emphasis from traditional database software to cloud computing, resulting in substantial high-margin sales growth. The company has expanded its dividends since initiating them in 2009, steadily increasing payouts from $0.05 to $0.40 per share per quarter. In parallel, Broadcom’s dividend has grown from $0.007 to $0.53 during this same timeframe.

In the past year, Oracle’s stock has risen by 72%, whereas Broadcom shares increased by 114%. Although rapid price hikes have lowered their yields—Oracle now at 0.9% and Broadcom at 1.2%—both firms still attract investors focused on value and passive income through dividends.

Broadcom’s shares saw a 4.2% surge on October 29 after it announced a partnership with OpenAI for a new chip. This reflects its ongoing commitment to artificial intelligence, though AI is just part of its expansive offerings.

ORCL Revenue (TTM) data by YCharts

Despite past struggles, Oracle is now positioned well within the tech landscape, having found new opportunities through AI. Its cloud division is noted for being simpler and more adaptable than many competitors, offering a broad range of services.

A Second Chance at Investment Opportunity

Do you ever worry that you’ve missed your chance at good investments? Now may be your opportunity to revisit that thinking.

Occasionally, our team of analysts makes a rare “Double Down” recommendation for stocks they believe are poised for rapid growth. If you’re concerned that the window for investment has closed, this may be the prime time to act. The success stories speak volumes:

- Amazon: A $1,000 investment in 2010 is worth $22,292 now!*

- Apple: A $1,000 investment in 2008 has grown to $42,169!*

- Netflix: Investing $1,000 in 2004 would now yield $407,758!*

Currently, we are issuing alerts for three remarkable companies, and opportunities like this may not be available again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron, Oracle, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Value ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.