C3.ai: Bridging the AI Gap for Businesses

In a recent study by McKinsey and Company, it was revealed that 72% of businesses have implemented artificial intelligence (AI) in at least one area. Nevertheless, only 8% are utilizing AI across five or more functions, suggesting that many companies remain cautiously experimental with their AI strategies.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks for immediate investment. See the 10 stocks »

Though the costs associated with developing AI are decreasing—illustrated by the DeepSeek scenario—companies still require substantial financial backing and expertise. C3.ai (NYSE: AI) aims to address this challenge by providing over 130 ready-to-use applications that assist businesses in accelerating their AI adoption.

C3.ai’s stock is currently trading 80% below the all-time high reached during the tech boom of 2020. However, as the company experiences accelerating revenue growth, its stock is becoming more appealing. Investors with around $35 might want to consider purchasing a share in this AI innovator.

AI Made Accessible Across Industries

C3.ai caters to a diverse range of sectors including financial services, manufacturing, healthcare, transportation, and the oil and gas industry. Many of these sectors typically do not associate with cutting-edge technology, driving them to seek assistance from firms like C3.ai. The company claims that it can deploy a functional AI application able to solve a specific business issue within three to six months after an initial client meeting.

The implementation process is straightforward. Given that many businesses utilize a primary cloud services provider for their digital operations, C3.ai has ensured its applications are compatible with major platforms such as Microsoft Azure and Amazon Web Services. This approach allows C3.ai to harness the immense computing capacity of these platforms, equipping clients with the power necessary for effective AI deployment.

For instance, Shell, an oil and natural gas leader, is developing over 100 AI applications to monitor more than 10,000 pieces of equipment to avert disastrous failures. Additionally, the company uses C3.ai’s Real-Time Production Optimization application to boost efficiency at its liquefied natural gas facilities, significantly reducing carbon emissions. This is just one example of how businesses are enhancing their operations using C3.ai’s technology.

Looking ahead, C3.ai’s partnership with Microsoft Azure, which extends until 2030, could further expand its customer base. This collaboration will expedite the adoption of C3.ai’s applications among Azure customers, with Microsoft even subsidizing initial pilot programs.

Boosting Revenue Growth

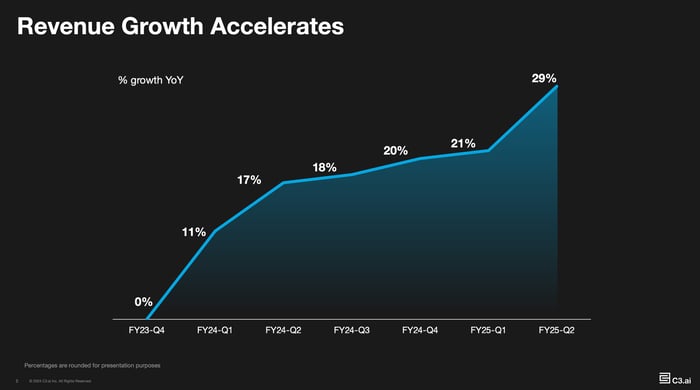

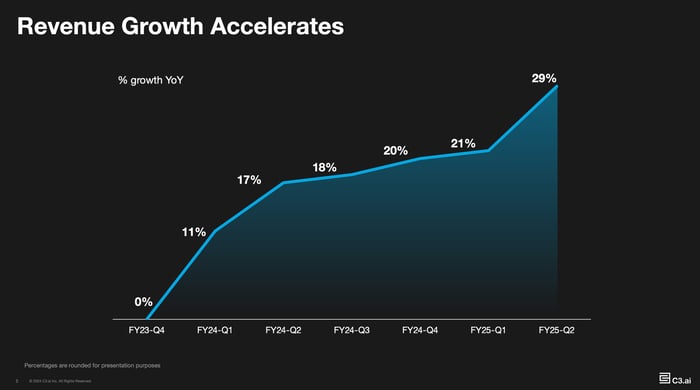

Two and a half years ago, C3.ai transitioned from a subscription revenue model to a consumption-based model, streamlining contract processes and enabling quicker client engagement, as clients only pay for what they utilize.

Initially, this change resulted in a noticeable decline in revenue growth—a consequence that management anticipated as it took time for consumption to ramp up. Nevertheless, the aim was to facilitate faster revenue increases over the long haul, and this strategy is now yielding positive results.

In its fiscal 2025 second quarter (ending October 31), C3.ai reported an impressive $94.3 million in revenue, marking a 29% increase compared to the same quarter the previous year. This marks the seventh consecutive quarter of accelerating growth.

Image source: C3.ai.

Despite significant revenue gains, C3.ai continues to operate at a loss, primarily due to heavy investments in research, development, and marketing to broaden its product offerings and attract new clients.

Through the first six months of fiscal 2025, the company recorded a net loss of $128.8 million, a slight improvement from a $134.1 million loss in the same period last year. However, when viewed through a non-GAAP lens, which excludes one-time and non-cash expenses like stock-based compensation, C3.ai’s adjusted net loss for this period was only $14.7 million.

C3.ai holds more than $730 million in cash and marketable securities, providing ample runway to manage losses in the coming years. Investors will likely look for a continued decrease in losses as a sign of progress toward profitability.

A Favorable Valuation for C3.ai Stock

C3.ai entered the public market late in 2020 amid a stock market frenzy fueled by pandemic stimulus measures from the government and the Federal Reserve. At its peak that year, the stock reached $161, leading to a price-to-sales (P/S) ratio that exceeded 80—a valuation deemed unsustainable.

Although the stock has recently recovered from a 52-week low, it remains 80% lower than its record high. This decline, coupled with continuous revenue growth, has reduced the P/S ratio to a more reasonable 11.2, which is below its long-term average of 16.

AI PS Ratio data by YCharts

C3.ai’s CEO, Thomas Siebel, likens the rise of AI to significant technological events like the emergence of the internet and smartphones. He anticipates a massive market opportunity of $1.3 trillion for C3.ai, based on Bloomberg research, highlighting that the current revenue is just a fraction of this potential.

When considering C3.ai’s broad addressable market, accelerating growth, and appealing valuation, it seems reasonable to view its stock as a compelling long-term investment.

Is C3.ai Stock a Good Investment for You?

Before purchasing stock in C3.ai, it’s important to weigh your options:

The Motley Fool Stock Advisor analyst team has identified their picks for the 10 best stocks for investors right now, and C3.ai was not included. The stocks that did make the list are believed to have the potential for significant returns in the near future.

Consider that when Nvidia appeared on this list on April 15, 2005… a $1,000 investment then would now be worth $714,954!*

Stock Advisor offers investors a clear path to success, featuring portfolio-building guidance, regular updates from analysts, and two new stock recommendations each month. The Stock Advisor service has outperformed the S&P 500 by more than four times since 2002*.

Learn more »

*Stock Advisor returns as of February 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends C3.ai and also suggests options like long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.