“`html

Tech Titans to Watch: Micron and AMD are Poised for Growth as 2025 Approaches

Today’s episode of Full Court Finance at Zacks discusses the current state of the stock market as we head into 2025.

The episode highlights two technology stocks—Micron and Advanced Micro Devices—trading over 50% below their average price targets, suggesting they may be good buys for long-term investment in artificial intelligence (AI).

Regardless of market fluctuations before Christmas, a major pullback is expected to reassess inflated stock valuations.

Investors are encouraged to prepare their watchlists to take advantage of the next market dip. This upcoming downturn should be quickly capitalized on given the optimistic outlook for earnings growth in 2025 and 2026. Furthermore, slower interest rate cuts imply ongoing economic stability.

Fortunately, there are attractive stocks trading at significant discounts even before the market’s next move downward.

The two prominent semiconductor stocks examined today are both trading more than 40% below their highs as we approach Christmas. Both Micron and AMD offer investors a chance to engage with the growing AI sector.

Consider Micron Stock: Over 40% Discount with Significant Long-Term AI Potential

Micron Technology, Inc. (MU) faced a downturn following disappointing results for Q1 fiscal 2025 and guidance on December 18.

The company noted a “weaker” short-term outlook for consumer markets, contributing to a bleak forecast for Q2. However, they expect a return to growth in that sector during the latter half of FY25.

Despite the recent selloff, Micron’s growth in AI is remarkable. Their AI-focused data center revenues surged 40% from the previous quarter and more than 400% year-over-year, elevating data center sales to over 50% of total revenue for the first time. CEO Sanjay Mehrotra remarked, “We continue to gain share in the highest margin and strategically important parts of the market and are exceptionally well positioned to leverage AI-driven growth.”

Image Source: Zacks Investment Research

Micron anticipates record demand for memory chips driven by AI, positioning itself as a key supplier for Nvidia’s (NVDA) leading AI processors. The company is projected to increase revenue by 44% in FY25 and 26% in FY26, potentially reaching approximately $46 billion—adding $20 billion to revenues between FY24 and FY26.

Adjustments predict Micron’s earnings to rise by 566% in FY25, followed by another 45% increase in the succeeding year. These estimates may adjust slightly as more analysts update their forecasts after Q1 results.

Some of the cautious earnings outlook is already reflected in Micron’s stock price. Additionally, Micron maintains a solid balance sheet and offers dividends. Wall Street analysts remain bullish, with 24 out of 29 brokerage ratings from Zacks categorized as “Strong Buys.”

Image Source: Zacks Investment Research

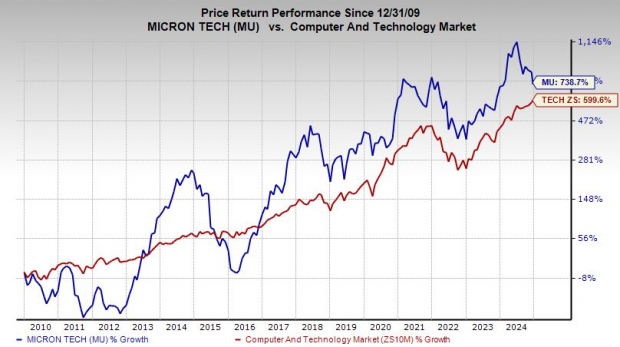

Despite its volatility, Micron stock has gained 740% over the last 15 years, compared to the tech sector’s 600%. This includes a 43% drop from its summer 2024 peaks, resulting in Micron trading 70% below its average price target set by Zacks.

Currently, Micron is trying to find support at its 2024 lows, closely aligning with the highs of 2021 and 2022. In terms of valuation, MU trades at a 66% discount compared to the tech sector, far below its historical highs at 9.1x forward earnings.

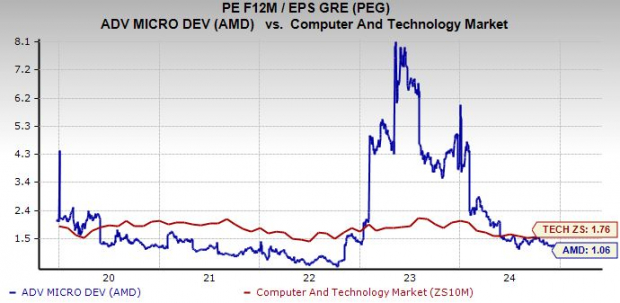

With its impressive earnings growth and current downturn, Micron is trading at a 90% discount relative to the tech sector when considering its price-to-earnings-to-growth (PEG) ratio.

Why Invest in AMD: A Challenging Yet Promising Opportunity

Advanced Micro Devices (AMD) stands out in the semiconductor industry, focusing on GPUs and CPUs. Currently, AMD is striving to expand its share in the AI chip market, competing against heavyweight Nvidia.

Over the past decade, AMD has thrived with the rapid growth of the gaming sector, data centers, and more. The company’s revenue grew from around $4 billion in FY15 to nearly $23 billion last year.

However, AMD remains significantly behind Nvidia, the leader in AI chips. Since March, Wall Street has been bearish on AMD’s stock, fearing it may not be able to catch up to Nvidia. Nevertheless, the burgeoning AI market presents substantial opportunities for AMD, which is benefiting from the same trends fueling Nvidia’s growth.

Image Source: Zacks Investment Research

“`

AMD Reports Impressive Q3 Revenue Growth Amid AI Boom

Strong Performance Driven by Data Center Products

AMD achieved record revenue in the third quarter, largely due to “higher sales of EPYC and Instinct data center products, alongside strong demand for our Ryzen PC processors.” The company is on track to achieve record annual sales in 2024, thanks to growth in AI data centers.

Bright Future with Solid Revenue Projections

Though AMD may play second fiddle to Nvidia in the AI chip arena, it remains a strong contender. Analysts expect AMD’s revenue to increase by 13% in 2024 and jump 26% in 2025, rising from $22.68 billion in FY23 to $32.37 billion in 2025. Furthermore, adjusted earnings are projected to grow by 25% in 2024 and 48% in 2025.

Image Source: Zacks Investment Research

Strategic Adjustments Amid Market Challenges

Following last quarter’s less-than-ideal guidance, AMD is re-evaluating its business strategy. The stock has dipped 18% in 2024, trailing the tech industry’s 30% growth, and currently trades over 40% below its peak in March. Analysts anticipate a 57% increase in stock value based on the average price target from Zacks, with the majority of brokerage recommendations indicating “Strong Buys.”

Valuation Insights Amidst a Competitive Landscape

AMD shares are currently valued at a 30% discount compared to its five-year average, at 28.9 times forward earnings, and are close to the tech industry’s metrics. Despite recent declines, the outlook for strong earnings growth positions AMD 40% lower than the tech sector based on its PEG ratio.

Image Source: Zacks Investment Research

Long-Term Growth and Historic Gains

Despite experiencing a remarkable increase of over 4,400% in stock value over the past decade, far surpassing the tech sector’s 322%, AMD is currently testing support levels at its 200-week moving average, while hitting some of its lowest Relative Strength Index (RSI) readings in ten years.

Zacks Lists Top 10 Stocks for 2025

Be among the first to discover Zacks’ top ten stock picks for 2025, which could yield outstanding returns.

Since 2012, under the guidance of Sheraz Mian, the Zacks Top 10 Stocks portfolio has returned +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Sheraz is currently sifting through 4,400 companies to select the best ten for 2025. Don’t miss the opportunity to invest in these stock recommendations when they’re revealed on January 2.

Discover the latest insights from Zacks Investment Research. You can download a report featuring “5 Stocks Set to Double” at no cost.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.