Choosing the Right Dividend ETF for Steady Income

Are you in need of dividends? You’re not alone; many investors appreciate the reliability of cash payments arriving in their accounts. While individual dividend stocks can be risky, diversifying through an exchange-traded fund (ETF) can help mitigate this risk.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

With numerous dividend ETFs available, which one is best for income-focused investors? One option stands out, albeit unexpectedly.

Understanding the Importance of Yield

The ProShares S&P 500 Dividend Aristocrats® ETF (NYSEMKT: NOBL) is a popular choice for those looking for an ETF that simplifies dividend income. The term “Dividend Aristocrats” is a registered trademark of Standard & Poor’s Financial Services LLC.

The stocks within this ETF have consistently paid and increased dividends for at least 25 consecutive years. Currently, it has a trailing yield of about 2%. Although this yield is modest, it’s important to note that the underlying dividends have demonstrated long-term growth.

Yet, this might not be the best fit for all investors.

Similarly, the iShares Core Dividend Growth ETF (NYSEMKT: DGRO) tracks the Morningstar US Dividend Growth Index. This ETF includes companies that have increased their annual payouts for at least five consecutive years. It encompasses over 400 stocks with an average trailing yield of 2.3%, appealing to investors seeking growth.

Comparing the Top Dividend ETFs

The key difference lies in how these ETFs’ underlying indexes are constructed.

The Dividend Aristocrats ETF comprises an equal-weighted group of 66 S&P 500 (SNPINDEX: ^GSPC) stocks meeting the 25-year criteria. However, not all these companies offer significant growth beyond their steady dividends.

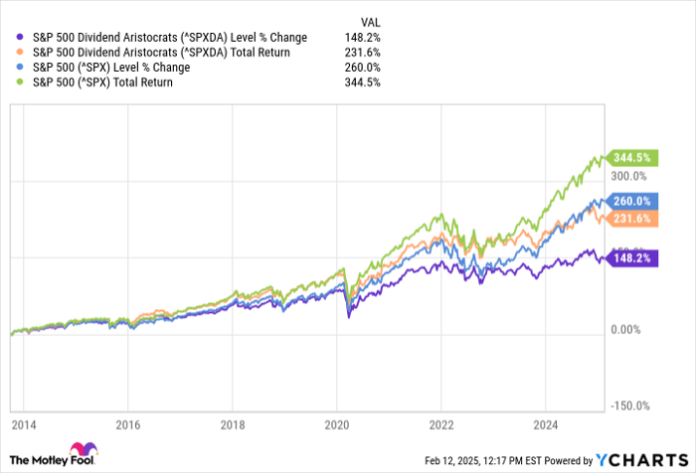

For instance, J.M. Smucker and Amcor have experienced share price declines over the past decade. Despite their high-quality dividend payouts, this ETF has lagged in capital appreciation in recent years.

^SPXDA data by YCharts.

The Morningstar US Dividend Growth Index has a somewhat different approach, lowering the bar for dividend growth criteria, but introducing a level of evaluation to ensure stocks can sustain their dividends.

Nonetheless, the index’s construction method may also influence performance. Top holdings like JPMorgan Chase and Johnson & Johnson rely on the total value of their dividend payments rather than market capitalization.

In contrast, the Vanguard Dividend Appreciation ETF’s underlying index — the S&P U.S. Dividend Growers Index — opts for a balance of quality and growth potential. Stocks must have raised their dividends for at least 10 years to qualify. It excludes the highest-yielding 25% of names, suggesting that high yields might indicate underlying issues, like potential dividend cuts.

The methodology shows promise; The Hartford indicates that consistent dividend payers tend to outperform the overall market over time. Moreover, companies that maintain robust dividends without sacrificing their growth often yield better returns.

Looking back, the Vanguard fund’s quarterly dividend payment has roughly doubled over the last decade.

Long-Term Commitment is Key

This does not imply that owning the ProShares S&P 500 Dividend Aristocrats ETF or the iShares Core Dividend Growth ETF guarantees a loss. Each of these ETFs shares similar attributes, and switching solely to the Vanguard fund may not be necessary, especially if it triggers tax consequences.

However, this comparison highlights that not all ETFs in the same category function the same way. Experienced investors understand that small differences become significant over time. The unique advantages of the Vanguard Dividend Appreciation ETF are most relevant for long-term holders. If you sell too quickly, you risk exiting the market during a downturn, potentially undervaluing dividend stocks.

Seize a New Opportunity in the Market

Do you feel like you’ve lost out on investing in some of the biggest success stories? If so, you may want to pay attention to this.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for firms they believe are on the verge of significant growth. If you’ve worried about missed chances, now is an opportune moment to act. The figures speak for themselves:

- Nvidia: If you had invested $1,000 when we recommended it in 2009, you’d have $360,040!

- Apple: A $1,000 investment at our 2008 recommendation would now be worth $46,374!

- Netflix: Investing $1,000 when we doubled down in 2004 would yield $570,894!

Currently, we are issuing “Double Down” alerts for three promising companies, and another opportunity like this may not come anytime soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amcor Plc, J.M. Smucker, JPMorgan Chase, ProShares S&P 500 Dividend Aristocrats ETF, and Vanguard Dividend Appreciation ETF. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.