MercadoLibre Faces Short-Term Challenges but Remains a Strong Long-Term Investment

MercadoLibre (NASDAQ: MELI) has become a popular choice among long-term investors, yet the stock has experienced a downturn following its latest earnings report. In the past two months, it has dropped by about 20%.

Initially, the decline was triggered by missed earnings expectations, leading to concerns about profitability. However, this may represent a special opportunity for long-term investors to enter the market. The core business of MercadoLibre continues to grow quickly, and several future catalysts could significantly boost revenue in the coming years.

Start Your Mornings Smarter! Get Breakfast news delivered to your inbox every trading day. Sign Up For Free »

Current Profit Struggles But Strong Growth Continues

As previously noted, the primary factor for MercadoLibre’s stock decline was its missed profit targets. The company’s EBIT margin plummeted by 7.4 percentage points year-over-year during the third quarter, influenced by increased growth investments and rising bad debt. Notably, free cash flow turned out to be negative.

This situation warrants attention, but it is crucial to realize that MercadoLibre’s growth trajectory remains strong. The e-commerce segment sold 28% more items compared to a year ago, adding over 10 million active buyers. Additionally, the Mercado Pago payment processing arm experienced 34% year-over-year growth, bringing its annual payment volume to over $200 billion. Lastly, the emerging credit division has seen outstanding loan balances rise to $6 billion, marking a 77% increase from the previous year’s third quarter.

Reasons to Consider MercadoLibre Right Now

One significant factor is that MercadoLibre’s primary operations offer ample growth potential. Currently, e-commerce penetration in the U.S. sits at around 16%, with even lower percentages in the Latin American markets where MercadoLibre operates. The same applies to the adoption of cashless payments, especially given the large unbanked population in the region.

The Latin American market boasts over 650 million people, nearly double that of the U.S. As logistics in this region continue to improve, it will open opportunities for more online transactions.

Moreover, several of MercadoLibre’s initiatives are still in their infancy but show enormous promise. The company’s credit card services and investment platform have both nearly tripled in size over the past year, with the latter seeing assets under management soar by 93% in the last quarter. Additionally, the Mercado Ads platform is just beginning to expand beyond product advertising, potentially driving future high-margin revenue. The new MELI+ subscription model, similar to Amazon (NASDAQ: AMZN) Prime, could deepen customer engagement with MercadoLibre’s diverse services.

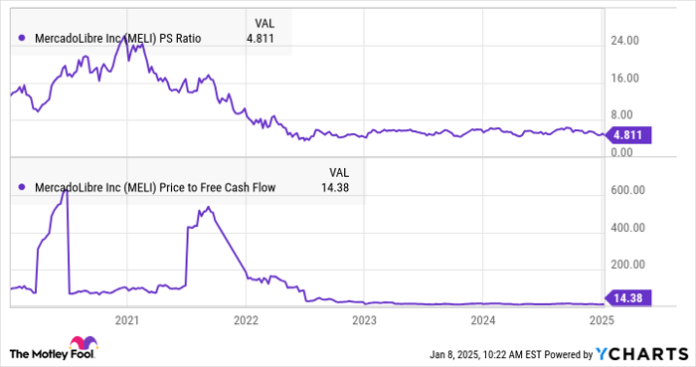

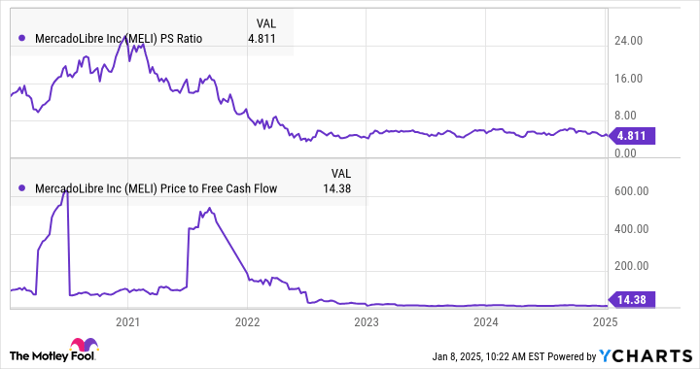

Valuation considerations also come into play. Although the stock surged by 180% over the past five years, its valuation has decreased according to many financial metrics due to its rapid business growth. For instance, MercadoLibre’s current price-to-sales ratio is down by approximately 64% from what it was five years ago, and it trades at a historically low valuation of just 14.5 times trailing-12-month free cash flow, compared to about 96 at the start of 2020.

MELI PS Ratio data by YCharts

Final Thoughts

Despite being down about 20% from its recent highs, MercadoLibre’s stock appears to be undervalued based on several assessments. With impressive growth momentum and considerable future opportunities, MercadoLibre remains one of my top choices as we approach 2025, even though it represents one of my largest investments already.

Should You Invest $1,000 in MercadoLibre Now?

Before deciding to invest in MercadoLibre, it’s important to consider this:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to invest in right now, and MercadoLibre did not make the list. The recommended stocks have the potential for substantial returns in the upcoming years.

For example, when Nvidia was included in this list on April 15, 2005, a $1,000 investment would now be worth $832,928!

Stock Advisor offers a straightforward plan for investors, including portfolio guidance, regular updates from analysts, and two new stock picks each month. Since its launch, the Stock Advisor service has achieved returns that are more than four times those of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, ex-CEO of Whole Foods Market, which is an Amazon subsidiary, serves on The Motley Fool’s board. Matt Frankel holds positions in both Amazon and MercadoLibre. The Motley Fool has positions in and recommends Amazon and MercadoLibre. Their disclosure policy is available for review.

The opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.