Meta Platforms Set to Announce Q3 Earnings: Analysts Expect Strong Results

Social media powerhouse Meta Platforms (META) is preparing to announce its third-quarter fiscal 2024 results today, right after the market closes.

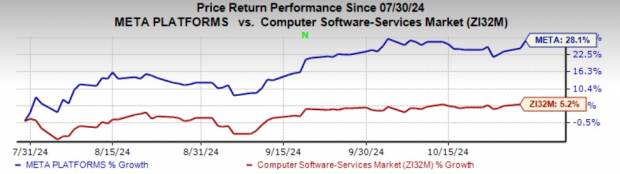

META has shown impressive growth, with returns of 28.1% over the past three months, significantly outpacing the industry average of 5.2%. Analysts anticipate that this upward trend will likely continue, as Meta has a strong chance of exceeding earnings estimates. Recent positive revisions in earnings projections typically signal a potential earnings beat, further supported by analysts becoming more optimistic ahead of the report.

Image Source: Zacks Investment Research

ETF Spotlight on Meta Platforms

Attention is now shifting towards exchange-traded funds (ETFs) that have made significant investments in Meta. Notable ones include iShares Global Comm Services ETF (IXP), Fidelity MSCI Communication Services Index ETF (FCOM), Vanguard Communication Services ETF (VOX), Communication Services Select Sector SPDR Fund (XLC), and First Trust Dow Jones Internet Index Fund (FDN).

Positive Earnings Indicators

Meta Platforms has an Earnings ESP of +2.83% and holds a Zacks Rank #2 (Buy). This combination suggests a higher likelihood of an earnings beat. The company has seen slight upward adjustments in earnings estimates over the past month, indicating analyst confidence. The Zacks Consensus Estimate predicts a year-over-year earnings growth of 17.8% and a revenue increase of 17.6%. In the last four quarters, Meta has averaged an earnings surprise of 12.6%.

Pricing Trends for Meta Platforms

Meta Platforms, Inc. price-consensus-eps-surprise-chart | Meta Platforms, Inc. Quote

The company has consistently surpassed the Zacks Consensus Estimate for earnings in the past seven quarters and for revenues in the last nine quarters. Currently, Wall Street analysts have a recommendation average of 1.39 (with 1 being Strong Buy and 5 being Strong Sell), based on analyses from 49 firms. This rating has improved from 1.32 a month ago with 47 recommendations. Out of these, 41 are Strong Buy, and one is a Buy.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Based on projections from 46 analysts, the average price target for Meta Platforms stands at $620.91, with predictions ranging from a low of $425.00 to a high of $811.00. META holds solid Growth and Momentum Scores of B and trades at 26.97X forward earnings, a discount compared to the Zacks Internet-Software industry average of 32.31X.

Wall Street Optimism Grows

As the earnings report approaches, many analysts on Wall Street express growing confidence about Meta’s potential for growth. UBS has raised its price target to $690 from $635 with a Buy rating, while Guggenheim increased its target to $665 from $600. Both Jefferies and TD Cowen lifted their price targets to $675 from $600, maintaining a Buy rating. KeyBanc also raised its target from $560 to $655, keeping an Overweight rating.

Analysts attribute this optimism to improved user engagement and enhanced monetization strategies, particularly with the Reels feature. Increased advertising load and usage of short-form videos on Instagram are seen as key drivers of growth.

Bank of America highlighted Meta as a “top AI pick,” noting growth in AI-powered advertising and rising engagement among younger users, which point towards further AI opportunities.

Looking Back at Recent Developments

In its last quarter, Meta reported that WhatsApp exceeded 100 million monthly users in the U.S. and noted that Meta AI is on track to become the world’s most used AI assistant by year-end. CEO Mark Zuckerberg announced that the company plans to invest heavily in AI infrastructure, projecting a capital expenditure of $37-$40 billion for 2024, up from an earlier forecast of $35-$40 billion. Total expenses for 2024 are expected to be in the range of $96-99 billion.

For the upcoming quarter, Meta anticipates revenues between $38.5-$41 billion.

ETFs That Invest in Meta Platforms

iShares Global Comm Services ETF (IXP) – Holds the largest share of Meta at 23.6%.

Fidelity MSCI Communication Services Index ETF (FCOM) – Places Meta at the forefront with a 23.2% share.

Vanguard Communication Services ETF (VOX) – Also lists Meta in a leading position with a 23.1% share.

Communication Services Select Sector SPDR Fund (XLC) – Features Meta as its top holding with a 20.3% stake.

First Trust Dow Jones Internet Index Fund (FDN) – Meta accounts for 10.2% of its assets.

Stay Informed

For key ETF insights, subscribe to Zacks’ free Fund Newsletter, which updates you on news, analyses, and top-performing ETFs each week.

Interested in Zacks Investment Research’s latest recommendations? Download the report on 5 Stocks Set to Double at no cost. Click to access this free resource.

First Trust Dow Jones Internet ETF (FDN): ETF Research Reports

Vanguard Communication Services ETF (VOX): ETF Research Reports

Fidelity MSCI Communication Services Index ETF (FCOM): ETF Research Reports

iShares Global Comm Services ETF (IXP): ETF Research Reports

Communication Services Select Sector SPDR ETF (XLC): ETF Research Reports

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.