Roku Stock Plummets 84%: Is This a Buying Opportunity?

Roku (NASDAQ: ROKU) shares have dropped a staggering 84% since their 2021 peak during the pandemic. Investors have largely hesitated to buy the stock, waiting for clearer signs of recovery.

Understanding Roku’s Role in Streaming

Despite its low stock price, Roku remains an important player in the streaming industry. The company is not currently profitable and faces stiff competition, yet its discounted stock price could present an appealing opportunity for risk-tolerant investors.

If you’re unfamiliar with Roku, it makes the devices that connect to televisions, allowing users to access popular streaming services like Amazon Prime, Netflix, and The Walt Disney Company‘s Disney+. Many modern TVs already include Roku’s technology built in.

However, hardware sales are not the main source of Roku’s revenue. Over 85% of its income comes from advertising and partnerships with streaming platforms, including its own ad-supported channel. The devices serve primarily as a means to drive ad revenue.

Roku currently leads the U.S. over-the-top (OTT) advertising market, holding a substantial 37% share, according to ComScore. In addition, the company controls 43% of the media-playing device market, outperforming Amazon’s Fire TV. Though Roku hasn’t concentrated extensively on international markets, its presence is growing globally.

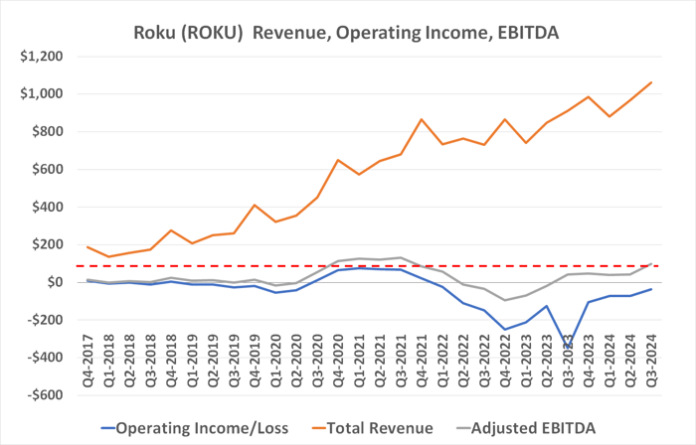

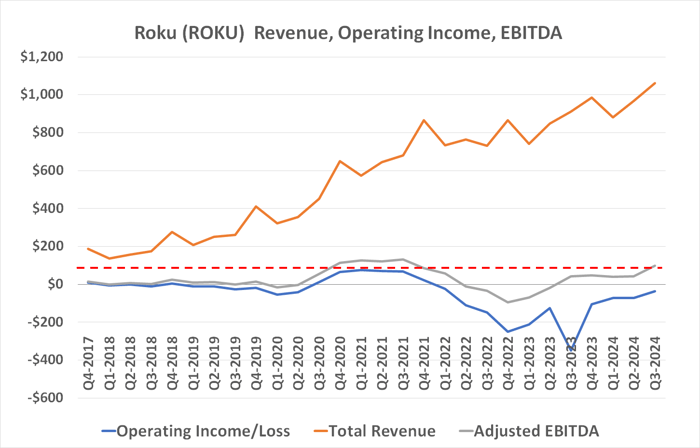

The company is making steady progress, with revenue on the rise and losses appearing to decrease.

Data source: Roku. Figures are in millions.

Why the Stock Price Doesn’t Reflect Growth

The surge in Roku’s stock price during 2020 can be attributed to pandemic lockdowns, which drove many consumers to streaming services. ComScore reported a 70% year-over-year increase in live TV viewing in March 2020 alone. Roku benefited significantly, with device sales increasing by 35%, and active accounts rising by 41% to 43.0 million during that same period. This rapid growth continued until late 2021.

However, the stock’s impressive rise of 540% during that time was unsustainable. A necessary correction took place in 2022, with the share price stagnating since then, leaving investors stunned by the magnitude of the decline.

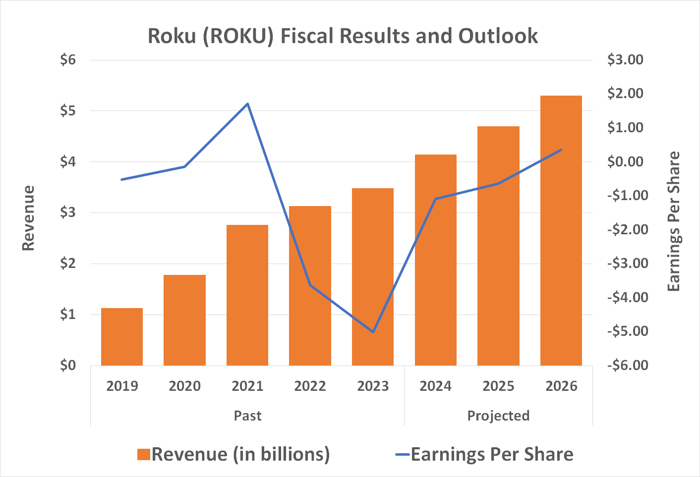

This situation may be a classic case where pessimism overshadows reality. Analysts predict Roku could become profitable by 2026, projecting $5.3 billion in revenue as it capitalizes on the growing advertising market, which is expected to expand by about 10% annually through 2027.

Data source: StockAnalysis.com. Chart by author.

Despite the potential, many analysts currently recommend holding Roku stock, with a consensus price target of $83.13—only about 8% higher than its current price. This lack of enthusiasm among industry experts may indicate an opportunity for investors willing to take a chance.

Act Before the Market Recognizes Roku’s Potential

While investing in Roku isn’t without risks, the potential for rewards appears to be greater than the perceived risks. As the market eventually recognizes Roku’s continued growth, early investors may benefit. It may be more advantageous to buy shares now rather than wait for prices to rise as the company moves closer to profitability.

Seize This Opportunity Before It’s Gone

Wondering if you missed your chance to buy successful stocks? Here’s a chance to consider investing now before prices change dramatically.

Our analysts occasionally identify stocks they believe are poised for significant gains. If you think you’ve missed out on top investments, take advantage of this opportunity now. Historical returns illustrate the potential:

- Nvidia: Investing $1,000 in 2009 would now be worth $348,216!*

- Apple: $1,000 invested in 2008 is now worth $47,425!*

- Netflix: $1,000 from 2004 would have grown to $480,681!*

We are currently issuing alerts for three promising companies; this opportunity may not return soon.

See 3 promising stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Netflix, Roku, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.