Here are three stocks rated as buys, demonstrating robust growth potential for investors to consider today, November 8:

Top Stock Picks for Growth-Oriented Investors

Interface, Inc. (TILE)

Interface, Inc. (TILE) is a company specializing in modular carpet products. It has a Zacks Rank of #1 and recently, the Zacks Consensus Estimate for its annual earnings has increased by 7% over the past 60 days.

Price Trends for Interface, Inc.

Interface, Inc. price-consensus-chart | Interface, Inc. Quote

Interface has a PEG ratio of 1.20, compared to the industry average of 1.34, and it holds a strong Growth Score of A.

Interface, Inc. PEG Ratio (TTM)

Interface, Inc. peg-ratio-ttm | Interface, Inc. Quote

The Progressive Corporation (PGR)

The Progressive Corporation (PGR), an insurance holding company, also carries a Zacks Rank of #1. Its current year earnings estimate has risen by 5.7% in the last two months.

Price Trends for The Progressive Corporation

The Progressive Corporation price-consensus-chart | The Progressive Corporation Quote

With a PEG ratio of 0.72, significantly lower than the industry average of 1.38, the company is rated with a Growth Score of B.

The Progressive Corporation PEG Ratio (TTM)

The Progressive Corporation peg-ratio-ttm | The Progressive Corporation Quote

Vertiv Holdings Co (VRT)

Vertiv Holdings Co (VRT), which operates in the digital infrastructure sector, also holds a Zacks Rank of #1. Its earnings estimate for the year has gone up by 4.3% within the last two months.

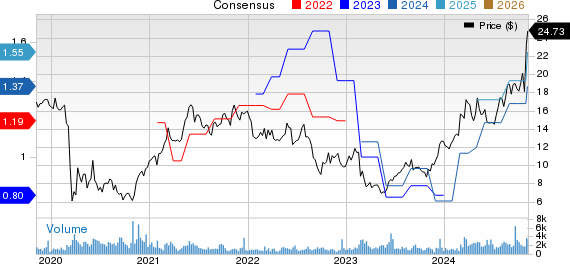

Price Trends for Vertiv Holdings Co.

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

Vertiv’s PEG ratio stands at 1.31, contrasted with a high industry average of 12.42, and it earns a Growth Score of B.

Vertiv Holdings Co. PEG Ratio (TTM)

Vertiv Holdings Co. peg-ratio-ttm | Vertiv Holdings Co. Quote

For more options, see the full list of top ranked stocks here.

Discover details about the Growth score and how it is calculated here.

Explore 5 Stocks to Buy Amid Infrastructure Spending Surge

With trillions of dollars in federal funding allocated to uplift America’s infrastructure, opportunities abound. This influx will enhance not just roads and bridges but also AI data centers and renewable energy projects.

This situation opens doors for several surprising stocks that are geared for significant advantages amid this spending boom.

Download a free report on how to profit from the trillion-dollar infrastructure boom.

The Progressive Corporation (PGR) : Free Stock Analysis Report

Interface, Inc. (TILE) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

Click here to read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.