Unlocking Investment Opportunities: Stocks to Consider as 2025 Approaches

As 2025 draws near, many investors may find themselves with cash ready to invest. Whether it’s $50 or $50,000, fractional shares allow individuals to buy stocks proportionate to their budgets. If you’re looking to make the most of your cash reserves, here are some stocks to consider.

Start Strong with an S&P 500 Index Fund

While it may seem like a basic choice, investing in an index fund, specifically the S&P 500 (SNPINDEX: ^GSPC), can be an excellent first step. Top picks for this index include the SPDR S&P 500 (NYSEMKT: SPY) and the Vanguard S&P 500 (NYSEMKT: VOO). These affordable ETFs act like stocks while offering broad market exposure.

Investing in an index fund means you are not aiming to outpace the market, but rather, you will match its performance. Historically, the market returns about 10% annually, making this a reliable starting investment.

However, for more seasoned investors already holding an S&P 500 fund, the focus might shift to individual stocks with potential for growth.

Spotlight on Taiwan Semiconductor

Taiwan Semiconductor (NYSE: TSM) stands as the world’s leading chip manufacturer, producing essential components for major tech firms like Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA). The company’s role has been pivotal in advancing modern technology.

With the rise of artificial intelligence (AI), Taiwan Semi is set to significantly benefit from increased demand. For 2024, management anticipates revenue related to AI to triple, representing a mid-teens percentage of total revenue. Wall Street forecasts a 25% increase in revenue for Taiwan Semi next year, showcasing its robust position.

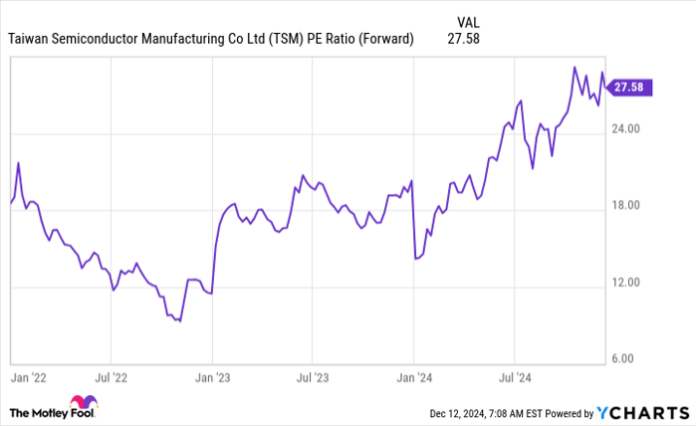

Although not the cheapest stock available, Taiwan Semi’s forward price-to-earnings (P/E) ratio aligns with those of other major tech firms.

TSM PE Ratio (Forward) data by YCharts

Overall, Taiwan Semiconductor presents a strong investment opportunity as both AI and chip demand are expected to grow.

Meta Platforms: A Solid Player in a Dynamic Market

Meta Platforms (NASDAQ: META), formerly known as Facebook, generates most of its revenue from popular social media platforms like Facebook, Instagram, and WhatsApp. A staggering 98% of Meta’s income comes from advertising.

With its advertising success, Meta has invested in emerging technology projects. Although the metaverse initiative has not met expectations, investments in generative AI show promise. Meta’s open-source platform, Llama, allows for broader training sources, potentially enabling faster and cheaper AI model development.

The business implications of Llama could be significant, providing a competitive edge and an opportunity for future monetization. Despite current stock prices around 28 times forward earnings, similar to Taiwan Semiconductor, the prospects for Meta remain promising due to its potential in generative AI and its solid advertising revenue.

META PE Ratio (Forward) data by YCharts

While this stock may not be labeled “cheap,” its potential in the tech sector warrants consideration.

Seize the Opportunity Before It’s Too Late

Have you ever felt you missed out on investing in winning stocks? Here’s good news: our expert analysts have identified stocks with promising growth potential and are recommending a “Double Down” on these companies. If you believe you’ve missed your chance, now is an ideal moment to invest.

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $348,112!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,992!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,539!*

Currently, we are spotlighting three exceptional companies for potential “Double Down” investments.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Randi Zuckerberg, former director of market development at Facebook and CEO Mark Zuckerberg’s sister, is on The Motley Fool’s board of directors. Keithen Drury holds positions in Meta Platforms, SPDR S&P 500 ETF Trust, Taiwan Semiconductor Manufacturing, and Vanguard S&P 500 ETF. The Motley Fool recommends Apple, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and Vanguard S&P 500 ETF. Visit our disclosure policy for more information.

The views expressed in this article are those of the author and do not reflect the views of Nasdaq, Inc.