Three Key Stocks to Consider in a Bull Market

Investing in stocks can seem daunting when the S&P 500 and Nasdaq Composite approach record highs. Renowned investor Warren Buffett advises caution, saying to be “fearful when others are greedy.” Many high-growth stocks currently hold lofty valuations, making prudent investment choices essential.

If you’re considering an investment of at least $50,000 in today’s market, it’s wise to look for companies that are market leaders, exhibit strong growth, and remain undervalued compared to their potential. Here are three strong contenders: Broadcom (NASDAQ: AVGO), Advanced Micro Devices (NASDAQ: AMD), and Taiwan Semiconductor Manufacturing (NYSE: TSM).

Image source: Getty Images.

Broadcom: A Strong Player in AI

Broadcom, formerly known as Avago Technologies before acquiring Broadcom in 2016, stands as a premier chipmaker and software provider globally. Its chip division develops a variety of processors for mobile, wireless, networking, data storage, and industrial uses. Meanwhile, its software branch offers cloud and security services, bolstered by significant acquisitions.

The company is experiencing growth in both divisions, largely due to the surge in the artificial intelligence (AI) industry. In fiscal 2024, which concluded in October, Broadcom’s revenue from AI-specific networking and optical chips soared to $12.2 billion, tripling from the previous year. This accounted for 24% of total revenue and comfortably offset losses in its non-AI chip sales.

Looking ahead to fiscal 2025, analysts predict an 18% increase in revenue and a 27% jump in adjusted earnings per share (EPS) as AI sales climb. With a valuation of 29 times forward earnings, Broadcom stands to gain significantly as its non-AI segments also thrive.

AMD: The Resilient Challenger

Advanced Micro Devices, or AMD, ranks as the second-largest x86 CPU and discrete GPU producer globally. While it competes behind Intel and Nvidia, AMD finds success selling comparable components at lower prices.

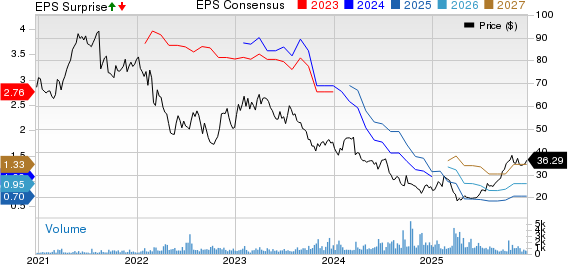

Unlike Intel, which makes most of its chips in-house, AMD is a fabless manufacturer. It relies on partnerships with contractors like Taiwan Semiconductor, allowing it to navigate industry supply chain issues effectively while pushing ahead in chip technology.

Although AMD’s growth slowed as the PC market softened last year, it has rebounded in the last two quarters. Sales of AI-focused data center chips—including EPYC CPUs and Instinct GPUs—helped lift its revenue, with data center sales making up over half of total revenue in the most recent quarter. Analysts foresee a 13% revenue growth and 25% EPS growth this year, with even stronger projections of 27% revenue growth and 54% EPS growth in 2025, all while trading at just 26 times forward earnings.

TSMC: The Semiconductor Cornerstone

Taiwan Semiconductor, or TSMC, is the largest and most advanced contract semiconductor manufacturer worldwide. It produces chips for major companies like Nvidia, AMD, Apple, and Qualcomm. Revenue dipped 9% in 2023 due to a drop in PC shipments and the conclusion of the smartphone 5G upgrade cycle.

TSMC anticipates a nearly 30% revenue bump in 2024, driven by stabilization in the PC and smartphone sectors alongside expansion in the AI market. The rapid growth within AI is expected to provide significant long-term benefits to TSMC, particularly in its high-performance computing (HPC) segment, which supplies powerful GPUs for AI applications.

For 2025, TSMC plans to increase the production of its cutting-edge 2 nm chips, helping it maintain its lead over rivals like Intel and Samsung. Analysts forecast this could translate to a 25% increase in revenue and 26% in EPS for the year. Trading at just 21 times forward earnings, TSMC represents a straightforward opportunity to invest in the chip and AI market growth.

Is Broadcom a Good Investment Opportunity?

Before making an investment decision in Broadcom, consider the following:

The Motley Fool Stock Advisor team recently highlighted what they believe are the 10 best stocks available right now, and Broadcom did not make the list. The recommended stocks could see substantial returns in the upcoming years.

For context, when Nvidia was featured on this list back on April 15, 2005, investing $1,000 would have grown to $822,755!

Stock Advisor offers investors guidance on portfolio building, updates from analysts, and new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Leo Sun has positions in Apple. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom while also advising to short February 2025 $27 calls on Intel. There is a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.