Preparing for a Stock Sale: What to Expect in Early 2025

As 2024 unfolds and following an impressive rally, analysts predict that stocks may become more affordable in early 2025. The Nasdaq has surged over 90% in the past two years, setting the stage for potential buying opportunities.

Now is an ideal time to build your stock watchlist and monitor high-performing stocks to capitalize on future market pullbacks.

Understanding Market Corrections and Pullbacks

Market trends can only rise for so long before corrections occur, which help to reset valuations and eliminate excess. Corrections, defined as drops of 10% to 19% from a peak, are common events that savvy investors often exploit.

Recently, the Nasdaq experienced a 1.5% decline, retreating below its 21-day moving average after a rally before Christmas. This index has maintained its position above the 50-day moving average since early September, indicating resilience.

Image Source: Zacks Investment Research

For long-term investors, the 50-day and 200-day moving averages for the S&P 500 and Nasdaq are crucial levels to monitor for buying opportunities.

As we anticipate a stock market downturn, investors should move quickly, given positive earnings growth projections for 2025 and 2026. Additionally, stable economic performance suggests the Federal Reserve may not rush with interest rate cuts.

Political Climate: Adding Fuel to the Market

A pro-growth and lower tax environment, particularly under the potential second Trump administration, could further energize the stock market.

Let’s explore two strong stock candidates investors might consider purchasing when prices drop in 2025.

Top Tech Stock to Watch in 2025

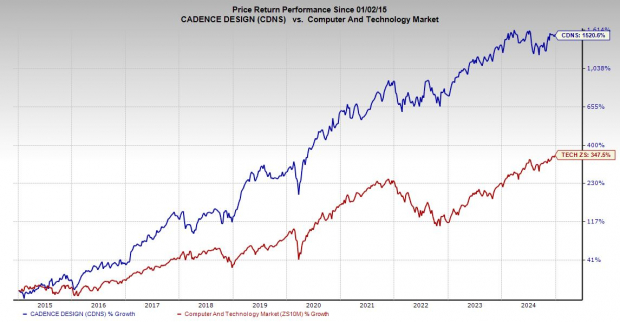

Cadence Design Systems, Inc. (CDNS) has gained around 5,000% over the last 15 years, outperforming the Tech sector’s 625% and the Computer-Software industry’s 975% gains.

Investors are drawn to Cadence Design Systems for its crucial modeling and computational software, which are integral in the semiconductor lifecycle and beyond.

In 2024, CDNS has not kept pace with the Tech sector, which may present a valuable entry point for investors come 2025.

Image Source: Zacks Investment Research

The increasing sophistication of semiconductors required for emerging technologies like artificial intelligence (AI) has made Cadence a key partner for many chip manufacturers.

Major companies, including Nvidia (NVDA), rely on Cadence’s technology prior to the production of their advanced semiconductors. Over the past five years, Cadence has averaged a 14% revenue growth.

Revenue is expected to rise by 13% in both 2024 and 2025, potentially adding over $1 billion between FY23 and FY25, which will help drive adjusted earnings per share (EPS) growth of 15% and 16%, respectively.

Cadence’s earnings estimates for 2025 and 2026 declined this year, contributing to its underperformance.

Image Source: Zacks Investment Research

Cadence’s stock trades at a premium, currently at 55.2 times its forward 12-month earnings compared to the Tech sector’s average of 27.8. However, it is 25% off its peak in price-to-earnings ratios, while the overall Tech sector hovers just 5% below its highs.

Cadence’s steady growth is well regarded on Wall Street, with 13 out of 17 brokerage recommendations rated as “Strong Buys.”

In 2024, Cadence has remained stable, currently trading 7% below its highs. When CDNS approaches its 50-day or 200-day moving averages, we could see a resurgence in its stock price, possibly reaching new all-time highs.

Investing in a Leading Data and AI Stock

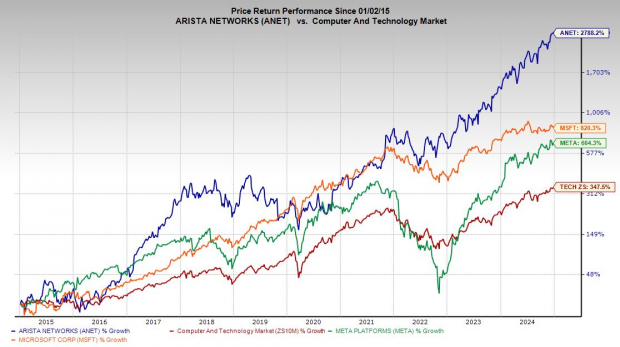

Arista Networks (ANET) is a leading player in client-to-cloud networking, with a strong focus on large AI, data center, campus, and routing environments. Over the past decade, ANET has rapidly expanded its networking infrastructure, driven by the growth of cloud computing and big data technologies.

With over 8,000 cloud customers globally, including major tech firms such as Microsoft and Meta, Arista Networks derives 46% of its revenue from these “cloud titans.”

Arista Networks Thrives Amid Demand from Tech Giants

Microsoft MSFT and Meta META are increasingly dependent on Arista Networks as they pursue growth in big data and artificial intelligence.

Wall Street Backs Arista’s Growth

Analysts view Arista Networks’ expanding partnerships with Microsoft and Meta as strong endorsements. According to Zacks, 13 out of 19 brokerages label ANET as a “Strong Buy.”

Significant Revenue Expansion Forecasted

Since 2013, ANET has seen its revenue climb from $361 million to $5.86 billion last year, demonstrating an average growth rate of 37% over three years. Projections suggest sales will increase by 19% in FY24 and 17% in FY25, reaching about $8.15 billion.

Strong Earnings Growth Ahead

Looking forward, ANET expects adjusted earnings to rise by 26% and 10% in FY24 and FY25, respectively, following a remarkable 52% EPS growth in FY23. This upward trend has positioned Arista Networks with a Zacks Rank #2 (Buy), consistently exceeding quarterly estimates for the past five years.

Image Source: Zacks Investment Research

Strong Financial Standing

Arista Networks boasts a robust balance sheet, with $7.4 billion in cash and equivalents, liabilities totaling $3.6 billion, and zero debt.

Exceptional Stock Performance

Over the last decade, ANET stock has surged approximately 2,800%, outpacing Meta’s 670% and Microsoft’s 820% gains. Notably, the stock rose 92% in 2024 alone.

Stock Split and Future Pricing Considerations

Historically, Arista has traded at a premium in the tech sector. However, a recent 4-for-1 stock split has made it more accessible to investors.

Despite its strengths, ANET may need to re-evaluate its position, as it currently trades near record highs concerning forward earnings. A drop to its 50-day or 200-day moving average could present a valuable buying opportunity for those interested in the tech stock.

Zacks Highlights Top Picks for 2025

Interested in early insights on the Zacks Top 10 Stocks for 2025?

Data shows remarkable performance historically. From 2012 until November 2024, the Zacks Top 10 Stocks gained +2,112.6%, outpacing the S&P 500’s +475.6%. Zacks Director of Research Sheraz Mian is now selecting the best 10 stocks to hold throughout 2025. Don’t miss the chance to learn about these stocks when they’re announced on January 2.

Stay informed with the latest recommendations from Zacks Investment Research.

Download the report on 5 Stocks Set to Double for free.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.