RenaissanceRe Holdings: Strong Growth Amid Rising Costs

RenaissanceRe Holdings Ltd. (RNR) is currently benefiting from higher premiums and robust investment income, along with strong performance in its business segments and recent acquisitions. Positive shifts in returns from its fixed maturity portfolio, coupled with improved underwriting results, further drive its progress.

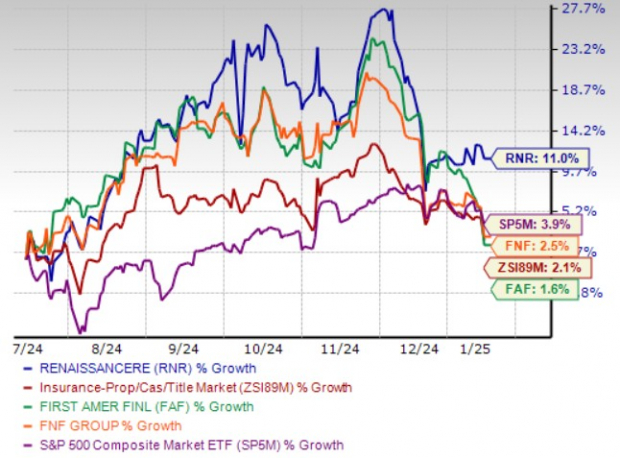

In the past six months, RNR has achieved an impressive 11% growth, significantly outperforming the industry average growth of 2.1%. The company’s stock performance has also surpassed that of notable peers such as First American Financial Corporation (FAF) and Fidelity National Financial, Inc. (FNF), which reported gains of 1.6% and 2.5%, respectively. In comparison, RNR outstripped the S&P 500’s rise of 3.9% during the same period.

RNR’s 6-Month Price Performance Comparison

Image Source: Zacks Investment Research

Now, let’s examine the key factors driving RNR’s growth.

Key Growth Factors for RNR

RenaissanceRe pursues growth through strategic acquisitions and expansions. Its recent acquisition of Validus Re and related businesses from AIG has notably strengthened its global property and casualty reinsurance operations, boosting profitability as well. The firm is also focusing on optimizing its portfolio by selling off non-core assets.

RNR’s strong cash reserves provide essential support for growth initiatives and enhance shareholder returns. Over the last year, the company generated $3.9 billion in net operating cash flow and repurchased $106.8 million in shares during the third quarter.

Anticipated increases in premiums from its Property and Casualty & Specialty segments are set to propel performance further. Recent upward revisions in estimates highlight strong underwriting results contributing to profit growth.

Additionally, RNR is trading at a discount relative to the industry average. Currently, the stock trades at 1.24X its trailing 12-month tangible book value, compared to the industry’s 1.48X, indicating it may be undervalued. The company’s Value Score stands at B.

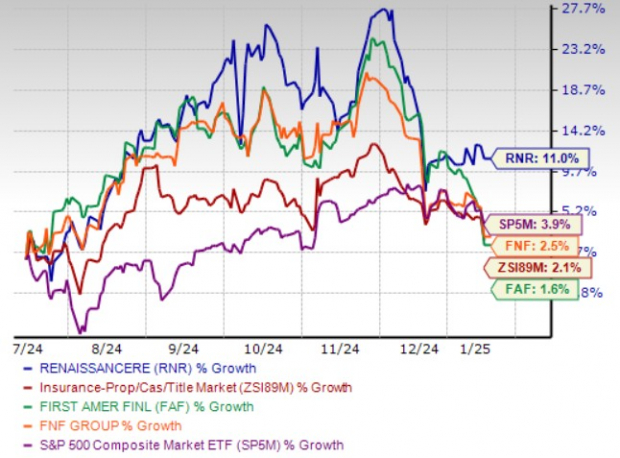

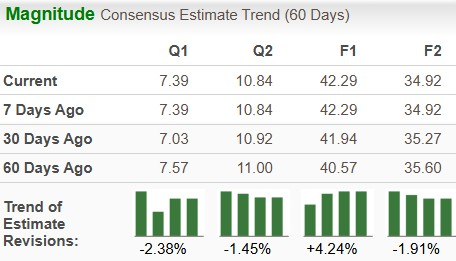

Earnings Estimate Revisions for RNR

Reflecting positive market sentiment, the Zacks Consensus Estimate for RNR’s earnings per share has seen upward revisions. Currently, the consensus estimate for adjusted earnings in 2024 is at $42.29 per share, signaling a growth of 12.7% year-over-year. Moreover, RNR has consistently exceeded earnings estimates in the past four quarters, with an average surprise of 28%. The consensus forecast for 2024 revenues suggests a remarkable 35.5% year-over-year growth.

Image Source: Zacks Investment Research

Concerns to Watch for RNR

Investors should consider certain potential risks impacting RenaissanceRe.

The firm faces escalating expenses, driven by higher net claims, acquisition costs, and operational expenses. These costs are projected to rise by over 44% year-over-year in 2024, presenting a challenge to profit margins.

Additionally, RNR’s long-term debt to capital ratio stands at 43.9%, significantly exceeding the industry average. The company’s debt load has increased from $1.2 billion at the end of 2022 to $1.9 billion as of September 30, 2024. This elevated debt has resulted in a sharp increase in interest expenses, which surged by 41.1% year-over-year during the first nine months of 2024.

Conclusion

RenaissanceRe demonstrates substantial growth potential, bolstered by strategic acquisitions like Validus Re, rising premiums, and strong underwriting performance. Recent upward revisions in earnings estimates reflect its resilience, supported by robust cash flow and shareholder-friendly actions such as share repurchases. Nonetheless, rising expenses, high debt levels, and increased interest costs could impact profitability. Current shareholders might consider holding their positions, while potential investors may wish to wait for a more opportune moment to enter and take advantage of the company’s long-term prospects.

RNR stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys, which they consider “Most Likely for Early Price Pops.”

Since 1988, these selections have outperformed the market more than twice, achieving an average gain of +24.1% per year. So be sure to pay close attention to these hand-picked 7 stocks.

RenaissanceRe Holdings Ltd. (RNR): Free Stock Analysis Report

First American Financial Corporation (FAF): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.