Dr. Reddy’s Laboratories (RDY) stands out in the generic drugs market, operating through three main segments: Global Generics, Pharmaceutical Services & Active Ingredients, and Others. Below, we explore four reasons why investing in Dr. Reddy’s stock could be a wise choice for fiscal 2025.

A Robust Pipeline of Generic Drugs

Dr. Reddy’s holds a strong position in the generic market. As of September 30, 2024, the company had 80 generic applications pending with the FDA, which include 75 abbreviated new drug applications (ANDAs) and five new drug applications. Notably, 44 of the ANDAs are filed under Paragraph IV, a crucial category for generics.

In fiscal 2024, Dr. Reddy’s reported notable success in North America and the EU, launching 21 new products in North America alone. In the second quarter of fiscal 2025, they released four additional products in the United States, with plans for continued launches throughout the year.

Marketed Biosimilars Set to Enhance Revenue

To cater to rising demand, Dr. Reddy’s has expanded its biosimilars facility in India. In the fourth quarter of fiscal 2024, they launched Versavo (bevacizumab), a biosimilar of the cancer medication Avastin, in the UK.

In July 2024, the company received a favorable opinion from the European Advisory Committee, recommending approval for its biosimilar, DRL_RI, which targets Roche’s Rituxan/MabThera. This product is expected to be marketed as Ituxredi in Europe shortly, and upon approval, it could significantly enhance revenue. Dr. Reddy’s also markets Hervycta (trastuzumab), another biosimilar aimed at treating HER2-positive cancers in India.

Moreover, Dr. Reddy’s, in collaboration with Senores Pharmaceuticals, introduced Ivermectin Tablets USP in the U.S., and launched a biosimilar for Coherus’ Loqtorzi in India, treating a rare head and neck cancer. These initiatives signify the company’s continued focus on biosimilars and global product expansion.

This year, Dr. Reddy’s shares have increased by 1.6%, compared to the industry’s average growth of 12.5%.

Image Source: Zacks Investment Research

Strategic Initiatives Driving Growth

Dr. Reddy’s has implemented various strategic measures to enhance operations and diversify its offerings. These include updating infrastructure, improving quality management processes, and automating essential tasks to boost efficiency.

In 2023, the company sold off non-core dermatology brands to refocus on essential areas and established RGenX to target India’s trade generics market. Partnerships with major firms such as Sanofi and Bayer have strengthened their market position by collaborating on drug distribution and new product development.

Additionally, Dr. Reddy’s has expanded into various product lines, including acquiring rights to Takeda’s gastrointestinal drug, Vonoprazan, for India and initiating a partnership with Novartis for diabetes treatments in Russia. A joint venture with Nestlé India in nutritional products demonstrates their commitment to diversification.

Globally, the company has secured a licensing agreement with Gilead Sciences (GILD) to manufacture and distribute lenacapavir, an HIV treatment, across India and 120 other countries, further positioning itself for continued growth.

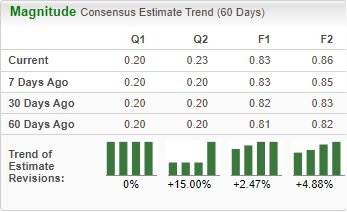

Increasing Earnings Estimates Signal Growth Potential

The Zacks Consensus Estimate for Dr. Reddy’s fiscal 2025 earnings per share (EPS) rose from 81 cents to 83 cents recently. Similarly, forecasts for fiscal 2026 EPS increased from 82 cents to 86 cents.

Image Source: Zacks Investment Research

Assessing Investment in RDY Stock

While RDY faces tough competition amid a crowded generics market, the company is navigating challenges posed by pricing pressures in North America. Competitors like Viatris, Teva, Sandoz, and Aurobindo Pharma continue to pose significant threats. However, Dr. Reddy’s extensive pipeline of generic drugs and dedicated efforts to enhance its position in the generics and biosimilars markets offer promising competitive advantages.

With multiple generic applications pending FDA review, the company anticipates approvals in the coming months, which could further solidify its market presence.

Growing earnings estimates reflect analysts’ favorable outlook for future expansion. Therefore, investors might consider this Zacks Rank #2 (Buy) stock for potential long-term benefits. For further recommendations, you can check the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dr. Reddy’s Laboratories Ltd Price and Consensus

Solar Stocks Set to Thrive Amid Energy Transition

Clean Energy Investment Expected to Surge

The solar sector is prepared for a significant resurgence as technology firms and the economy move away from fossil fuels to fuel the growth of artificial intelligence (AI).

Over the next several years, trillions of dollars will flow into clean energy, with forecasts indicating that solar power could contribute 80% to the expansion of renewable energy. This presents a substantial chance for investors looking to profit in both the short and long term. However, selecting the right stocks is crucial.

Discover Zacks’ top solar stock recommendation for free.

Dr. Reddy’s Laboratories Ltd (RDY): Free Stock Analysis Report

Roche Holding AG (RHHBY): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Coherus BioSciences, Inc. (CHRS): Free Stock Analysis Report

To read more about Dr. Reddy’s stock, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.