Inogen, Inc. Positioned for Growth Amid Challenges in 2025

Inogen, Inc. (INGN) is strategically positioned for growth in the upcoming quarters, particularly in the portable oxygen concentrator (POC) sector. Positive fourth-quarter 2024 results and a robust product lineup support this optimism. However, challenges such as intense competition and foreign exchange volatility present notable risks.

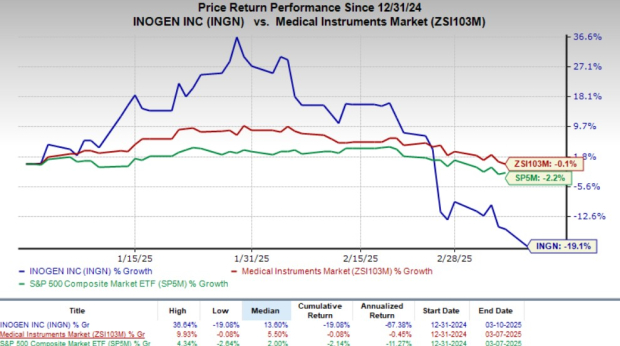

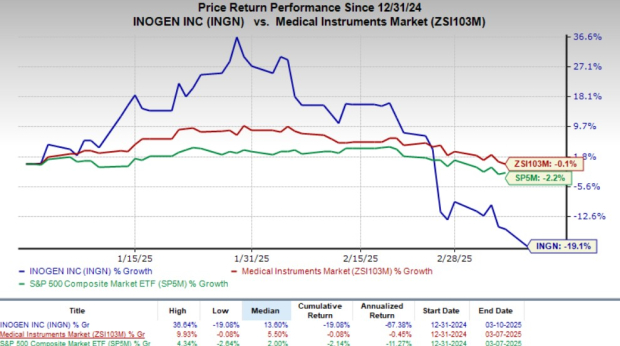

Inogen, which holds a Zacks Rank of #3 (Hold), has seen its shares decline 19.1% this year, contrasted with a 0.1% decrease in its industry. The S&P 500 has also experienced a slight downturn of 2.2% during the same period.

With a market capitalization of $205.9 million, Inogen projects a 7.2% growth in earnings for 2025, anticipating sustained business improvements. The company’s price-to-sales (P/S) ratio stands at 0.6X, markedly lower than the industry average of 2.5X, indicating an attractive valuation.

Image Source: Zacks Investment Research

Let’s explore the key drivers influencing Inogen.

Promising Potential in the POC Market

The POC market reveals promising potential as these devices outshine traditional oxygen therapy methods. Inogen focuses on developing, manufacturing, and marketing innovative POCs to support long-term oxygen therapy for patients with chronic respiratory ailments. The company reported over 20% year-over-year growth in its business-to-business (B2B) channel for the third consecutive quarter during Q4.

This progress is attributed to the rising recognition of Inogen’s high-quality solutions, which offer ease of servicing and a long service life. According to a report from Markets And Markets, the POC market was valued at $15.05 billion in 2024 and is projected to grow to $22.63 billion by 2029 at a CAGR of 8.5%.

Expanding Product Portfolio

Inogen’s product portfolio is expanding, exemplified by the launch of the Rove 4, the lightest POC on the market, in October 2024. Featuring 840 milliliters of medical-grade oxygen per minute and nearly six hours of battery life, early market adoption has been promising.

The company anticipates that the Rove 4 will significantly enhance revenue in 2025. Inogen also received FDA clearance for the Simeox device in December 2024, intended to meet the diverse needs of patients with chronic respiratory issues in the U.S.

In January 2025, Inogen announced a strategic partnership with Yuwell, a global leader in home healthcare medical devices. This collaboration will allow Inogen to expand its product offerings by distributing certain respiratory products in the U.S. and selected other markets while fostering innovation through joint research and development efforts—facilitating entry into China as well.

Strong Q4 Performance

Inogen recently reported solid results for the fourth quarter. Revenues for Q4 rose by 5.5% year-over-year, totaling $335.7 million for the full year—a 6.4% increase from 2023. Adjusted gross profit for the quarter increased by 25.4%, reaching $39.3 million, with an adjusted gross margin improvement of 777 basis points to 49.1%.

The rise in revenue was primarily driven by heightened demand and a growing customer base in both domestic and international B2B channels. This growth was, however, partially offset by decreased direct-to-consumer (DTC) sales and rental revenues.

Potential Risks Ahead

Seasonality Impact: The first quarter of 2025 is projected to be seasonally weaker, especially in the DTC channel, with expected challenges in lead generation and increasing advertising costs. The DTC segment has already seen revenue declines from operating with a reduced sales team, likely impacting INGN’s first-quarter performance further.

Forex Volatility: A significant portion of Inogen’s income is derived from foreign markets, where management anticipates continued revenue fluctuations due to distributor size and timing. Recent foreign exchange rate movements have adversely affected revenue growth, exacerbated by a stronger U.S. dollar against the euro and other currencies. In Q4 2024, unfavorable forex impacts reduced international sales by 330 basis points.

Inogen, Inc. Stock Price

Inogen, Inc. price | Inogen, Inc. Quote

Estimate Revision Trends

Inogen has seen a positive trend in estimate revisions for 2025. Over the past month, the Zacks Consensus Estimate for its loss per share narrowed by 2.6% to $1.41. The consensus estimate for 2025 revenues stands at $352.8 million, indicating a 5.1% increase from the previous year’s figures.

Stocks Worth Considering

For investors interested in alternatives, some better-ranked stocks in the broader medical sector include Cardinal Health, Inc. (CAH), ResMed Inc. (RMD), and Aveanna Healthcare (AVAH).

Cardinal Health, currently with a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 9.5%. The company has consistently surpassed earnings estimates over the past four quarters, enjoying an average surprise of 9.64%. CAH shares have appreciated by 4.8%, outperforming the industry’s growth of 1.2% year-to-date.

ResMed, also holding a Zacks Rank of 2, carries an estimated long-term growth rate of 16%. RMD has likewise consistently exceeded earnings estimates, with an average surprise of 6.86%. However, its shares have seen a modest gain of 3.5%, lagging behind the industry’s 10.5% growth this year.

Aveanna Healthcare has a Zacks Rank of 2 and anticipates significant growth of 666.7% in 2025. This stock has not only exceeded earnings estimates in the last four quarters, with an average surprise of 135.00%, but its share price has decreased by 19.5% compared to the industry’s 3.5% growth in 2023.

Zacks’ Research Chief Identifies “Top Stock” Likely to Double

Our team of experts has recently identified five stocks that hold the greatest potential for gains exceeding 100% in the near future. Among them, Director of Research Sheraz Mian emphasizes one stock expected to rise significantly. This top choice is part of the most innovative financial firms boasting a rapidly expanding customer base of over 50 million and a diverse range of cutting-edge solutions.

While not every pick guarantees success, this stock has the potential to outperform past winners like Nano-X Imaging, which surged by 129.6% within just nine months.

Stay informed with the latest recommendations from Zacks Investment Research by downloading our report: 7 Best Stocks for the Next 30 Days. Click here to get this free report.

Cardinal Health, Inc. (CAH): Free Stock Analysis

ResMed Inc. (RMD): Free Stock Analysis

Inogen, Inc. (INGN): Free Stock Analysis

Aveanna Healthcare Holdings Inc. (AVAH): Free Stock Analysis

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.