Exploring the Invesco S&P 500 GARP ETF: A Value Investment for 2024

As of now, the S&P 500 has surged nearly 27% in 2024, showcasing remarkable growth. However, investors should remain cautious as such rapid increases may indicate potential overvaluation.

This is why value-oriented investors may consider purchasing the Invesco S&P 500 GARP ETF (NYSEMKT: SPGP) at this moment, even starting with a modest investment of $200. Here’s what to know about this distinctive S&P 500 index variant.

Looking to invest $1,000 right now? Our analyst team has identified the 10 best stocks available. Discover the 10 stocks »

Understanding the S&P 500 Index

Broadly speaking, the S&P 500 index aims to represent the U.S. economy. A dedicated committee selects the stocks based on this objective, favoring larger, influential companies. Generally, the index serves as a reliable measure of stock market performance.

Image source: Getty Images.

However, issues can arise. Notably, the index is weighted by market capitalization, which means larger companies disproportionately influence performance. When specific sectors become overly inflated, they can skew overall index results.

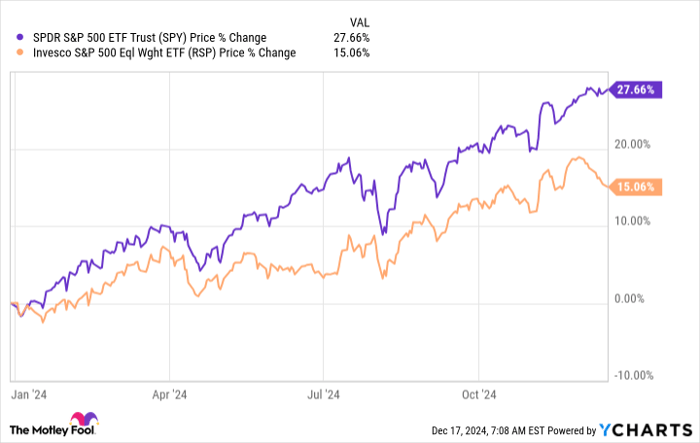

A comparative look at the S&P 500 index alongside an equal-weighted version reveals that Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) has underperformed compared to its market cap-weighted counterpart. For valuation-minded investors, this suggests a need to broaden their search beyond a standard S&P 500 index fund.

SPY data by YCharts

The Appeal of GARP Investment Strategy

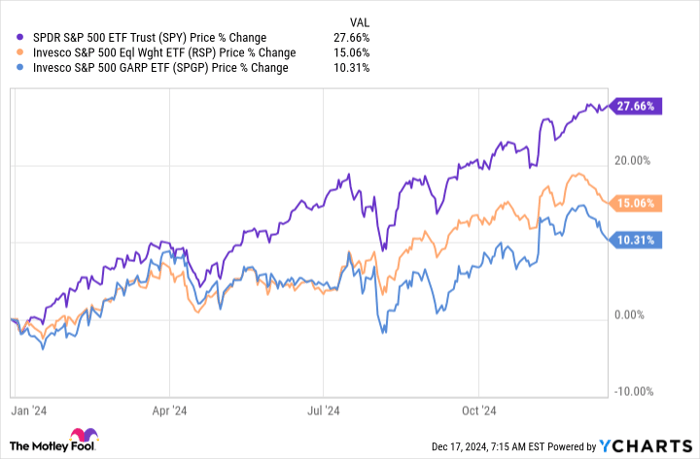

The Growth At a Reasonable Price (GARP) investment strategy seeks to balance growth and value in stock selection. The Invesco S&P 500 GARP ETF stands out as a solid GARP option within the S&P 500 index. So far in 2024, it has performed even less robustly than the equal-weighted index.

SPY data by YCharts

This is unsurprising, given that a handful of large companies are driving the S&P 500 index higher. These expensive stocks usually don’t qualify for the Invesco S&P 500 GARP ETF. This ETF begins with the S&P 500 and then evaluates factors such as sales growth, earnings growth, P/E ratios, financial leverage, and return on equity to identify reasonably priced growth opportunities.

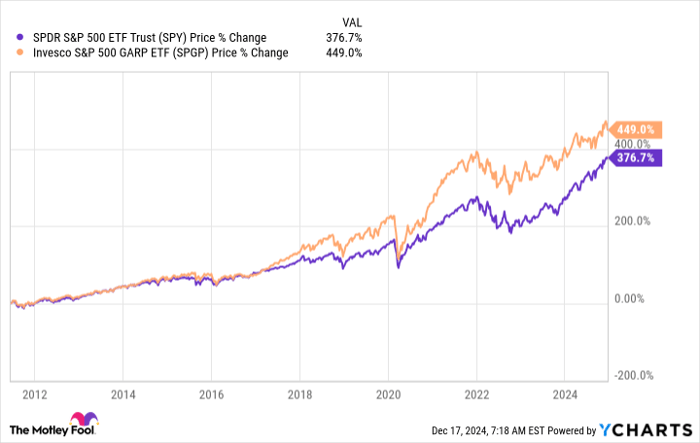

Although this strategy has underperformed compared to the favored stocks of Wall Street, history shows that GARP has had great success over time, as illustrated in the accompanying chart.

SPY data by YCharts

While historical performance cannot predict future results, the Invesco S&P 500 GARP ETF’s methodology has proven effective over time. Investors are likely to again prioritize valuation at some point in the future.

Currently, the average price-to-earnings ratio of Invesco S&P 500 GARP ETF stands at approximately 14.5, compared to the S&P 500 index’s roughly double that figure. Should value investing regain popularity, the S&P 500 index may experience significant downturns.

Weighing the Benefits and Drawbacks of GARP

The Invesco S&P 500 GARP ETF offers a value-oriented approach to invest in S&P 500 stocks successfully over time. Nevertheless, it only comprises about 75 holdings, which may not reflect the broader U.S. economy as accurately as the S&P 500 index.

This ETF allows investors to pivot their portfolios away from the few large companies that dominate the S&P 500, a strategy that could be appealing if there are concerns that the current bull market is accelerating too quickly.

Is Now the Right Time to Invest in the Invesco S&P 500 GARP ETF?

Prior to investing in the Invesco S&P 500 GARP ETF, it’s essential to consider the following:

The Motley Fool Stock Advisor analyst team recently listed what they believe are the 10 best stocks to buy right now, and the Invesco S&P 500 GARP ETF did not make that list. The selected stocks have potential for significant growth in the near future.

Reflect on Nvidia’s inclusion on this list back on April 15, 2005. If you had invested $1,000 at that time, you would now have $800,876! *

Stock Advisor provides a straightforward investment roadmap with guidance on portfolio building, analyst updates, and two new stock recommendations each month. The Stock Advisor service’s returns have more than quadrupled the S&P 500’s performance since 2002.*

Discover the 10 stocks »

*Stock Advisor returns as of December 16, 2024.

Reuben Gregg Brewer currently holds no positions in any stock mentioned. The Motley Fool holds no positions in any stocks mentioned. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein reflect the author’s views and do not necessarily represent those of Nasdaq, Inc.