Top Stocks to Buy Now: Taiwan Semiconductor and Amazon Set for Success in 2025

It’s easy to spot companies likely to thrive in the coming year. Among them are Taiwan Semiconductor (NYSE: TSM) and Amazon (NASDAQ: AMZN). With favorable conditions aligning, now might be the perfect time to invest.

Taiwan Semiconductor: Driving the Tech Revolution

Taiwan Semiconductor is crucial for today’s technology advancements. The chips they produce are essential for major tech devices like smartphones and the powerful GPUs that support modern artificial intelligence (AI) models.

Wondering where to invest $1,000 now? Our team of analysts has identified the 10 best stocks to buy at this moment. See the 10 stocks »

The company’s state-of-the-art 3-nanometer (nm) chips are in high demand, with plans already in motion for their next generation of chips. The 2nm chips are expected to launch in late 2025 and commence full production by 2026. Excitingly, pre-orders for these chips are surpassing those for 3nm and 5nm chips, primarily due to their enhanced efficiency.

In fact, when matched for speed to 3nm chips, the 2nm chips use 25% to 30% less energy, significantly improving battery life and reducing energy costs.

The favorable conditions for TSMC set it up for a strong year ahead. Analyst projections indicate a promising 25% revenue growth in 2025, a remarkable achievement for a company of its size. However, the stock trades at 22 times 2025 earnings, which is steep but still less than many competitors with lower potential, such as Apple at 30 times 2025 earnings.

In summary, Taiwan Semiconductor seems positioned for an excellent performance in 2025, making it a compelling stock to acquire now.

Amazon: The Cloud Computing Leader

For Amazon, 2025’s focus shifts away from e-commerce to its cloud computing giant, Amazon Web Services (AWS). As the largest cloud computing entity, AWS established its position by being a pioneer in the market.

Cloud computing allows businesses to run applications on Amazon’s servers, a flexible and economical option that saves the expense of maintaining rapidly outdated hardware. Additionally, it provides powerful resources for training AI models without needing constant access to a supercomputer.

Though AWS contributed only 17% of Amazon’s total revenue in Q3, it was responsible for an impressive 60% of the operating profit. With AWS growing at a 19% annual rate—much quicker than the retail segment—its impact on investor sentiment is significant.

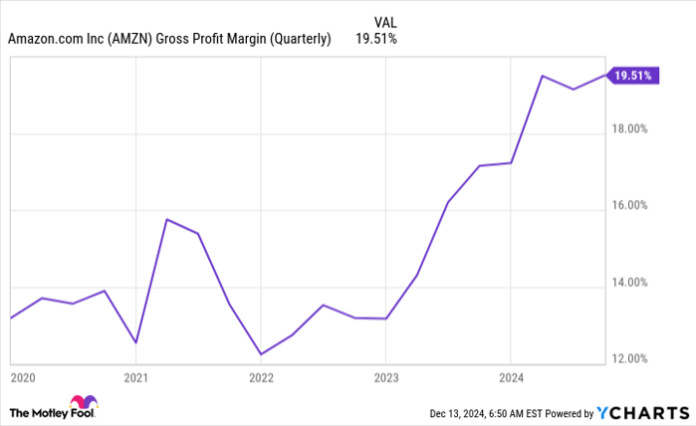

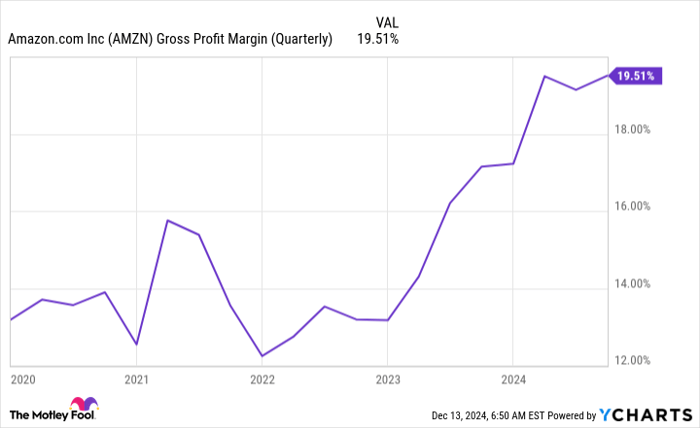

Additionally, as AWS profits increase, Amazon’s gross profit margin continues to improve.

AMZN Gross Profit Margin (Quarterly) data by YCharts

With AWS’s strong performance, Amazon may be viewed more as a tech stock rather than just retail. However, it trades at 37 times 2025 earnings, suggesting investors must weigh its potential against the price. For those adopting a long-term perspective of over five years, this could still represent a worthwhile investment.

Don’t Miss This Opportunity

Have you ever felt you missed out on investing in the best-performing stocks? If so, take note.

On rare occasions, our analysts recommend “Double Down” stocks—companies they believe are on the verge of significant growth. If you’re concerned about having missed your chance, now might be an ideal moment to invest before opportunities slip away. The results speak for themselves:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $338,103!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $48,005!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,679!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and there may not be another opportunity like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Amazon, Apple, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.