Affirm Holdings Experiences Stock Decline Amid Strong Earnings Report

https://www.youtube.com/watch?v=0oJcXyrasDE[/embed>

Affirm Holdings (AFRM) is a financial services company specializing in “buy now, pay later” solutions. This allows customers to make purchases and pay for them over time.

The company offers flexible payment plans, including interest-free options, across a variety of merchants.

Recently, the stock fell to six-month lows following a market sell-off. For long-term investors, this decline might present an opportunity to gain exposure in the fintech sector.

About the Company

Founded in 2012 and based in San Francisco, Affirm’s market valuation stands at $12 billion, and the company employs approximately 2,000 people.

Affirm provides a variety of payment solutions through its platform, which includes a consumer-facing app, merchant commerce tools, and point-of-sale financing. Partnerships with banks allow customers to buy now and pay later, all without hidden fees or compounding interest.

The company’s services accommodate transactions for a wide range of merchants, from small businesses to large enterprises, in sectors such as travel, fashion, home goods, sporting equipment, electronics, and general retail.

Affirm has received a Zacks Style Score of “B” in Growth and “A” in Momentum; however, the stock carries an “F” score in Value.

Q2 Earnings Beat

In February, the company reported earnings that exceeded expectations, achieving an EPS beat of 215%. Additionally, Affirm outperformed revenue expectations and raised its future guidance.

For Q3, revenues are projected to be between $755 million to $785 million, surpassing the expected $773 million. For FY25, revenue guidance has been adjusted upward to a range of $3.13 billion to $3.19 billion, compared to the anticipated $3.11 billion.

Additionally, the company reported 337,200 active merchants, up from 323,000 last quarter, and 21 million active consumers, an increase from 19.5 million in the previous quarter.

Affirm Reports Strong Growth and Positive Analyst Estimates

Affirm Holdings, Inc. showcased a record-breaking holiday season, marked by impressive growth in several key sectors. Third-party marketplaces surged by 44%, and travel experienced a significant increase of 42%. Moreover, the Affirm Card achieved a remarkable 113% year-over-year increase in gross merchandise volume (GMV). A key factor in this growth was a notable 70% rise in 0% APR GMV. The company is approaching profitability sooner than expected, attributing this to strong operating leverage, robust unit economics, and a confident approach to navigating high-interest rate environments. Leadership emphasized Affirm’s strengths in credit performance, merchant trust, and consumer experience.

Analyst Estimates on the Rise

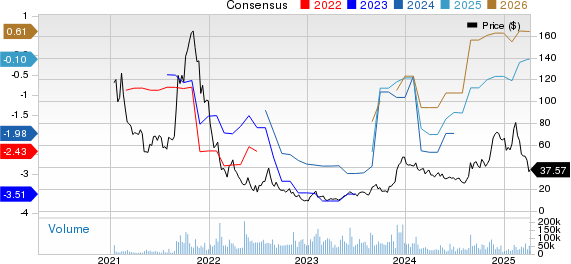

In recent weeks, analyst estimates for Affirm have trended upward across multiple time frames. For the current quarter, estimates have improved from -$0.15 to -$0.07 over the past 90 days. Looking ahead to the next quarter, estimates have stabilized, remaining at $0.09.

For the current fiscal year, estimates surged from -$0.55 to -$0.10 since the latest earnings report. For the following year, projections have increased from $0.50 to $0.61, reflecting an 18% rise over the last 90 days.

Affirm Holdings, Inc. Price and Consensus

Affirm Holdings, Inc. price-consensus-chart | Affirm Holdings, Inc. Quote

Since the earnings release, several financial firms have reaffirmed their buy ratings:

BMO Capital Markets has resumed coverage of Affirm with an Outperform rating and set a price target of $69.

Goldman Sachs has reiterated its Buy rating for Affirm, with a price target of $56.

TD Cowen initiated coverage on Affirm with a Buy rating and set a price target of $50.

Market Performance Overview

Affirm started the year positively, with stock prices climbing between $50 and $80 within the first six weeks. However, the stock has since experienced a significant correction due to the recent downturn in the market.

Affirm Stock Shows Signs of Recovery with Key Resistance Levels

The stock appears to have stabilized around the $30 mark and is beginning to recover. Analysts suggest there is still room for growth, as moving averages are notably higher than current trading prices.

Potential Resistance Levels

Here are some key resistance benchmarks to monitor:

- 21-day: $46.00

- 200-day: $48.25

- 50-day: $57.20

- Fibonacci resistance: $62.00

Despite the stock’s upward movement, ongoing market weakness may pose challenges. Investors should monitor these resistance levels for potential profit-taking opportunities.

In Summary

Affirm Holdings is gaining momentum as it approaches profitability, supported by strong revenue growth and an expanding user base. Analysts are increasingly optimistic about the company’s prospects.

Following a record-setting holiday quarter, the company has raised its guidance and improved estimates, demonstrating its resilience in a higher interest rate environment.

Though the stock has experienced a pullback from earlier highs, the recent recovery and favorable technical indicators suggest it may have further upside. For investors focused on growth within the fintech sector, AFRM deserves close attention.

5 Stocks Set to Double

Each was selected by a Zacks expert as the top stock likely to gain +100% or more in 2024. Some previous picks have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks in this report are currently under Wall Street’s radar, presenting a significant opportunity for early investors.

Today, See These 5 Potential Home Runs >>

Affirm Holdings, Inc. (AFRM): Free Stock Analysis Report

Originally published by Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.