Wall Street Stays Strong Amid AI Developments and Economic Concerns

Wall Street bulls showed resilience at the start of 2025, despite news surrounding DeepSeek artificial intelligence (AI), tariff concerns, and other challenges.

Stable Movement for Key Indices

The market remained steady as the S&P 500 and Nasdaq approached their 50-day moving averages and previous breakout levels following the Trump election. While 2025 started slowly, this helped stabilize a stock market that had been overheating, even as earnings reports and forecasts remained generally positive.

Check out the Zacks Earnings Calendar to keep up with important market news.

In today’s Full Court Finance episode from Zacks, we analyze two Zacks Rank #1 (Strong Buy) stocks: Arista Networks and Robinhood Markets. These are potential investments to consider before their upcoming earnings reports, as they indicate long-term growth prospects.

Arista Networks: A Gem in AI and Networking

Arista Networks ANET has gained 75% in the last year, outpacing the Zacks Tech sector by a significant margin. This growth is part of a robust ten-year trajectory for the company.

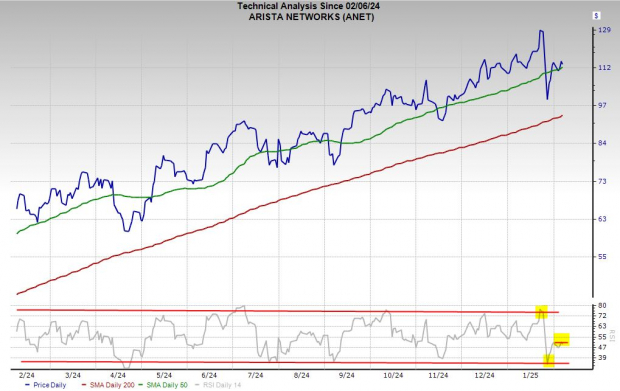

After a selloff caused by the DeepSeek news, Arista’s stock has rebounded and is currently 10% below its recent highs, just as it prepares for its Q4 2024 earnings report on Tuesday, February 18.

Image Source: Zacks Investment Research

Focusing on large-scale AI, data centers, and networking, Arista Networks has seen significant growth over the decade, mirroring the rise of cloud computing and big data.

Big clients like Microsoft MSFT and Meta META continue to invest heavily in their AI infrastructure, committing billions even amidst recent controversies.

From $361 million in revenue in 2013, Arista’s earnings grew to $5.86 billion by 2023, achieving an average growth rate of 37% over the past three years. Projections suggest a 19% increase for FY24 and 18% for FY25, aiming for a total of $8.18 billion.

Image Source: Zacks Investment Research

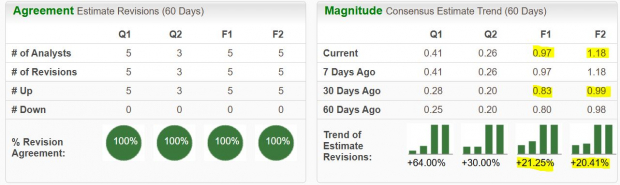

Projected adjusted earnings are set to rise by 26% in 2024 and 10% in FY25, following remarkable 52% growth last year. Analysts have consistently revised Arista’s earnings forecasts upward over the past year.

A Zacks Rank #1 rating (Strong Buy) reflects ANET’s optimistic earnings outlook, which has surpassed estimates by an average of 15% in recent quarters.

With a strong balance sheet, Arista boasts $7.4 billion in cash and equivalents and nearly $13 billion in assets, while total liabilities are just $3.6 billion and there is no debt.

However, ANET trades at 52X forward earnings, compared to the tech sector average of 26X. Despite this premium, investors have continued to support ANET’s valuation due to its strong performance in a vital industry.

Image Source: Zacks Investment Research

Over the last decade, ANET stock has skyrocketed approximately 2,800%, comparing favorably against Meta’s 840% and Microsoft’s 850% increases, as well as the broader tech sector’s 320% growth. Recently, ANET surged 240% in two years and 45% in the last six months.

Though ANET faced a setback after the DeepSeek news, it quickly bounced back above its 50-day moving average, moving from overbought conditions to a neutral stance.

Robinhood: A Rapid Ascent in Online Trading

Robinhood Markets HOOD has emerged as a major player, experiencing a remarkable 385% increase in stock price over the past year, including an 80% rise in the last three months. This free stock-trading platform has positioned itself as a strong competitor to established companies like Fidelity.

Robinhood appears poised to challenge its previous 2021 highs, with its Q4 results set to be released on Wednesday, February 12.

Robinhood’s Growing Influence in the Investment Landscape

Transformation into a Mainstream Broker

Image Source: Zacks Investment Research

Robinhood has reshaped the online brokerage industry by introducing commission-free stock trading. This approach has influenced many digital brokers, including Fidelity, to adopt similar practices. Originally popular during the pandemic, Robinhood has evolved into a serious competitor to Fidelity, attracting a diverse range of investors and active traders with its expanding services.

Expanding Product Offerings

In addition to stock trading, Robinhood has launched retirement accounts, cryptocurrency trading, and futures. Recently, in October, the company introduced Robinhood Legend, a desktop trading platform designed specifically for active traders.

The company is also venturing into robo-advisory and wealth management services. In November, Robinhood announced its acquisition of TradePMR, a custodial and portfolio management platform for Registered Investment Advisors (RIAs).

Investors on Wall Street welcomed the confirmation of Robinhood’s SEC settlement in January, signaling a positive shift for the company.

Positive User Growth and Financial Metrics

Image Source: Zacks Investment Research

In the third quarter, Robinhood reported a 7% year-over-year increase in monthly active users, reaching 11.0 million. The average revenue per user also rose by 31% to $105. The company’s Assets Under Custody soared by 76% year-over-year to reach $152.2 billion, primarily due to increased net deposits and rising equity and cryptocurrency values.

Looking ahead, HOOD is forecasted to shift from an adjusted loss of -$0.61 per share last year to a profit of +$0.97 per share in 2024. The bottom line is expected to grow by 22% the following year.

Robinhood’s earnings projections have received notable boosts recently, anticipating 20% increases for FY24 and FY25. The company’s upward revisions earned it a Zacks Rank #1 (Strong Buy).

Moreover, revenue expectations stand at a significant rise of 54% in FY24 and a further 23% increase in FY25, predicting a total of $3.53 billion compared to $1.9 billion in 2023.

Stock Performance and Valuation Trends

Image Source: Zacks Investment Research

Robinhood shares have surged by 385% over the past year and 210% in the last six months. However, the stock may encounter resistance at its post-IPO highs from 2021, aside from an exceptional short-term spike. Following a dip on Thursday, it could test its 21-day or 50-day moving averages based on upcoming guidance.

Currently, Robinhood’s valuation appears to be improving, trading at a 50% discount to its 12-month highs at 44.9X forward 12-month earnings. Its PEG ratio, which factors in earnings growth potential, stands at 0.7 compared to 1.3 for the Finance sector and 1.7 for Technology.

Explore Emerging Energy Opportunities

The demand for electricity continues to rise, while efforts to reduce reliance on fossil fuels like oil and natural gas are ramping up. Nuclear energy presents a strong alternative.

Global leaders from the U.S. and 21 other countries have committed to tripling nuclear energy capacities. This ambitious goal could lead to substantial gains for investments in nuclear-related stocks for those who act swiftly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights the key players and technologies driving this shift, featuring three standout stocks poised for significant benefits. Download Atomic Opportunity: Nuclear Energy’s Comeback for free today.

Stay updated with Zacks Investment Research’s latest stock recommendations. Today, you can access 7 Best Stocks for the Next 30 Days for free.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.