Top Stocks to Buy This November: Value Picks for Smart Investors

Here are three stocks with strong buy rankings and compelling value characteristics for investors to consider today, November 22:

StoneX Group Inc. (SNEX): This global financial services network provider holds a Zacks Rank #1, with the Zacks Consensus Estimate for its current year earnings increasing by 8.7% over the past 60 days.

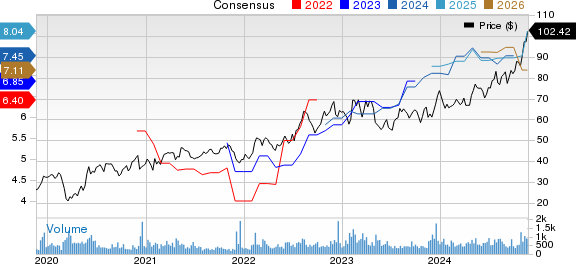

Analyzing StoneX Group Inc.’s Price and Consensus

StoneX Group Inc. price-consensus-chart | StoneX Group Inc. Quote

StoneX Group has a price-to-earnings ratio (P/E) of 12.78, significantly lower than the S&P average of 24.65. The firm boasts a Value Score of B.

Looking at StoneX Group Inc.’s PE Ratio (TTM)

StoneX Group Inc. pe-ratio-ttm | StoneX Group Inc. Quote

Norwegian Cruise Line Holdings Ltd (NCLH): This cruise line also carries a Zacks Rank #1, seeing a 1.9% rise in the Zacks Consensus Estimate for its current year earnings over the last 60 days.

Examining Norwegian Cruise Line Holdings Ltd.’s Price and Consensus

Norwegian Cruise Line Holdings Ltd. price-consensus-chart | Norwegian Cruise Line Holdings Ltd. Quote

Norwegian Cruise Line has a P/E ratio of 16.35, below the industry average of 23.70. The company holds a Value Score of A.

Investigating Norwegian Cruise Line Holdings Ltd.’s PE Ratio (TTM)

Norwegian Cruise Line Holdings Ltd. pe-ratio-ttm | Norwegian Cruise Line Holdings Ltd. Quote

Artisan Partners Asset Management Inc. (APAM): This investment management firm also ranks #1 according to Zacks, with a 3.9% increase in the earnings estimate over the past 60 days.

Analyzing Artisan Partners Asset Management Inc.’s Price and Consensus

Artisan Partners Asset Management Inc. price-consensus-chart | Artisan Partners Asset Management Inc. Quote

Artisan Partners has a P/E ratio of 13.43, which is lower than the industry average of 15.20. It holds a Value Score of B.

Reviewing Artisan Partners Asset Management Inc.’s PE Ratio (TTM)

Artisan Partners Asset Management Inc. pe-ratio-ttm | Artisan Partners Asset Management Inc. Quote

For a detailed overview of more top-ranked stocks, check out the full list here.

To understand more about the Value score and its calculation, click here.

Five Stocks Poised for Significant Growth

These stocks have been identified by a Zacks expert as the #1 choice to potentially double in value in 2024. Historical performance of prior selections has shown remarkable gains, with returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the highlighted stocks in this report are currently below Wall Street’s radar, presenting a unique opportunity to invest early.

Discover These 5 Potential Growth Stocks >>

For a free analysis report on Norwegian Cruise Line Holdings Ltd. (NCLH), click here.

For a free analysis report on Artisan Partners Asset Management Inc. (APAM), click here.

For a free analysis report on StoneX Group Inc. (SNEX), click here.

Read this article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.