“`html

Vanguard’s Top ETFs to Watch for Wealth Growth in 2025

Exchange-traded funds (ETFs) provide an attractive way to build wealth, offering a wide range of options often with minimal fees. Let’s explore some standout ETFs from Vanguard and identify the top pick for 2025.

Image source: Getty Images.

Where can you invest $1,000 now? Our analyst team has just released their list of the 10 best stocks to buy today. See the 10 stocks »

A Look at Vanguard’s Leading ETFs

Vanguard stands out as a top ETF provider, with more than 80 ETFs and over $2.6 trillion in assets under management. This means plenty of excellent options are available for investors. Here are a few notable choices:

The Vanguard Growth ETF (NYSEMKT: VUG) tracks large-cap growth stocks like Apple, Microsoft, and Nvidia. As of now, it reports a year-to-date return of 35%, placing it among the top performers in Vanguard’s lineup with a low expense ratio of 0.04%.

Next is the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG), which covers large-cap growth stocks, totaling around 300, and prominently features the “Magnificent Seven.” Currently, it holds the title of Vanguard’s best-performing stock ETF with a year-to-date return of 38%. While its expense ratio is slightly higher at 0.1%, it remains competitive within the industry.

The Vanguard Information Technology ETF (NYSEMKT: VGT) focuses on tech giants, heavily investing in Apple, Microsoft, Nvidia, and Broadcom. This ETF has yielded a 31% year-to-date return, along with an impressive five-year compound annual growth rate (CAGR) of 22%. Its expense ratio stands at 0.1%, making it cost-effective at only $10 in fees per year for each $10,000 invested.

VGT Total Return Level data by YCharts

Highlighting My Favorite Vanguard ETF

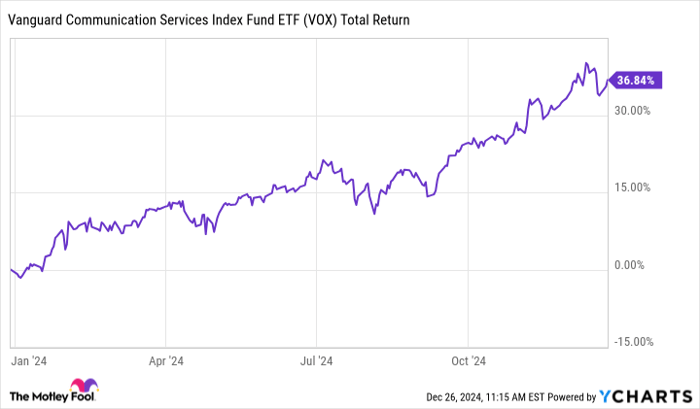

Among these stellar options, one Vanguard ETF currently stands out to me: the Vanguard Communication Services ETF (NYSEMKT: VOX). This fund is appealing due to its diverse mix of companies within its holdings.

VOX Total Return Level data by YCharts

Looking closely, the ETF has significant stakes in Meta Platforms (23% of assets) and Alphabet (21%). It also invests in Netflix (5%), Verizon (4%), Comcast (4%), AT&T (4%), and Walt Disney (4%). There are smaller investments in promising stocks such as The Trade Desk (2%) and Roblox (2%).

Interestingly, this ETF resembles more of an internet sector fund due to the significant influence of digital and social media companies. Traditional telecom players, while still included, are no longer the largest contributors to the fund, highlighting the shift in the communication landscape.

“““html

Why Vanguard’s Communication Services Fund is a Smart Choice Today

As digital ways of communicating and advertising take the spotlight, the Vanguard Communication Services Index Fund ETF stands out as a top investment option.

A New Opportunity for Investors

If you’ve ever thought you missed your chance to buy into successful stocks, you should pay attention now.

Our team of analysts sometimes identifies certain companies for their “Double Down” stock recommendations, believing these stocks are poised for growth. If you feel like you’ve already lost your opportunity, now could be the perfect time to invest before prices rise further. Here are the impressive statistics:

- Nvidia: Investing $1,000 when we made our “Double Down” call in 2009 would now value at $355,269!*

- Apple: If you invested $1,000 back in 2008 when we doubled down, it would be worth $48,404!*

- Netflix: Investing $1,000 when we made our call in 2004 has grown to $489,434!*

Currently, we’re offering “Double Down” alerts for three outstanding companies, and this opportunity may not last long.

Discover the 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Suzanne Frey, executive at Alphabet, and Randi Zuckerberg, former director at Facebook, are on The Motley Fool’s board of directors. Jake Lerch holds investments in AT&T, Alphabet, Nvidia, Roblox, and other companies. The Motley Fool has investments and recommends companies such as Advanced Micro Devices, Apple, and Netflix among others. The Motley Fool also recommends certain options on Microsoft. For full disclosures, please refer to The Motley Fool’s policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`