Vanguard ETFs Shine: Outstanding Returns Leading 2024 Market

Vanguard has become a favorite among investors, with 42 of its 86 exchange-traded funds (ETFs) providing double-digit returns year-to-date. Impressively, 16 of these ETFs have achieved total returns of at least 20%. Let’s explore the standout performer so far in 2024.

Leading Vanguard ETFs of 2024

Surprising names have risen to the top within Vanguard’s ETF lineup. The Vanguard Utilities ETF (NYSEMKT: VPU) has consistently held the title of Vanguard’s best performer for much of the past few weeks. Currently, it boasts a total return of 25.7%, ranking third among all Vanguard ETFs.

Traditionally, utility stocks attract less excitement. However, expectations for an interest rate cut by the Federal Reserve, which eventually occurred, created favorable conditions for the utilities sector and contributed to the Vanguard Utilities ETF’s strong performance.

Image source: Getty Images.

Next in line, the Vanguard Communication Services ETF (NYSEMKT: VOX) stands out with a total return of 27.3%. Most of this increase is attributed to share price gains, as many companies within the ETF either do not pay dividends or offer minimal returns.

Three stocks significantly boosted the Vanguard Communication Services ETF’s performance this year. Meta Platforms, the parent company of Facebook, accounts for 23.2% of the ETF. Its shares surged about 58% this year. Meanwhile, Google’s parent company, Alphabet, represents 21.1% of the ETF’s holdings, with both classes of shares appreciating by around 21% in 2024.

The Top Vanguard ETF in 2024

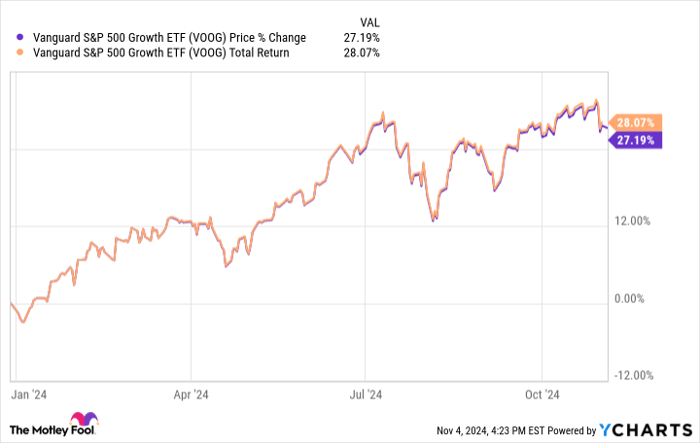

Leading the pack with unmatched returns is the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG). It has achieved a remarkable total return exceeding 28% this year, driven by a share price increase of over 27%.

VOOG data by YCharts

The Vanguard S&P Growth ETF seeks to replicate the performance of the S&P 500 Growth Index, which focuses on growth stocks in the S&P 500 with high sales growth, momentum, and a favorable earnings-to-price ratio.

This ETF currently holds 234 stocks, with its five largest investments being Apple, Microsoft, Nvidia, Amazon, and Meta. Collectively, these stocks represent approximately 45.8% of the ETF’s total portfolio. Nvidia has been particularly outstanding, with its share price soaring by 175% this year.

Since its launch in September 2010, the Vanguard S&P 500 Growth ETF has recorded an annualized average total return of 16%. Thanks to efficient management, the fund maintains a low annual expense ratio of just 0.1%, allowing more of its returns to benefit investors.

Evaluating the Vanguard S&P 500 Growth ETF as an Investment

Investors should note that past performance does not guarantee future results. The ETF’s elevated valuation could pose risks, as the average price-to-earnings ratio among its stocks is currently 34.4.

Despite holding a large array of stocks, the ETF’s concentration in top holdings can limit diversification. These leading stocks tend to show similar price movements, which can be a concern for some investors.

However, the significant recent growth in demand for artificial intelligence (AI) applications has played a crucial role in the strong performance of the Vanguard S&P 500 Growth ETF. If you believe that AI will continue to expand (and many analysts think it will), this ETF could be a solid investment choice, even at its high valuation.

Considering an Investment in the Vanguard S&P 500 Growth ETF

If you are contemplating investing $1,000 in the Vanguard S&P 500 Growth ETF, it’s worth considering additional recommendations:

The Motley Fool Stock Advisor team has identified their top ten stocks for investment, and the Vanguard S&P 500 Growth ETF was not included on this list. Their selections could yield substantial returns in the coming years.

For perspective, consider once again Nvidia: when it made their list on April 15, 2005, a $1,000 investment at that time would have grown to about $857,383!*

Stock Advisor offers investors a structured approach to successful investing, complete with portfolio guidance, regular analyst updates, and two new stock picks every month. Since its inception, the Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Alphabet, Amazon, Apple, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.