Investors Eye High Dividend Stocks: Insights on BGS, FLO, and KHC

In uncertain market conditions, dividend-yielding stocks become popular amongst investors. Companies with strong free cash flows often reward their shareholders with substantial dividends, making them attractive options for those seeking income during turbulent times.

For those interested in staying updated on stock performance, Benzinga offers a comprehensive Analyst Stock Ratings page. This resource allows traders to explore a wealth of analyst opinions, sortable by accuracy.

Here’s a look at three high-yielding stocks in the consumer staples sector, along with insights from top analysts.

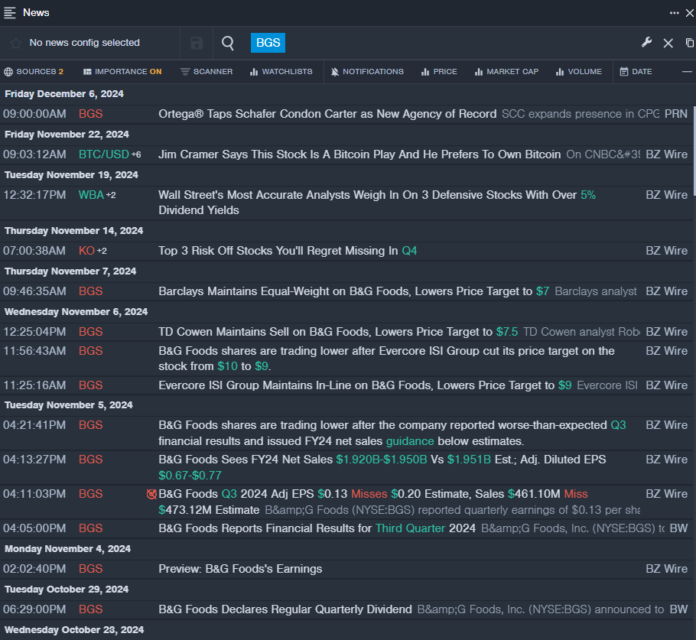

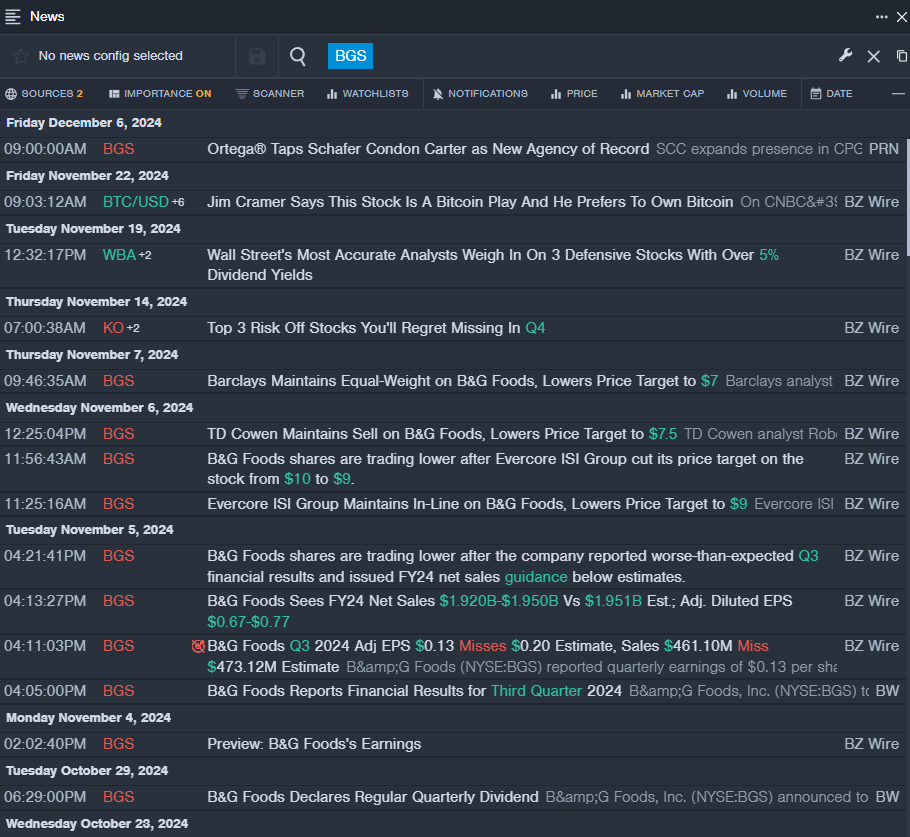

B&G Foods, Inc. BGS

- Dividend Yield: 10.72%

- Barclays analyst Brandt Montour has maintained an Equal-Weight rating but has reduced the price target from $8 to $7 as of Nov. 7, demonstrating a 66% accuracy rate.

- TD Cowen analyst Robert Moskow also holds a Sell rating, adjusting the price target down from $8 to $7.5 on Nov. 6 with a 65% accuracy rate.

- Recent News: On Nov. 5, B&G Foods announced disappointing third-quarter results and provided FY24 net sales guidance that fell short of estimates.

- Benzinga Pro’s real-time newsfeed keeps investors informed of the latest developments regarding BGS.

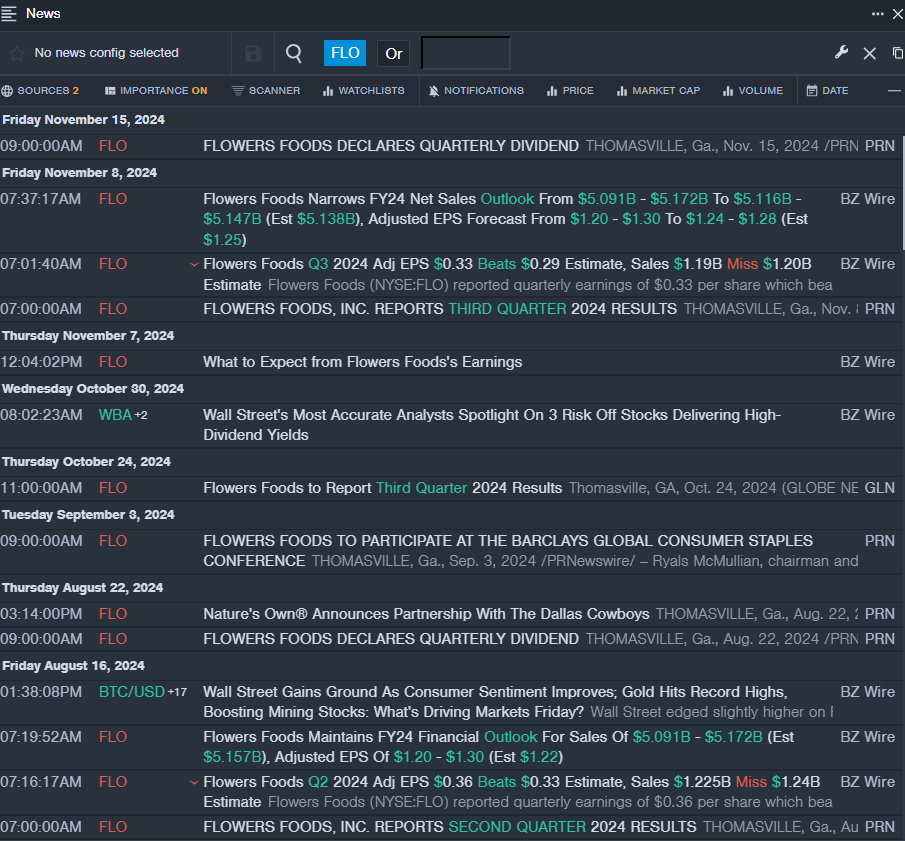

Flowers Foods, Inc. FLO

- Dividend Yield: 4.69%

- DA Davidson analyst Brian Holland has a Neutral rating and recently increased the price target from $24 to $25 as of May 17, showing a 67% accuracy rate.

- Deutsche Bank analyst Steve Powers has also maintained a Hold rating while raising the price target from $22 to $23 on May 9, with a 67% accuracy rate.

- Recent News: On Nov. 8, Flowers Foods released quarterly earnings that exceeded expectations.

- Benzinga Pro’s real-time newsfeed offers timely updates about FLO.

The Kraft Heinz Company KHC

- Dividend Yield: 5.22%

- Piper Sandler analyst Michael Lavery downgraded KHC from Overweight to Neutral, cutting the price target from $40 to $35 on Nov. 19, achieving a 67% accuracy rate.

- Mizuho analyst John Baumgartner maintained an Outperform rating and reduced the price target from $43 to $41 on Oct. 31, holding a 68% accuracy rate.

- Recent News: On Oct. 30, Kraft Heinz reported third-quarter earnings of 75 cents per share, surpassing estimates. However, the company noted a decline in revenue and suggested a lengthy recovery is needed for U.S. retail.

- Benzinga Pro’s charting tool has proven useful for tracking KHC stock trends.

https://www.youtube.com/watch?v=pVF0O2lsEH4[/embed>

Read More:

Market News and Data brought to you by Benzinga APIs