Top Investment Picks from Warren Buffett’s Berkshire Hathaway for 2025

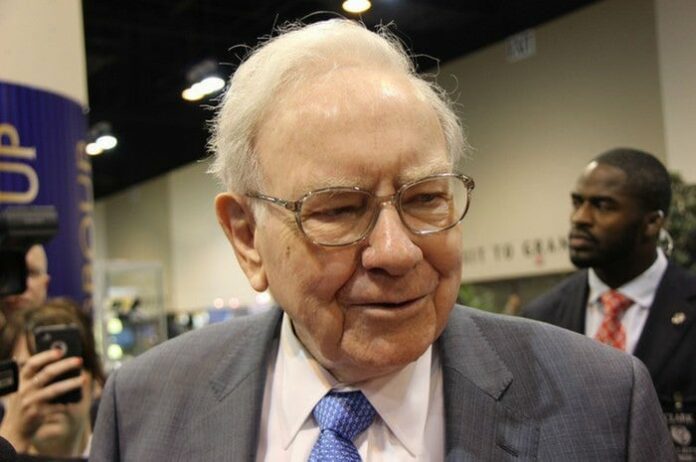

Looking to invest your money as the new year approaches? Checking out Warren Buffett’s portfolio could spark some ideas. Buffett, along with investing managers Todd Combs and Ted Wechsler at Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), focuses on strong companies that generate cash and have a competitive edge at reasonable prices.

Although Buffett isn’t infallible, reviewing the nearly 50 stocks in the Berkshire portfolio may provide a solid starting point. Among them, three standout options seem promising as we head into 2025.

Where to invest $1,000 right now? Our analysts just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Amazon: A Small But Significant Player

While Buffett’s portfolio has few tech stocks, Amazon (NASDAQ: AMZN) stands out with a modest 0.7% allocation. Berkshire first invested in Amazon in the first quarter of 2019, at a favorable time for tech investments, and since then, Amazon’s stock has nearly tripled. Despite this growth, Amazon remains an attractive buy.

In 2024, Amazon tackled two significant issues: the profitability of its e-commerce operations and concerns about falling behind in the generative AI field.

In its recent earnings reports, Amazon showcased improvements. Over the past year, North American e-commerce operating margins grew from 3.9% to 5.9%, and international e-commerce turned from a 3% loss into a 3.6% profit margin.

The Amazon Web Services (AWS) sector has also picked up momentum, reporting a 19% growth last quarter up from 12% five quarters ago. Additionally, its operating margin increased from 24.2% to 38.1% during this time.

A notable boost in confidence for Amazon came from its partnership with Anthropic, an AI startup led by a former OpenAI executive. After investing $1.25 billion in September 2023, Amazon continued to increase its stake with another $2.75 billion in March 2024 and an additional $4 billion in November.

This partnership allows Amazon to capitalize on Anthropic’s advanced AI models while helping Anthropic save costs by using Amazon’s Trainium chips instead of pricier options from Nvidia.

Chubb: Insurance with a Competitive Edge

Chubb (NYSE: CB) is a leading name in the property and casualty insurance sector. Thanks to its strong reputation for quick and fair claims processing, Chubb can charge higher premiums and earn greater profits than many of its peers. This reputation is a key competitive advantage that likely attracted Buffett to their stock.

Currently, the insurance sector is navigating unique challenges. The combination of inflation and significant natural disasters has shrunk competition. This landscape has allowed prominent insurers, like Chubb, to raise prices and sustain profitability. In the third quarter, despite a tough climate, Chubb posted an impressive property and casualty combined ratio of 87.7% and a return on tangible equity of 21.7%.

Image source: The Motley Fool.

Interestingly, higher inflation and rising interest rates have created favorable conditions for insurers, who can invest their “float” into fixed income assets. Chubb’s ability to reinvest at higher rates has led to a 16% increase in adjusted interest income last quarter. For investors anticipating ongoing inflation and interest rate risks, Chubb’s stock offers a way to navigate these challenges.

Sirius XM: Adapting to Change

Recently, Berkshire Hathaway expanded its stake in Sirius XM Holdings (NASDAQ: SIRI). While Berkshire has supported Sirius since 2016 through its Liberty Media tracking stock, the investment increased following Sirius’ merger with that tracking stock in September.

In 2024, Sirius faced a steep decline of 58%. However, Berkshire continued buying shares, likely anticipating a recovery ahead.

Sirius still maintains a dominant position in satellite radio, but its revenue has faced challenges over the past two years due to a slowdown in new vehicle purchases—a key driver for its growth. Many vehicles come with Sirius pre-installed, which offers a unique customer acquisition advantage. The rise of internet streaming has raised concerns, alongside general consumer caution.

Nonetheless, Sirius’ pre-installed feature remains valuable, and its exclusive content offers a competitive edge.

This summer, Sirius launched a free ad-supported service to attract new listeners, a move that could be crucial in countering the competition from streaming apps. Additionally, Sirius plans to reduce costs and concentrate on its core market in the upcoming year.

Currently trading at just over 7 times earnings, Sirius holds potential for significant appreciation if it can stabilize or grow its revenue. Should the auto market improve or the new ad-supported tier gain traction, the upside may be considerable.

A Second Chance for Lucrative Investments

Do you ever feel like you’ve missed out on investing in top stocks? It might be time to pay attention.

Occasionally, our expert analysts identify stocks that are poised for a rebound and issue a “Double Down” stock recommendation. If you think you’ve missed your opportunity, act now so you won’t be left behind. Here are some examples:

- Nvidia: An investment of $1,000 in 2009 would have grown to $374,613!*

- Apple: Investing $1,000 in 2008 would net $46,088!*

- Netflix: Backing $1,000 in 2004 would result in $475,143!*

Right now, we are issuing “Double Down” alerts for three remarkable companies, and you may not see another opportunity like this for quite some time.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Billy Duberstein and his clients have positions in Amazon and Berkshire Hathaway. The Motley Fool has positions in and recommends Amazon, Berkshire Hathaway, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.