Tesla Stock Sees Significant Power Inflow: What It Means for Traders

Tesla, Inc. (TSLA) witnessed a noticeable Power Inflow today, attracting attention from traders interested in market trends and institutional buying habits.

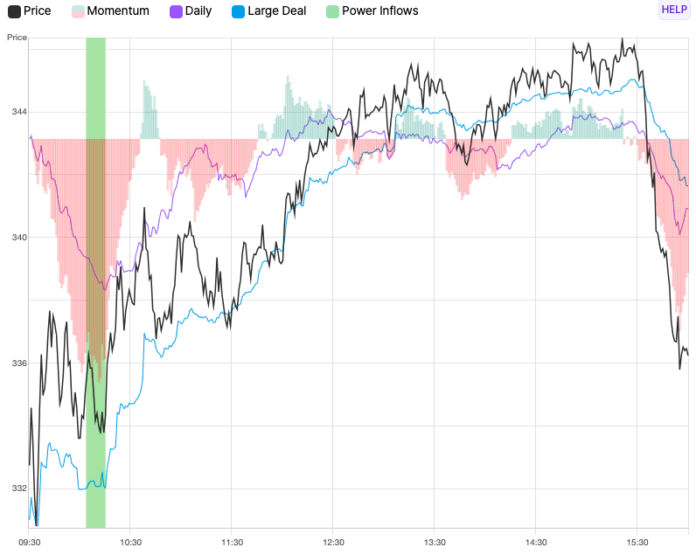

At 10:13 AM on February 12th, TSLA registered a Power Inflow at a price of $334.45. This trading signal is vital for investors looking to understand where institutional investments and “smart money” are heading. Such indicators can guide traders toward potential profit opportunities, suggesting that an uptrend in Tesla’s stock might be on the horizon. Investors often interpret this sign as bullish and closely monitor the stock for ongoing momentum.

Understanding Power Inflow

Power Inflow is part of order flow analytics, which evaluates the volume of buy and sell orders from both retail and institutional traders. This process examines the timing, size, and patterns of transactions to provide clearer insights for trading decisions. Active traders view this specific indicator as a bullish sign.

The occurrence of Power Inflow typically happens within the initial hours of the trading day. It serves as an indicator of the direction the stock is likely to take based on institutional activity, impacting the stock’s outlook for the rest of the day.

Traders applying order flow analytics can interpret market conditions more effectively, identifying trading opportunities that could enhance their performance. However, it’s vital to use sound risk management strategies to safeguard investments against unforeseen market shifts. A well-structured risk management approach increases traders’ chances of achieving long-term success in an unpredictable environment.

For those interested in the latest options trades for TSLA, Benzinga Pro offers real-time alerts to keep you informed.

Market News and Data are provided by Benzinga APIs, including firms like TradePulse, which contribute data to this article.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

The Power Inflow price was noted at $334.45. Following this, the stock reached a high price of $346.30 and closed at $336.53, resulting in returns of 3.5% and 0.6% respectively. This underscores the importance of having a strong trading plan that incorporates Profit Targets and Stop Losses aligned with individual risk appetites. The TradePulse data indicated a reversal in the last half hour of trading.

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs