Can Small Daily Savings Lead to Big Wealth? Here’s How Saving $10 a Day Could Build Your Million-Dollar Portfolio

Breaking It Down: Saving $10 a Day Adds Up

You might think that saving and investing to reach a goal like $1 million seems impossible. However, by aiming for small daily savings, that goal can start to feel more achievable. Consider reducing your dining out habits, switching to cheaper utility or cellphone providers, or opting for store-brand products instead of name brands. These small changes can lead to significant savings.

For instance, saving just $10 daily equates to setting aside $3,650 each year. At first glance, putting away that annual sum can appear daunting, especially with rising costs due to inflation. But breaking it down into smaller amounts—like $300 a month or $10 a day—illustrates just how manageable this task can become. By avoiding unnecessary daily expenses, like an expensive coffee or frequent dining out, you might easily save that amount each year.

Long-term savings can build a robust retirement fund. If you stick to saving $3,650 yearly, after 20 years, you could have around $73,000 saved. After 30 years, that amount could grow to nearly $110,000. Although that’s not $1 million yet, investing that money wisely can make a substantial difference.

Investing in a Vanguard ETF for Strong Returns

When you save $10 daily or around $300 monthly, investing those funds can yield even better results over time. Placing your savings into an exchange-traded fund (ETF) is one option that can enhance growth, while maintaining a relatively low risk. ETFs are known for their diversification and potential for robust long-term returns.

For instance, the Vanguard Growth Index Fund ETF (NYSEMKT: VUG) is a popular choice among growth investors. This fund primarily invests in growth stocks, holding 183 stocks overall, with technology stocks making up nearly 58% of its assets. Consumer discretionary stocks follow closely behind, representing over 18% of the fund. By investing in this ETF, you gain access to top players like Nvidia and Amazon, all for a low expense ratio of just 0.04%.

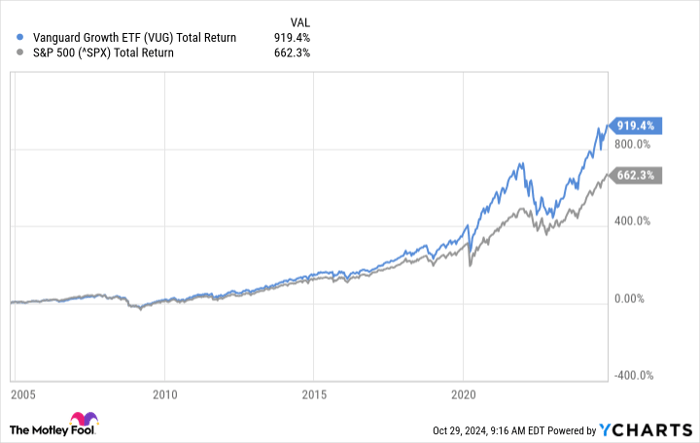

Impressively, over the past 20 years, the Vanguard fund has delivered total returns exceeding 900%, significantly outperforming the S&P 500.

VUG Total Return Level data by YCharts

How Consistent Investing Can Lead to Over $1 Million

The Vanguard ETF has generated around a 920% return, equating to a compounded annual growth rate (CAGR) of approximately 12.3%. In contrast, the S&P 500 has shown a CAGR of about 10.7% during the same period.

Assuming these growth rates persist, investing $10 a day, or $300 monthly, into the Vanguard fund could significantly benefit your long-term savings. Here’s a look at how your investment might grow over 30 years when compared to just matching the S&P 500:

| Years Invested | Vanguard ETF |

S&P 500 Equivalent |

|---|---|---|

| 10 | $70,240 | $63,979 |

| 15 | $154,213 | $132,647 |

| 20 | $309,049 | $249,618 |

| 25 | $594,546 | $448,867 |

| 30 | $1,120,967 | $788,267 |

Calculations by author.

While the growth figures may seem modest at first glance, the long-term differences in balances can significantly impact your financial future. Investing in growth-focused ETFs like Vanguard’s fund provides an opportunity to maximize your savings effectively.

It’s essential to remember that future returns are never a guarantee, and actual returns could differ from these expectations. However, by focusing on growth stocks, you could increase your chances of surpassing market performance over time.

Seize this Opportunity to Invest Wisely

Do you ever feel like you missed out on buying successful stocks earlier? It’s not too late. Our team of analysts occasionally recommends a “Double Down” stock that they believe is on the verge of rising significantly.

Here are just a few examples of past Double Down successes:

- Amazon: Investing $1,000 when we doubled down in 2010 would now be worth about $22,292!

- Apple: An investment of $1,000 when we doubled down in 2008 has grown to approximately $42,169!

- Netflix: A $1,000 investment when we doubled down in 2004 skyrocketed to nearly $407,758!

Currently, we have alerts for three promising companies, and you may not want to miss out on these opportunities.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Nvidia, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and may not reflect those of Nasdaq, Inc.