Nvidia: A Decade of Unmatched Growth in Tech Investment

Nvidia (NASDAQ: NVDA) has experienced one of the most remarkable growth stories in the tech industry over the last few years. Yet, the narrative of its dominance stretches back even further. With its leading GPUs (graphics processing units), Nvidia has delivered extraordinary returns to investors over the past decade. For those who invested a modest amount a decade ago and held onto their shares, the results have been nothing short of life-changing.

There are valuable lessons to learn from Nvidia’s journey, which might resonate with investors looking for similar opportunities.

Nvidia’s Path: Peaks and Valleys

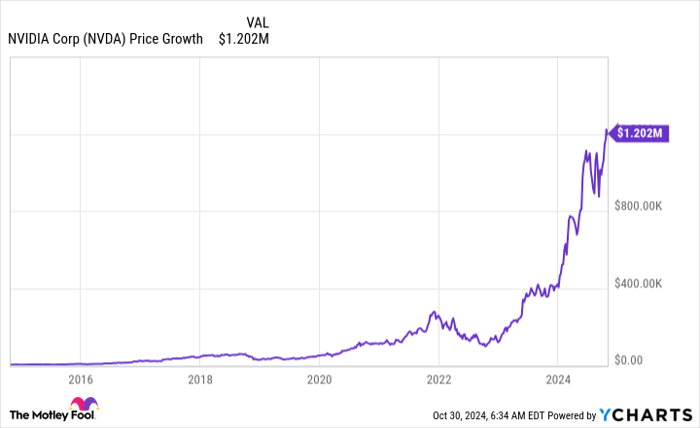

Consider this: if you had invested $4,000 in Nvidia stock ten years ago, today your investment would have grown to an impressive amount.

NVDA data by YCharts

This phenomenal growth might cause some to regret not investing sooner. However, it’s critical to remember that while Nvidia is unique, stocks that experience significant growth are not entirely rare. In any given decade, a few companies manage to deliver outstanding performance, making them exceptional rather than commonplace.

Nevertheless, the journey has not been smooth. Nvidia’s stock faced two significant declines in the past ten years, with the most recent drop occurring in late 2022, when the stock plummeted by 66%, erasing gains made since 2020.

Investors taking a long-term approach must recognize that substantial declines can test one’s resolve. During downturns, it’s essential to reflect on the reasons behind the stock’s potential and whether current difficulties will impact its long-term value. If the answer is no, patience is key.

While holding onto stocks is relatively simple, finding the right companies is a more challenging endeavor.

Identifying Companies with Massive Growth Potential

When searching for stocks with substantial upside potential, one critical factor stands out: mass market appeal. Does the company offer a product that could influence a significant portion of the global population?

This lens could have highlighted major successes like Amazon and Alphabet, as both companies revolutionized user experiences across broad demographics.

Nvidia, however, nearly missed the radar. Initially designed for gaming graphics, its powerful GPUs are invaluable in various domains, including data centers for AI training and engineering simulations, which fueled its recent surge—an evolution anticipated by some investors.

Nvidia’s potential for mass market influence makes it notable, and despite not being an obvious winner a decade ago, indicators of its future significance were present.

Investors should seek companies poised to change how society operates. If you find one, maintaining your investment during fluctuations could prove rewarding as the temporary setbacks may become irrelevant over time.

Is it Time to Invest $1,000 in Nvidia?

Before deciding to invest in Nvidia, it’s wise to consider this:

The Motley Fool Stock Advisor analyst team recently pinpointed their view of the 10 best stocks to buy now—but Nvidia was notably excluded. The selected stocks are anticipated to yield significant returns in the near future.

Reflecting back, when Nvidia made the list on April 15, 2005, if you had invested $1,000 at that time, your return would amount to $829,746!*

Stock Advisor offers investors a straightforward roadmap for success, with guidance on portfolio building, regular analyst updates, and new stock picks each month. The Stock Advisor service has achieved more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.