Investing in the Invesco QQQ Trust: A Path to Growth

Many of the world’s leading growth stocks are listed on the Nasdaq exchange, with the Nasdaq-100 index showcasing the largest nonfinancial companies. A popular investment choice among growth investors is the Invesco QQQ Trust (NASDAQ: QQQ), an exchange-traded fund (ETF) designed to track the Nasdaq-100. This article explores how a $50,000 investment in this ETF could grow over time and the likelihood of reaching $1 million by retirement.

Where to Invest $1,000 Right Now? Our analysts have identified the 10 best stocks to consider investing in now. Learn More »

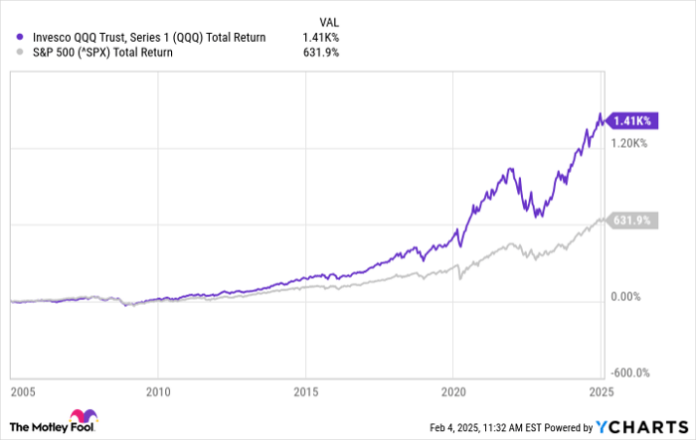

Data source: YCharts

Assessing Invesco’s Historical Performance

The Invesco QQQ Trust has shown impressive market-beating returns over the years, significantly outpacing the S&P 500. However, it’s important for investors to remember that past performance does not guarantee future results. Two decades have passed since the dot-com crash, and many technology stocks are currently trading near record highs. This situation raises questions about their potential to sustain high growth rates going forward. While a market crash may not be imminent, investors should prepare for the possibility of slower returns in the future.

Despite the changing nature of the Nasdaq-100 over time, I remain optimistic that this ETF could continue to deliver strong returns, making it a viable option for long-term investment until retirement.

Future Projections: $50,000 Investment in QQQ

To estimate the future value of a $50,000 investment, it’s essential to consider the number of years until retirement and the expected annual return rate. Below is a table showing how this investment could grow over time at various interest rates and retirement timelines.

| Projecting a $50,000 Investment Into the Future | ||||

|---|---|---|---|---|

| Annual Growth Rate | ||||

| Years to Retirement | 8% | 9% | 10% | 11% |

| 25 | $342,424 | $431,154 | $541,735 | $679,273 |

| 26 | $369,818 | $469,958 | $595,909 | $753,993 |

| 27 | $399,403 | $512,254 | $655,500 | $836,932 |

| 28 | $431,355 | $558,357 | $721,050 | $928,995 |

| 29 | $465,864 | $608,609 | $793,155 | $1,031,185 |

| 30 | $503,133 | $663,384 | $872,470 | $1,144,615 |

| 31 | $543,383 | $723,088 | $959,717 | $1,270,522 |

| 32 | $586,854 | $788,166 | $1,055,689 | $1,410,280 |

| 33 | $633,802 | $859,101 | $1,161,258 | $1,565,411 |

| 34 | $684,507 | $936,421 | $1,277,383 | $1,737,606 |

| 35 | $739,267 | $1,020,698 | $1,405,122 | $1,928,743 |

Data source: Calculations by author.

Achieving a value of over $1 million from your investment is possible, but two essential points are evident from the table. Firstly, maintaining your investment for over 30 years is likely necessary. Secondly, the fund must generate an annual return of at least 10%, which aligns with the long-run average of the S&P 500. While this may appear feasible, it is important to acknowledge that stock prices are currently elevated, making future returns uncertain.

Preparing for the Unexpected in Your Investment Journey

There are no guarantees with a $50,000 investment—even in a top-tier growth ETF—when it comes to reaching $1 million by retirement. However, you can increase your chances of success by consistently contributing additional funds to your ETF. Any incremental investment adds to the compound growth, resulting in a more substantial final portfolio, which aids in achieving retirement goals. Ideally, if your investment performs better than expected, you’ll be well-prepared for a financially secure retirement.

Seize This Opportunity for Potentially High Returns

Have you ever felt that you missed an opportunity to invest in top-performing stocks? Here’s your chance to avoid that feeling.

Our expert team of analysts occasionally issues a “Double Down” stock recommendation for companies poised for significant growth. If you believe you’ve missed your chance to invest, now is the ideal time to consider adding these stocks to your portfolio. Here’s a glimpse at past performance:

- Nvidia: Investing $1,000 when we first recommended it in 2009 would have grown to $336,677!*

- Apple: An initial investment of $1,000 in 2008 would now be worth $43,109!*

- Netflix: If you invested $1,000 in 2004, it would now be valued at $546,804!*

Our team is currently issuing “Double Down” alerts for three outstanding companies, and this might be a rare opportunity.

Learn more »

*Stock Advisor returns as of February 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.