TreeHouse Foods, Inc. THS appears to be at the crossroads of promising opportunities and pressing challenges as it moves through 2024. Let’s delve deeper into the factors shaping the journey of this renowned private brand snacks and beverage company.

Private-Label Strength and Market Dynamics

One of TreeHouse Foods’ strategic advantages lies in its position within two thriving consumer trends. These include the growth of private-label groceries in North America and the ongoing shift in consumer preferences toward snacking. On its first-quarter 2024earnings call management highlighted consistent market share gains that private brands have achieved over the past two decades, indicating substantial growth opportunities.

A closer look at the first-quarter results reveals sustained strength in private brand volume compared to national brands across the operational categories. Despite declines in national brand sales, private brand unit sales in measured retail channels demonstrated modest yet positive growth.

Additionally, the price disparities between national and private brands within the company’s categories emphasize the compelling value proposition that private labels offer to consumers. This supportive market environment for private brands helped boost unit share throughout the first quarter and also reflects robust prospects for TreeHouse Foods’ products to consumers and retailers.

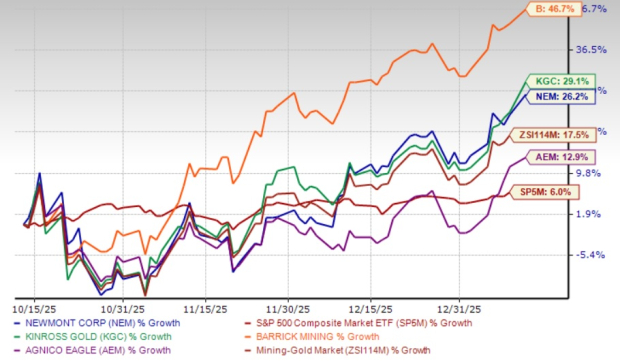

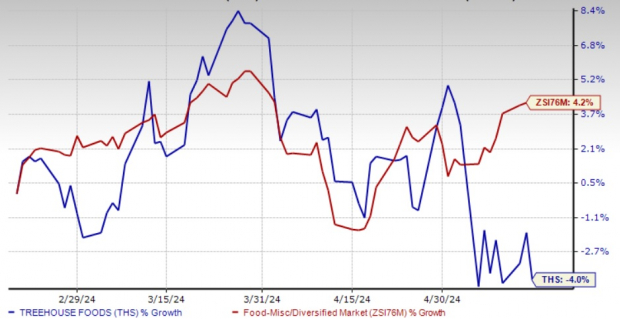

Image Source: Zacks Investment Research

TMOS Initiatives Aid

The company remains committed to implementing TMOS and other supply-chain initiatives aimed at enhancing execution, margin performance and enriching ties with customers. Its key priorities include TMOS, procurement and improvements in the distribution network. The ongoing advancements in these supply chain initiatives are expected to bolster margins in the years ahead.

It is worth noting that in the first quarter of 2024, the company’s TMOS initiatives led to improved overall equipment effectiveness (OEE) and better service levels. TreeHouse Foods expects to realize benefits from its efforts to enhance procurement, logistics and distribution. It expects gross cost savings of nearly $50 million in the latter half of the year and anticipates margin expansion in the second half of 2024.

Boulders on Way

Recent supply-chain disruptions, particularly from the restart of the broth facility, have impacted both volumes and margins of the company. Input cost inflation, especially in commodities like cocoa, adds to margin pressures. However, strategic pricing actions are underway to mitigate these effects.

Additionally, operating expenses have seen an uptick, impacting adjusted EBITDA in the first quarter of 2024. Adjusted EBITDA from continuing operations came in at $46 million in the first quarter, a significant drop from $91.3 million in the first quarter of 2023. The second quarter presents challenges, with expected declines in net sales and adjusted EBITDA compared to the previous year. Factors such as planned downtime at the broth facility and lag in pricing adjustments against inflationary pressures are likely to influence performance.

What’s Ahead?

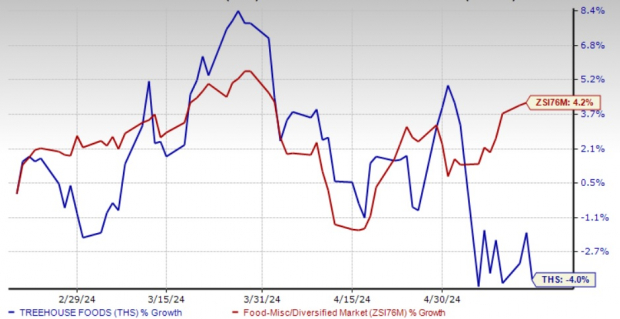

For the second quarter of 2024, TreeHouse Foods anticipates net sales to range between $770 million and $800 million, reflecting a roughly 2% decline at the midpoint but showing improvement compared to the first quarter. Adjusted EBITDA for the second quarter is projected between $55 million and $65 million compared with adjusted EBITDA from continuing operations of $76.4 million recorded in the second quarter of 2023. Shares of THS have fallen 4% in the past three months against the industry’s growth of 4.2%.

However, results are likely to improve sequentially in the second half of 2024. For the full-year 2024, TreeHouse Foods expects net sales in the band of $3.43-$3.5 billion, which indicates growth of nearly flat to 2% from the 2023 level. For 2024, adjusted EBITDA from continuing operations is likely to be in the band of $360-$390 million in 2024 compared with the $365.9 million reported in 2023.

TreeHouse Foods navigates a complex landscape, balancing growth opportunities with operational hurdles. Its strategic initiatives and focus on value creation position this Zacks Rank #3 (Hold) company for resilience and future success amid industry dynamics.

3 Appetizing Bets

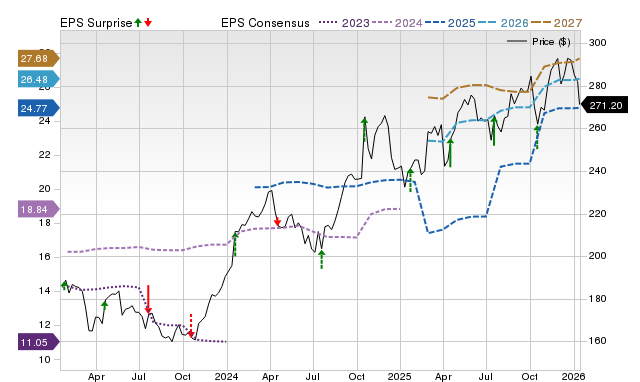

McCormick & Company, Inc. MKC is a leading manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors. It currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for McCormick & Company’s current fiscal-year sales and earnings indicates advancements of 0.3% and 5.6%, respectively, from the year-ago reported figures. MKC has a trailing four-quarter earnings surprise of 5.4%, on average.

The J. M. Smucker Company SJM, a branded food and beverage product company, currently carries a Zacks Rank #2. SJM has a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for J. M. Smucker’s current fiscal year earnings indicates growth of 7.6% from the year-ago reported figure.

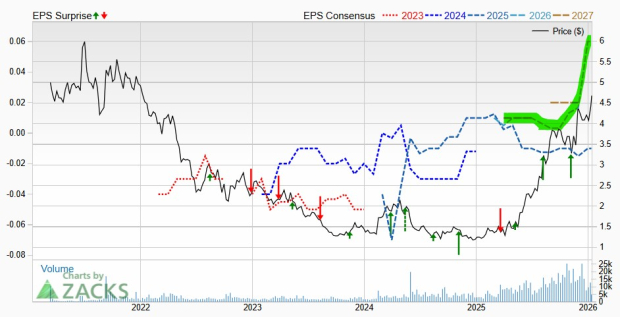

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks and currently carries a Zacks Rank #2. UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 24.6% from the year-ago reported numbers.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.