TripAdvisor Reports Mixed Q3 Results: Earnings Beat Expectations but Revenue Stalls

TripAdvisor TRIP announced its third-quarter 2024 non-GAAP earnings at 50 cents per share, which marked a 4% decrease compared to the same period last year. This figure, however, exceeded the Zacks Consensus Estimate by 13.64%.

The company’s revenues stood at $532 million, unchanged from the previous year. This total also surpassed the Zacks Consensus Estimate, which was $526 million.

The flat revenue was influenced by challenges in TRIP’s traditional hotel meta offerings. Conversely, growth in the Viator and The Fork segments helped mitigate some of these issues.

Strength in TRIP’s experience category, driven by broader trends and increased consumer interest, supported overall revenue performance. However, challenges in travel planning—recognized for its labor intensity and time demands—negatively impacted earnings.

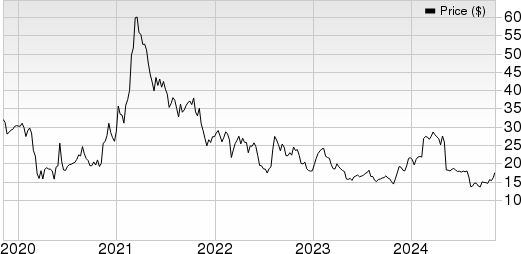

Overview of TripAdvisor’s Price and Performance

TripAdvisor, Inc. price-consensus-eps-surprise-chart | TripAdvisor, Inc. Quote

Key Financial Highlights for TRIP

Brand Tripadvisor: This segment generated $255 million in revenue (47.9% of total), representing a 12% decline year over year. Nevertheless, it beat the consensus estimate of $254 million. Media and advertising revenue grew by 5% to $40 million, largely due to an uptick in off-platform revenue and programmatic advertising, though direct advertising showed weak performance.

Experience and dining segment revenues came in at $51 million, a 7% year-over-year decrease. This decline was attributed to an increasing focus on self-service sales models and reduced experience revenues. Branded hotel revenues fell 17% to $151 million because of pricing difficulties in hotel meta, while other segment revenues dropped 19% to $13 million.

Viator: This segment accounted for $270 million in revenue (50.7% of total), which marked a 10% year-over-year growth, although it slightly missed the Zacks Consensus Estimate of $271 million.

TheFork: The Fork generated $49 million in revenue (9.2% of total), reflecting a robust 17% year-over-year increase, and exceeding the consensus estimate of $46.41 million.

Operating Results of TRIP

TripAdvisor’s selling and marketing expenses were stable at $271 million year over year, maintaining the same share of revenue. Administrative costs rose by 4% to $51 million, increasing its share of total revenue by 100 basis points.

Technology and content costs reached $73 million, up 11% compared to the prior year, raising its percentage of revenues by 200 basis points. The operating margin for the quarter was 13.16%, up 116 basis points from the previous year.

In terms of adjusted EBITDA, the margin was 22.93%, reflecting a decline of 90 basis points year-over-year.

Balance Sheet and Cash Flow Overview

As of September 30, 2024, cash and cash equivalents were $1.11 billion, a decrease from $1.18 billion as of June 30, 2024. Long-term debt was reported at $832 million, down from $841 million in the previous quarter.

In this quarter, TripAdvisor recorded negative cash from operations totaling $44 million, contrasting with $52 million generated in the previous quarter. The free cash flow for the third quarter was reported as negative $64 million.

TRIP’s Zacks Rank and Market Competitors

TripAdvisor currently holds a Zacks Rank #2 (Buy).

Other well-ranked stocks in the retail-wholesale sector include Alibaba BABA, Boot Barn BOOT, and Dutch Bros BROS, all of which carry a Zacks Rank #1 (Strong Buy). Notably, BABA’s shares have risen 24.4% year-to-date, with a projected long-term earnings growth rate of 10.44%.

BOOT has seen remarkable growth, with a 65.6% increase in shares for the year-to-date period and a long-term earnings growth estimate of 12.99%. BROS’ shares have increased by 29.5%, with a forecasted long-term earnings growth rate of 30%.

Exploring Future Investment Opportunities

The demand for electricity is on the rise worldwide, coinciding with efforts to reduce reliance on fossil fuels. Nuclear energy presents a viable alternative.

Recently, leaders from the US and 21 other nations committed to tripling the world’s nuclear energy capabilities, which may represent a significant opportunity for nuclear-related stocks and forward-thinking investors.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights key players and technologies in this sector, featuring three standout stocks that could see substantial benefits. Download your free copy today.

For the latest investment insights from Zacks Investment Research, you can access “5 Stocks Set to Double” at no cost. Click to view.

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

TripAdvisor, Inc. (TRIP) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.