A Bullish Outlook: Price Target on the Rise

Tronox Holdings (NYSE:TROX) has seen a significant 9.26% increase in its one-year price target, now standing at 17.21 per share, up from the previous estimate of 15.75 as of January 16, 2024. This upward revision signals a promising trajectory for the company, with analysts setting price targets ranging from 14.14 to 19.95 per share, representing a substantial 14.75% increase from the latest closing price of 15.00 per share.

The Fund Sentiment: Tracking Investor Activity

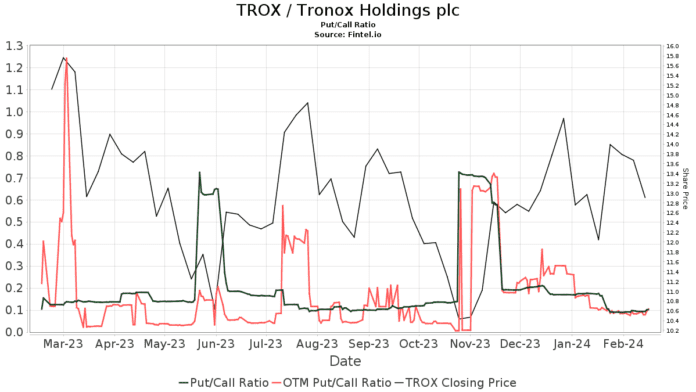

Tronox Holdings has caught the eye of 489 funds or institutions, maintaining consistent interest over the last quarter. The average portfolio weight dedicated to TROX among all funds stands at 0.17%, reflecting a minor decrease of 8.08%. Institutions have shown a growing interest, with total shares owned by them increasing by 1.96% in the last three months to reach 143,459K shares. The put/call ratio of TROX stands at 0.10, indicating a positive and bullish market sentiment.

Among the notable shareholders, Franklin Resources has increased its ownership in Tronox Holdings significantly, with 6,185K shares representing 3.94% ownership of the company. The firm ramped up its stake by 14.17% in its latest filing, demonstrating a strong vote of confidence in the company’s potential. On the other hand, Thrivent Financial For Lutherans and Capital International Investors have adjusted their portfolio allocations by decreasing and increasing their stakes, respectively, in the last quarter, revealing a nuanced market sentiment.

Moreover, Vanguard Total Stock Market Index Fund Investor Shares have subtly increased their ownership in Tronox Holdings by 0.18%, with 3,638K shares representing 2.32% ownership of the company. This strategic move indicates a steady and calculated approach by major institutional investors towards TROX.

Unveiling Tronox Holdings: A Gem in the Mining Industry

Tronox Holdings plc shines brightly as one of the global leaders in producing top-tier titanium products, encompassing titanium dioxide pigment, specialty-grade titanium dioxide products, high-purity titanium chemicals, and zircon. With operations spanning across six continents and nearly 6,500 employees, Tronox’s unmatched expertise and diverse portfolio position it as the unrivaled producer of titanium dioxide globally. The company’s vertical integration model and operational excellence further solidify its standing in the market, making it a formidable force to reckon with.

(Description provided by the company.)

For those seeking informed investment decisions, Fintel stands as a beacon of investing research, catering to individual investors, traders, financial advisors, and small hedge funds. Their comprehensive data includes a myriad of financial metrics, ownership insights, and sentiment analysis, empowering investors with the information they need to navigate the market landscape effectively.

Curious to learn more about the burgeoning opportunities in the market? Dive deeper into the world of investing with Fintel for a chance to unearth hidden gems and uncover potential investment prospects that could shape your financial future.

This insightful perspective is brought to you by Fintel, the ultimate destination for comprehensive investing research and actionable insights.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.