Truist Securities Rates Capital One Financial as a “Buy”

Latest Fund Sentiment Shows Institutional Interest Growing

On January 7, 2025, Truist Securities started coverage of Capital One Financial (WBAG:COFI), giving it a Buy rating.

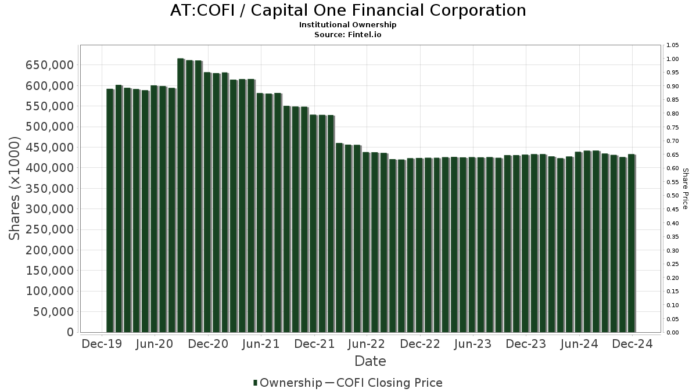

Institutional Ownership on the Rise

Currently, 2,091 funds and institutions hold positions in Capital One Financial, marking an increase of 11 owners or 0.53% from the previous quarter. The average portfolio weight being allocated to COFI has risen by 3.67% to reach 0.35%. Over the last three months, the total number of shares owned by institutions climbed by 1.70%, bringing the total to 432,940K shares.

Significant Changes Among Major Shareholders

Dodge & Cox has reported holding 18,662K shares, which is 4.89% of Capital One Financial. This is a decrease from their previous ownership of 19,939K shares, a drop of 6.84%. Moreover, they have cut their investment in COFI by 4.62% recently.

Capital Research Global Investors owns 17,886K shares, accounting for 4.69% ownership. Previously, they held 20,291K shares, reflecting a 13.44% decline and a 9.70% reduction in their investment strategy in COFI.

Harris Associates L.P. has 14,454K shares, representing 3.79% of the company. This is down from 15,180K shares, indicating a decrease of 5.03%, with a notable reduction of 22.01% in their portfolio allocation in COFI over the last quarter.

The DODGX – Dodge & Cox Stock Fund presently holds 13,318K shares for 3.49% ownership. This marks a slight decrease from their previous holdings of 13,699K shares, down by 2.86%, and a modest reduction of 0.85% in their COFI allocation.

On the other hand, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 11,482K shares, which is 3.01% of the company. Their previous count was 11,454K shares, which means an increase of 0.24% as they boosted their COFI allocation by 1.82% this past quarter.

Fintel stands out as a top-tier investing research platform for individual investors, traders, financial advisors, and small hedge funds. They offer comprehensive data including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and more. Their unique stock selections are based on rigorous, backtested quantitative models aimed at improving profits.

Click to Learn More

This report was originally published on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.