Trump’s Economic Policies May Benefit Consumer Stocks

Many Trump voters believe that his leadership could enhance their economic security, with family support being a primary concern. Targeting fundamental issues like personal finances has proven effective, and if Trump can deliver results, he is expected to maintain his popularity among supporters.

Though it is still early in this political cycle, we might anticipate policies such as tax cuts for both individuals and corporations, along with reduced business regulations. These were successful strategies during his last term, and their resurgence seems likely.

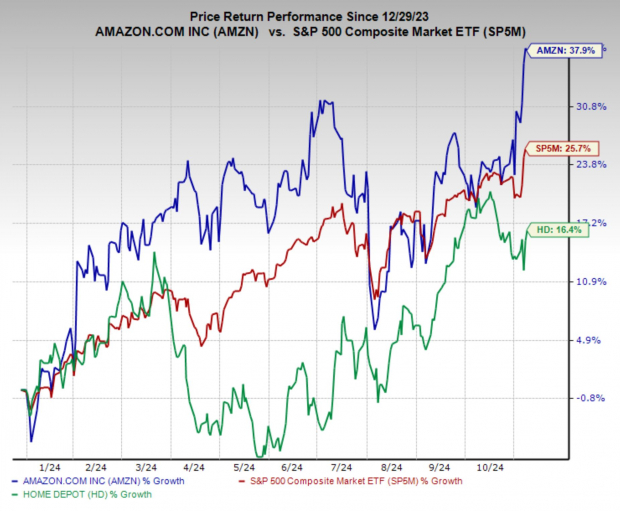

This could translate into extra cash for the average American, potentially spent on discretionary items or invested in the stock market. Two notable players in the consumer discretionary sector, Amazon (AMZN) and Home Depot (HD), stand to benefit from this trend, as both have top Zacks Ranks and promising growth forecasts.

Image Source: Zacks Investment Research

Amazon: A Top E-Commerce Stock

Before considering the implications of a Trump administration, Amazon was already a stock I greatly admired. Now, with the potential of increased consumer spending, it has climbed to the top of my must-own list.

After several months of stagnant trading, AMZN shares surged to record highs following the election results. This growth is driven not just by consumer spending but also by its cloud services, which are flourishing, particularly due to advancements in AI. AWS leads the cloud computing market with a substantial 31% share.

Amazon currently holds a Zacks Rank #2 (Buy) rating, supported by positive earnings revisions. Earnings estimates for the current quarter have increased by 8.8% in the past 60 days, and the forecast for FY24 has mirrored this growth. Analysts predict earnings per share will rise by an impressive 28.3% annually over the next three to five years, driven by both its e-commerce and AWS segments.

Image Source: Zacks Investment Research

Home Depot: Stock Surges After Election

Home Depot has become a popular spot for consumers looking to spend their extra cash. With more people working from home, there’s been a noticeable increase in home improvement projects. Moreover, as millennials enter the housing market, their demand for renovations is rising significantly.

Like Amazon, Home Depot has a solid Zacks Rank #2 (Buy) rating, with earnings growth projections of 9.6% per year in the next three to five years. However, as investors identify fresh growth opportunities, these estimates may increase further.

Home Depot’s stock has recently shown promising momentum, displaying a clear bullish pattern. Following a breakout this morning, the stock seems poised for further gains, provided it maintains its position above the breakout level.

Image Source: TradingView

Should Investors Consider AMZN and HD?

In light of potential economic impacts from a Trump presidency, it appears that his historical policies may favor stocks in consumer-focused sectors. Approaches prioritizing tax cuts, deregulation, and a business-friendly atmosphere should position companies like Amazon and Home Depot to benefit from increased consumer spending.

With solid fundamentals and current market momentum, both Amazon and Home Depot stocks present attractive opportunities for investors looking to take advantage of a buoyant U.S. consumer economy.

Free: 5 Stocks to Buy as Infrastructure Spending Increases

Trillions of dollars have been allocated for U.S. infrastructure improvements, covering everything from roads and bridges to AI data centers and renewable energy projects.

In this report, you’ll discover five surprising stocks with the potential to benefit most from this ongoing spending initiative.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” for free today.

Would you like the latest recommendations from Zacks Investment Research? You can download “5 Stocks Set to Double” at no charge.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.