Tesla’s Remarkable Resurgence Signals Bright Future Ahead

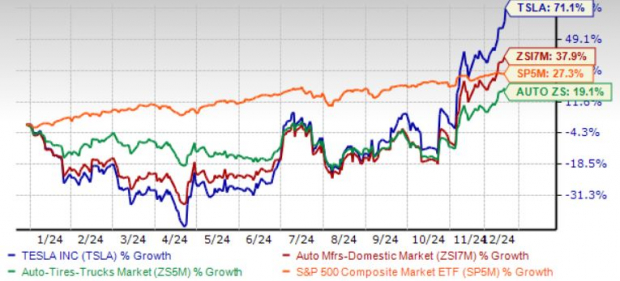

Electric vehicle (EV) giant Tesla’s TSLA rally just doesn’t seem to stop. Its shares rose for the sixth straight trading session yesterday to close at $424.77, hitting a record high. It marked the first time that shares surpassed the $420 threshold since its stock split in 2022.

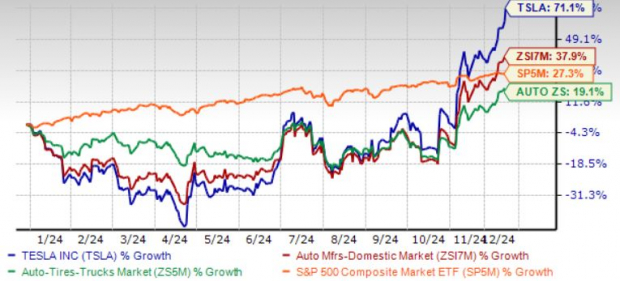

This year has been a roller coaster for Tesla! The stock began the year with a sharp 30% decline in the first quarter, fueled by worries about falling revenues and vehicle margin issues. This dip represented Tesla’s worst quarter since late 2022. Fast forward to today, and the company’s financial and operational metrics have shown substantial improvements. The excitement and optimism surrounding Tesla’s future are palpable.

Having doubled in value in 2023, TSLA shares are now up more than 70% in 2024, with most of the gains occurring since Donald Trump’s election win last month. The company has reassured investors with consistent advancements in its product lineup, strong delivery growth, and strategic initiatives aimed at enhancing its market position.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

After such a notable rally, investors may wonder if they have missed their chance. However, with the current sentiment surrounding the stock and several growth catalysts, Tesla can still be viewed as a strong pick for 2025.

Brokers Adjust Their Outlook: Price Targets Rise

The optimism for Tesla is reflected in the recent price target upgrades from major brokers. Bank of America (BofA) Securities raised its price target from $350 to $400, highlighting Tesla’s progress in Full Self-Driving (FSD) technology and the anticipated launch of its robotaxi fleet. Similarly, Wedbush Securities’ Dan Ives emphasized Tesla’s leadership in artificial intelligence (AI) and autonomous driving, calling it the most undervalued AI player in the market. Goldman Sachs and Morgan Stanley also raised their targets to $345 and $400, respectively.

While these elevated targets remain below the current stock price, analysts believe Tesla’s growth narrative is not finished. Given the stock’s momentum and a potential Santa Rally on the horizon, it wouldn’t be surprising to see Tesla reach the $500 mark before the year concludes.

TSLA Surpasses 50 & 200-Day Averages

Image Source: Zacks Investment Research

Trump’s Influence on Tesla’s Future

CEO Elon Musk’s connections with Trump seem to be yielding benefits. Last month, Trump appointed Musk to co-lead the newly formed Department of Government Efficiency (DOGE). This position provides Musk with a pathway to further Tesla’s innovative goals while minimizing bureaucratic obstacles.

Trump’s aim to repeal the $7,500 EV tax credit aligns with Tesla’s current trajectory. Unlike competitors, Tesla’s size and brand loyalty reduce its reliance on such incentives. Additionally, Trump’s tough stance on China could enhance Tesla’s market share in the U.S., particularly as Chinese EV manufacturers face potential tariffs. Tesla’s strong domestic production capabilities position it to gain a larger market presence.

Furthermore, the administration’s plans to create a unified federal framework for autonomous vehicles provide a favorable environment for Tesla, potentially easing obstacles that have hindered the rollout of FSD technology.

Key Growth Drivers for Tesla in 2025

Advancements in Full Self-Driving and Robotaxi Prospects: Tesla’s FSD software is advancing rapidly, with its latest update (version 13.2) introducing new features such as reverse driving and auto-parking. User feedback indicates a possible breakthrough in autonomous driving. With regulatory support likely, Tesla’s much-anticipated robotaxi service could launch by 2025. Musk has pledged to roll out robotaxis in Texas, California, and a few other states next year. Following General Motors’ exit from the robotaxi sector, Tesla’s main competitor is now Alphabet’s GOOGL Waymo.

Expansion in Energy Generation and Storage: Tesla’s energy division has excelled, experiencing triple-digit revenue growth over the past three years. This segment, which includes products like the Megapack, generates the highest margins among Tesla’s business units. Increasing production at the Megapack factory to meet rising demand positions Tesla well in the global energy transition.

Charging Network Monetization: Tesla’s extensive North American Charging Standard (NACS) network, featuring over 60,000 supercharger connectors globally, has emerged as a key revenue stream. The adoption of Tesla’s charging standard by major automakers, including GM and Ford, strengthens its position and opens up significant long-term growth opportunities.

Success of the Cybertruck: The Cybertruck has quickly gained popularity, ranking as the third most popular EV in the U.S. for the September quarter. It also achieved positive gross margins for the first time, reinforcing its potential profitability and enhancing Tesla’s innovative brand image.

Robust Delivery Projections and Margin Enhancements: Musk’s estimate of 20%-30% growth in vehicle deliveries for 2025 highlights strong demand. TSLA has also improved automotive gross margins (excluding leasing and regulatory credits), which rose to 18.6% last quarter, thanks in part to reduced raw material and logistics costs.

A Strong Financial Position: Tesla finished the third quarter of 2024 with over $33 billion in cash and equivalents, along with a low long-term debt-to-capitalization ratio of only 7%—much lower than the industry standard. With record operating cash flows of $6.3 billion last quarter, Tesla possesses the financial flexibility to pursue growth opportunities and withstand possible market challenges.

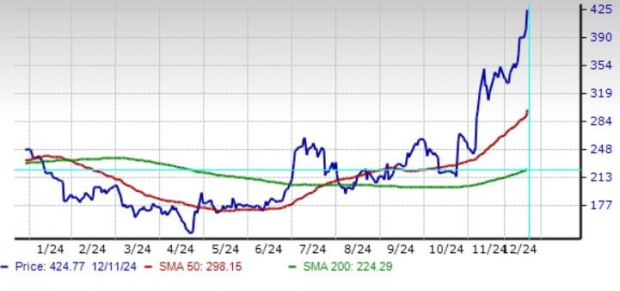

Growth Projections for TSLA

The Zacks Consensus Estimate for Tesla’s 2025 sales and earnings per share (EPS) indicates an expected year-over-year growth of 17.4% and 32.4%, respectively. Additionally, EPS estimates have experienced positive revisions in the last 30 days.

Image Source: Zacks Investment Research

Final Thoughts

Tesla is evolving beyond a car manufacturer, emerging as a transformative player in clean energy and technology. With a solid pipeline of growth opportunities—ranging from advancements in autonomous technology to an expanding energy business and strong delivery expectations—Tesla’s outlook for 2025 is promising. The positive influence from the Trump administration also adds a layer of optimism, facilitating Tesla’s pursuit of innovation.

Although some may argue that Tesla’s recent stock price surge is excessive, its upward trend appears sustainable due to the company’s unmatched market position and growth prospects. For those seeking long-term investment opportunities, TSLA continues to stand out as a compelling option even at these levels.

Tesla holds a Zacks Rank #1 (Strong Buy), providing further validation of its strong market potential. You can explore the complete list of Zacks Rank #1 stocks here.

Zacks’ Top 10 Stock Picks for 2025

Are you interested in early insights on our 10 top picks for all of 2025?

History suggests their performance could be exceptional.

Since 2012 (when our Director of Research Sheraz Mian took charge of the portfolio) through November 2024, the Zacks Top 10 Stocks achieved a staggering +2,112.6%, significantly surpassing the S&P 500’s +475.6%. Currently, Sheraz is reviewing 4,400 companies to select the best 10 stocks to buy and hold in 2025. Don’t miss the chance to invest in these stocks when they are announced on January 2.

Want the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free.

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.