Technology Stocks Shine as Utilities Hold Steady in Midday Trading

As of midday Tuesday, the Technology & Communications sector is standing out, gaining 0.6%, driven largely by impressive performances from Super Micro Computer Inc (Symbol: SMCI), which has surged 32.4%, and NVIDIA Corp (Symbol: NVDA), rising 3.8%. The Technology Select Sector SPDR ETF (Symbol: XLK) is also benefiting, up 0.8% for the day and a notable 20.81% for the year. Overall, Super Micro Computer Inc has achieved a slight 0.30% rise year-to-date, while NVIDIA Corp boasts a striking 193.77% increase over the same period. Together, SMCI and NVDA account for approximately 14.9% of XLK’s holdings.

The Utilities sector follows as the second-best performer, with a modest rise of 0.2%. Within this sector, Vistra Corp (Symbol: VST) stands out with a gain of 2.1%, while Edison International (Symbol: EIX) rose by 1.5%. Tracking these utilities, the Utilities Select Sector SPDR ETF (XLU) has increased by 0.3% today and is up 29.12% year-to-date. This year, Vistra Corp has made an impressive leap, gaining 290.51%, and Edison International has grown by 22.65%. Together, these companies represent about 6.8% of XLU’s holdings.

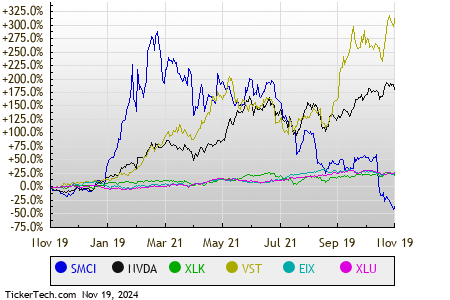

Looking at the last twelve months, the chart below illustrates the performance of these stocks and ETFs:

In the afternoon trading session, the S&P 500 components show mixed results, with only a few sectors managing gains, leaving six sectors in decline.

| Sector | % Change |

|---|---|

| Technology & Communications | +0.6% |

| Utilities | +0.2% |

| Industrial | -0.0% |

| Materials | -0.1% |

| Consumer Products | -0.2% |

| Services | -0.2% |

| Financial | -0.2% |

| Healthcare | -0.3% |

| Energy | -0.4% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

HMLP shares outstanding history

RVSB Insider Buying

ARCI Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.