Why Now is the Time to Reconsider Costco and Apple for Your Portfolio

With rising yields from bank-issued CDs, dividend stocks are losing their appeal. Currently, investors can find risk-free returns exceeding 4% with CDs, which is significantly higher than the yield on the S&P 500 index. However, this environment may offer savvy investors a chance to secure profitable long-term gains by focusing on two dividend stocks: Costco and Apple.

You might already know these companies and possibly have them in your investment portfolio. Here’s why you should consider increasing your investments in Costco Wholesale (NASDAQ: COST) and Apple (NASDAQ: AAPL).

Costco: A Steady Performer

Wall Street is optimistic about various factors that could lift Costco shares as we approach 2025. Recent increases in customer traffic indicate that the retailer continues to attract members, even amid rising prices. In early October, comparable-store sales climbed by 9%.

In addition to increased interest in discretionary items, Costco is benefiting from a recent membership fee hike, which is likely to enhance profit margins. More impressively, the retailer reported annual cash flow of $12 billion, which positions it well to support growth while providing excess cash for investors.

Though Costco’s dividends come in inconsistent payments, the potential for both growth and returns makes it a compelling option for investors who can manage variable income.

Apple: Anticipation Grows for New Products

Despite a slight decline in net sales over the first nine months, Apple is on the verge of releasing its fiscal fourth-quarter results at the end of October. The primary reason for the earlier downturn was reduced demand in the iPhone segment. However, analysts predict a rebound in the fourth quarter, projecting a 13% increase in revenue, targeting $94 billion, thanks to the new iPhone 16 lineup.

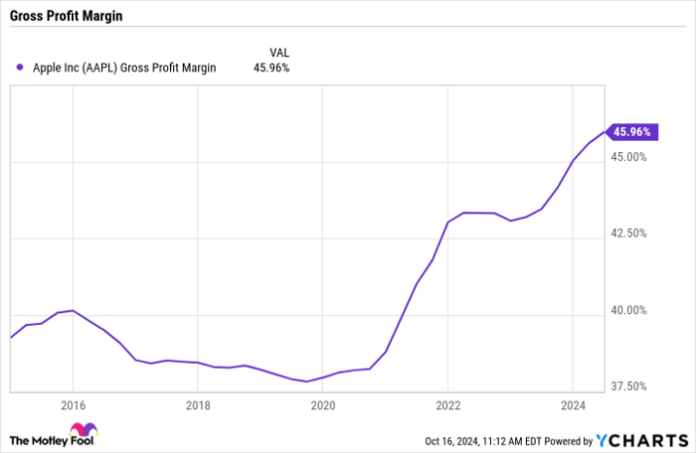

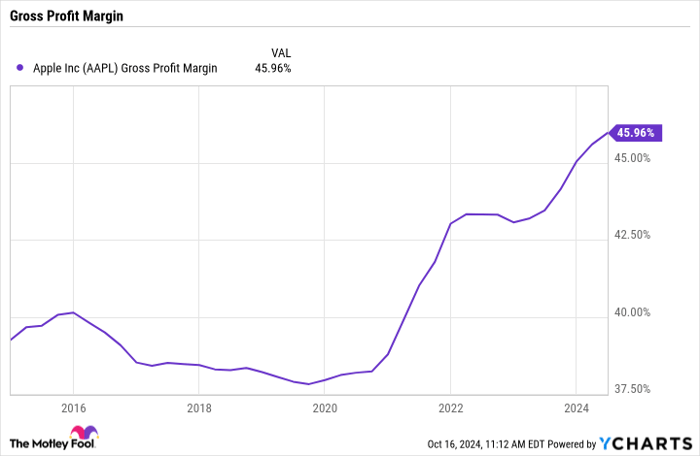

During these challenging times, Apple’s profit margins have shown resilience, which bodes well for shareholders as sales may increase into 2025. The booming services sector also enhances the company’s profitability.

AAPL gross profit margin, data by YCharts.

While Apple’s dividend yield stands at a modest 0.4% as most of its earnings are reinvested, the potential for significant returns through increased dividends and stock buybacks makes it a worthwhile holding for patient investors. Furthermore, given its standing in the market, many investors may already have substantial exposure to Apple without realizing it.

Seize the Moment for Growth

If you’ve ever felt you passed up the opportunity to invest in top companies, now might be your moment. Our analysts often identify positions they believe are about to see significant growth.

- Amazon: If you invested $1,000 when we recommended it in 2010, you’d have $21,285!

- Apple: A $1,000 investment from our 2008 recommendation would have turned into $44,456!

- Netflix: A $1,000 investment made in 2004 has grown to an impressive $411,959!

Presently, we are offering “Double Down” alerts for three promising companies. Timing is crucial, and this could be a rare chance to invest with potential high returns.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Demitri Kalogeropoulos has positions in Apple and Costco Wholesale. The Motley Fool has positions in and recommends Apple and Costco Wholesale. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.