Long-Term Investing: Top Tech Stocks Worth Holding

Successful investing often means thinking ahead. It is not enough to just find a good stock; investors need to be patient and let time work in their favor.

This is why a buy-and-hold strategy can be so effective. Identifying strong companies and staying invested in their stocks for years can lead to attractive returns.

With this idea in mind, let’s look at two tech stocks that long-term investors might want to consider.

Image source: Getty Images.

ServiceNow: A Leader in IT Management

The first stock on our list is ServiceNow (NYSE: NOW).

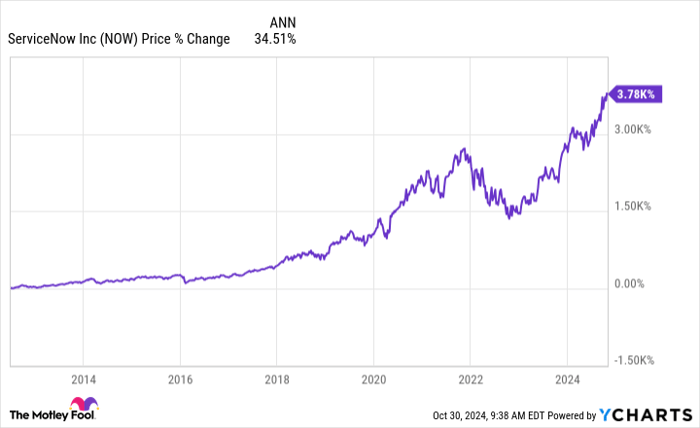

When looking for tech stocks to hold for the long term, it’s important to choose a company with a strong history. ServiceNow is a standout in Information Technology Service Management (ITSM). Since its IPO in 2012, its stock price has increased more than 3,770%, resulting in a compound annual growth rate (CAGR) of 34.5%.

NOW data by YCharts

The company’s primary product, the Now Platform, is cloud-based and assists companies in managing their workflows. Notably, more than 85% of Fortune 500 companies rely on it, contributing to over 8,100 total customers.

ServiceNow’s financials remain strong. In its latest quarter, ending on September 30, 2024, the company reported revenue of $2.8 billion, 96% of which came from subscriptions. This is a 22% increase compared to the previous year.

ServiceNow has captured a significant market and continues to grow. Its products are widely used by a majority of large companies in America, pushing its revenue higher.

For those searching for a tech stock that deserves a long-term investment, ServiceNow is worth keeping in mind.

Netflix: A Streaming Giant’s Comeback

The second stock is Netflix (NASDAQ: NFLX). Netflix is making significant strides in the competitive streaming landscape.

Just two years ago, Netflix seemed to be losing ground in the face of deep-pocketed competitors like Apple and Amazon. Both companies were investing heavily, which threatened Netflix’s market share.

Yet, recent viewership statistics show that Netflix is still holding its own. The company’s efforts to limit password sharing and introduce an ad-supported tier have proven successful.

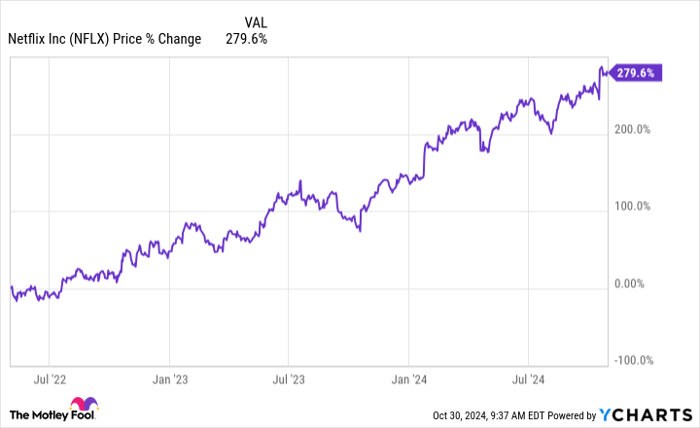

Consequently, Netflix’s share price has surged, climbing 279% over the last three years.

NFLX data by YCharts

Moreover, Netflix is experiencing substantial growth across key metrics. In its most recent quarter, ending on September 30, 2024, revenue grew by 15% to $9.8 billion, with paid subscribers increasing by 14% to 283 million.

Most impressively, Netflix’s trailing 12-month operating margin rose to 25.7%, the highest in its history, compared to just 12.9% five years ago.

In summary, Netflix has accomplished a remarkable turnaround, enhancing its subscriber base and revenue while improving profitability by increasing prices and managing costs effectively.

This combination indicates that Netflix remains a strong buy-and-hold option for long-term investors.

Should You Invest $1,000 in ServiceNow Right Now?

Before making any investment in ServiceNow, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now. Notably, ServiceNow was not included in this list. The selected stocks have the potential to produce significant returns in the coming years.

For context, when Nvidia made this list on April 15, 2005, an investment of $1,000 at that time would now be worth $853,860!

Stock Advisor offers investors a straightforward strategy for success, including portfolio guidance, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has shown returns that are more than four times that of the S&P 500 since 2002.

Explore the 10 stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Jake Lerch has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, Netflix, and ServiceNow. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.