Nasdaq’s Remarkable Surge: Capitalizing on Tech Gains in 2024

The Nasdaq Composite index enjoyed a remarkable surge in 2024, gaining nearly 31% over the year. This strong performance was anticipated due to the tech-focused nature of the index and the substantial growth seen in various technology companies, driven largely by advancements in artificial intelligence (AI).

It’s important to recognize that the Nasdaq Composite index’s success in 2024 followed an impressive 43% rise in 2023. For technology investors, this trend bodes well; historical data shows that after years of gaining more than 30%, the Nasdaq has delivered an average return of 19% in the following year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

While past performance does not guarantee future results, favorable conditions—like strong economic growth in the U.S., controlled inflation, and increased consumer spending—could support further stock gains in 2025. Additionally, the expanding use of AI across multiple sectors is expected to favor technology stocks in the coming year.

Therefore, this is an opportune moment for investors to explore several Nasdaq stocks that may offer substantial returns both this year and in the long term.

Marvell Technology: Growth Driven by Custom AI Chip Demand

Marvell Technology (NASDAQ: MRVL) provided impressive returns of 83% for investors in 2024, particularly in the latter half of the year as its significance in the AI chip market emerged.

Marvell specializes in custom processors called application-specific integrated circuits (ASICs), designed for data centers to optimize specific tasks. Major cloud service providers are now utilizing these ASICs for AI model training and inference, a shift that reduces their dependence on Nvidia while lowering model development costs.

For instance, Amazon asserts that its Trainium 2 custom AI processor offers more computing power than Nvidia’s chips and enables customers to train models with a 40% cost reduction. Notably, Marvell designs Amazon’s custom AI chips, solidifying the companies’ partnership.

During its recent earnings call, Marvell’s management announced:

“Yesterday, we announced the expansion of our strategic relationship with Amazon Web Services through a comprehensive multi-generational five-year agreement. This multi-generational agreement encompasses a broad range of Marvell’s data center semiconductors, including custom AI products, optical DSPs, active electrical cable DSPs, PCIe retimers, data center interconnect optical modules, and Ethernet switching silicon solutions.”

This renewed agreement is expected to significantly boost business volume between both firms. Additionally, Marvell has numerous customers for its custom AI chips, contributing to faster-than-anticipated growth in its AI sector. The company anticipates selling $1.5 billion in AI chips this fiscal year—ending this month—and expects sales to reach at least $2.5 billion in fiscal 2026.

With an increase in custom AI chip production planned, Marvell may surpass these estimates. Also noteworthy is Marvell’s predicted total addressable market (TAM) in data centers, poised for growth from $21 billion in 2023 to $75 billion in 2028, signifying substantial opportunities for long-term growth.

Analysts project that Marvell’s earnings will soar by 77% in the upcoming fiscal year to $2.76 per share, following a modest 3% increase in the current year. This substantial earnings growth may drive Marvell’s stock price higher in 2025, while ongoing expansion in the custom AI chip sector could support a sustained price rally.

Meta Platforms: Capturing Increased Digital Ad Spending

In 2024, social media powerhouse Meta Platforms (NASDAQ: META) delivered strong stock market performance with gains of 65%. Currently, investors can acquire this stock at an appealing valuation of 28 times trailing earnings and 24 times forward earnings even after the substantial rise last year. Given that digital ad spending is slated to grow nearly 8% in 2025, approaching $799 billion, this could be a wise investment.

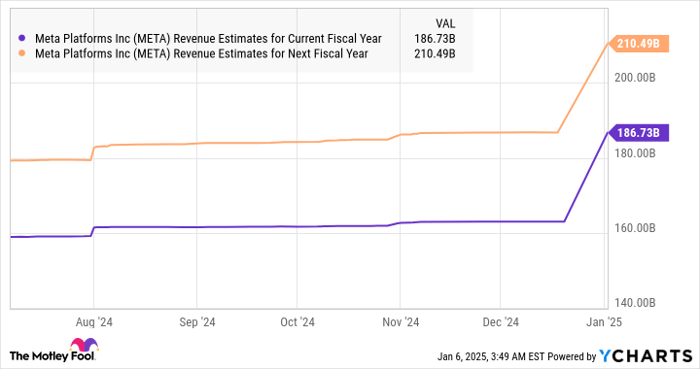

Meta has been gaining momentum in this lucrative segment, with revenues increasing by 22% to $116.1 billion in the first nine months of 2024. Guidance for the fourth quarter suggests a revenue of $46.5 billion, which would total approximately $162.6 billion for the year—a 20.5% increase from 2023. Analysts expect Meta’s revenue growth to continue at double-digit rates in both 2025 and 2026, outperforming the overall digital ad market.

META Revenue Estimates for Current Fiscal Year data by YCharts.

So, Meta appears to be grabbing a larger slice of the advertising budget pie. With a massive active user base of 3.29 billion across its suite of apps, it is positioned to reach a broad audience for brands and advertisers. This broad reach has delivered a year-over-year increase of 7% in ad impressions across its platforms, alongside an 11% growth in average ad prices in Q3 2024.

AI has significantly enhanced Meta’s advertisement revenue potential by improving audience targeting and optimizing returns on advertising investments. The expanding role of AI in digital marketing suggests a potential revenue opportunity of $1.78 trillion by 2033, indicating that Meta could access unprecedented growth potential.

As a result, Meta Platforms stands out as a compelling Nasdaq stock for the long haul. Moreover, analysts predict a 12% earnings increase this year, reaching $25.42 per share. If Meta achieves this and trades at 27 times forward earnings after a year—consistent with the Nasdaq-100 index—it could see its stock price rise to $689. This represents a potential 14% increase from current values. Stronger-than-expected earnings growth could further elevate its stock price, especially as Meta’s attractive valuation makes it a tempting purchase at this time.

Seize This Second Chance at an Exciting Investment Opportunity

Ever felt like you missed out on investing in the top-performing stocks? If so, you should pay attention.

Occasionally, our expert analysts give a “Double Down” stock recommendation for companies they predict will experience significant growth soon. If you’re concerned you missed your opportunity, now is an ideal time to invest before it’s too late. The statistics are compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $363,307!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $45,963!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $471,880!*

We are currently issuing “Double Down” alerts for three exceptional companies, and this may be a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Meta Platforms, and Nvidia. The Motley Fool recommends Marvell Technology. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.