Exploring Under-the-Radar Stocks: Dillard’s and Coupang

While the “Magnificent Seven” stocks dominate headlines, other promising investments are gaining momentum away from Wall Street’s spotlight.

Where can you invest $1,000 today? Our expert analysts have identified the 10 top stocks available right now. Discover the 10 stocks »

Let’s spotlight two lesser-known stocks with significant potential.

1. Dillard’s: The Surprising Success

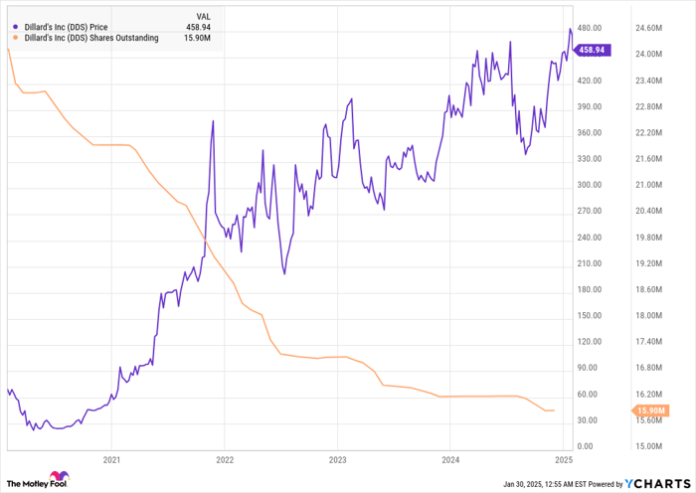

Dillard’s (NYSE: DDS) may be the best stock you’ve overlooked. This department store chain from Arkansas has witnessed a remarkable 670% increase in shares over the past five years. Thanks to a robust share buyback strategy and several competitive advantages, Dillard’s stands out in a time when many peers struggle.

One key factor in Dillard’s success is its top-tier inventory management system, which has allowed it to avoid the aggressive markdowns that often hurt competitors’ profits. Moreover, Dillard’s diversifies its operations by owning a construction business and has taken a cautious approach to online sales, which generally offer lower margins. Currently, in-store sales make up over 85% of its revenue.

Additionally, the company has managed costs by reducing workforce hours. While the rate of share buybacks has slowed, the company has lowered its share count by nearly 40% in the last five years, as demonstrated below.

Data by YCharts.

Currently, Dillard’s appears affordable with a price-to-earnings ratio of 12, despite a decline in both revenue and earnings per share in the third quarter of fiscal 2024. Their gross margin remains strong for a retailer at 45%.

If Dillard’s can rebound in growth, its stock is poised for further gains, especially if share buybacks accelerate once more.

2. Coupang: South Korea’s E-Commerce Giant

While e-commerce success stories like Amazon have long captured headlines, Coupang (NYSE: CPNG), the largest e-commerce platform in South Korea, remains relatively unknown outside its country. After its initial public offering in March 2021, Coupang’s stock has yet to recover to its IPO price, but it is starting to show resilience through steady growth and improving profitability.

Following a strategy reminiscent of Amazon’s, Coupang has expanded from being a direct online seller to a more diversified platform. It now includes higher-margin services such as a third-party marketplace, video streaming, and food delivery, alongside a membership program called Rocket Wow, which boosts growth.

Operating in densely populated South Korea, known for its rapid internet speeds, has played in Coupang’s favor. This results in faster, more cost-effective delivery options, including same-day and dawn delivery, enhancing customer satisfaction.

In the third quarter of 2024, Coupang reported a 27% increase in revenue, amounting to $7.9 billion, while gross profit surged 45% to $2.3 billion, reflecting an improved gross margin of 350 basis points compared to the previous year.

Moreover, Coupang made a strategic acquisition of Farfetch for $500 million last year, allowing it to enter the luxury market and enriching its position in global e-commerce.

Over time, Coupang appears to have the potential to emulate success stories like Amazon and MercadoLibre, promising promising returns in the future.

Should You Invest $1,000 in Coupang Now?

Before purchasing Coupang stock, consider this:

The Motley Fool Stock Advisor team recently highlighted what they believe are the 10 best stocks to invest in right now—and Coupang is not among them. The recommended stocks are expected to yield substantial returns in the years ahead.

For example, when Nvidia was included on the list on April 15, 2005, an investment of $1,000 then would now be worth $735,852!*

Stock Advisor offers a straightforward path to investment success, providing guidance on portfolio building, frequent updates from analysts, and two new stock picks each month. The service has more than quadrupled its returns compared to the S&P 500 since its inception in 2002*.

Learn more »

*Stock Advisor returns as of February 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon and MercadoLibre. The Motley Fool has positions in and recommends Amazon and MercadoLibre, as well as Coupang. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.