Exploring 2025’s Top Dividend Stocks: Coca-Cola and Visa

Dividend investing remains a popular strategy. People value the prospect of earning money with minimal effort. Additionally, companies that consistently increase their dividends often possess reliable businesses. This historical consistency has led dividend stocks to outperform their non-dividend counterparts over extended periods. As a result, focusing on income stocks could be a smart move for 2025.

Consider these two strong choices: Coca-Cola (NYSE: KO) and Visa (NYSE: V).

Where to invest $1,000 right now? Our analysts have identified the 10 best stocks to consider for immediate investment. See the 10 stocks »

Coca-Cola: A Timeless Brand with Steady Growth

Coca-Cola is recognized globally as a leading soft drink brand. Its strong presence in nearly every country gives it a competitive edge, allowing the company to attract substantial business. Beyond soft drinks, Coca-Cola has successfully diversified its offerings to include products such as alcoholic beverages, coffee, tea, sports drinks, energy drinks, and water.

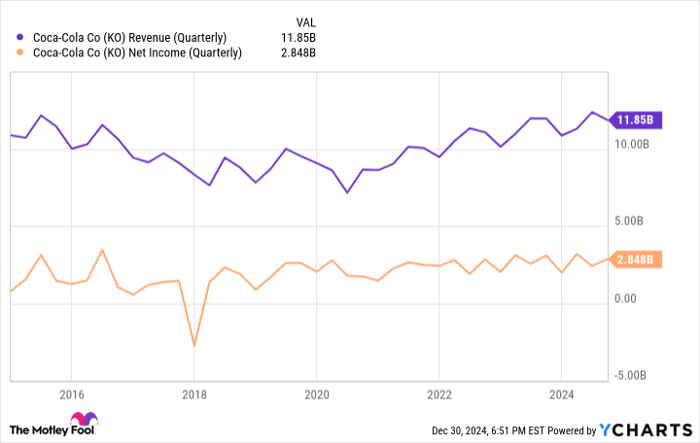

This diversification helps Coca-Cola adapt to various market preferences and decreasing reliance on less health-conscious products, making it resilient in today’s health-aware society. While it may not match the growth of tech stocks, Coca-Cola excels in consistency and dependability, boasting steady revenue and profits.

KO Revenue (Quarterly) data by YCharts.

Coca-Cola has a remarkable track record of dividend payments—62 consecutive increases. With a forward yield of 3.11%, it significantly exceeds the S&P 500 average of 1.32%. Although its payout ratio is a notable 74%, the company has historically managed such ratios while still boosting dividends. Investors can expect Coca-Cola to remain a strong income stock beyond 2025. It’s no surprise that Warren Buffett considers it a favorite.

Visa: A Leader in Financial Transactions

Visa holds one of the most recognizable brands in the financial sector. With millions of credit cards in circulation, it earns a percentage from every transaction processed through its network. Like any company, Visa faces risks, especially during economic downturns when consumer spending decreases, potentially leading to lower revenue.

However, Visa’s ability to thrive during favorable conditions more than compensates for occasional downturns. The ongoing trend of shifting from cash to credit and digital payments provides a sustained advantage. While traditional payment methods still exist, Visa stands to gain as more consumers choose electronic transactions.

Even a small share of the overall market — which is expected to expand — will support Visa’s revenue and earnings growth over time. The company’s strong market presence and network effects position it favorably for ongoing success. Consequently, Visa typically showcases impressive financial results.

V Revenue (Annual) data by YCharts.

Visa’s dividends have increased by almost 392% in the last decade. Though its forward yield stands at 0.74%, this is still attractive for income-focused investors, especially with a payout ratio of 21.36%, allowing room for further dividend growth.

Don’t Miss This Potentially Lucrative Investment Opportunity

Have you ever felt like you lost out on investing in top stocks? Now’s the chance to catch up.

Occasionally, our expert team highlights companies poised for significant growth, referred to as a “Double Down” stock recommendation. If you’re anxious that opportunities have passed you by, this is a prime moment to invest before prices rise. Consider these highlights:

- Nvidia: Investing $1,000 in 2009 would be worth $348,216 now!*

- Apple: A $1,000 investment in 2008 has grown to $47,425!*

- Netflix: If you put in $1,000 in 2004, it would have ballooned to $480,681!*

Our latest “Double Down” alerts feature three remarkable companies, and this may be a rare opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Visa. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.