DoorDash and Sea Limited Surge Ahead with Impressive Sales Growth

Sales growth often indicates a company’s future success, and this has propelled DoorDash DASH and Sea Limited SE to new heights over the past year.

These tech companies have secured positions on the Zacks Rank #1 (Strong Buy) list, revealing their potential for substantial earnings growth.

Image Source: Zacks Investment Research

Growth of DoorDash

DoorDash has significantly expanded its online marketplace, enabling merchants to connect with customers through delivery personnel known as “dashers.” Currently, DoorDash’s Zacks Internet-Services Industry ranks in the top 15% of about 250 Zacks industries.

In 2021, DoorDash acquired Finnish food delivery company Wolt, which enhanced its footprint in over 20 European markets. This move extended its operations beyond the U.S. into countries like Australia, Canada, Japan, and New Zealand.

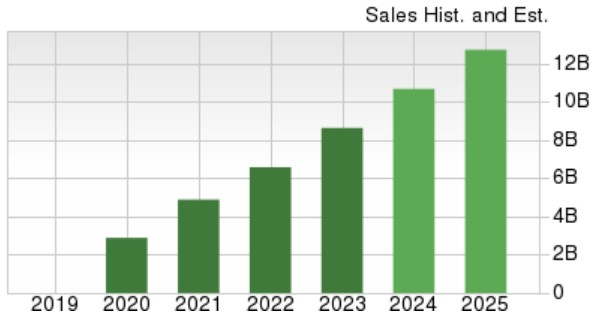

Following this growth, DoorDash’s total sales are expected to rise by 23% in fiscal 2024, with a further 19% growth projected for FY25, reaching $12.72 billion. Impressively, this estimate signifies a 340% increase from the $2.89 billion in sales recorded in 2020, the year DoorDash went public.

Image Source: Zacks Investment Research

Sea Limited’s Growth

Sea Limited is also thriving as a consumer internet company, providing e-commerce, digital entertainment, and financial services. Operating from Singapore, it serves markets in Indonesia, Taiwan, Vietnam, Thailand, Malaysia, and the Philippines.

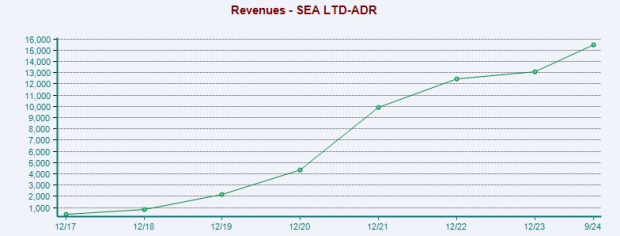

Its Zacks Internet-Software Industry rank is in the top 10% of all Zacks industries. Sea Limited’s revenue is projected to grow by 28% in FY24, followed by another 17% increase in FY25, reaching $19.62 billion. This remarkable forecast reflects an 800% growth compared to sales of $2.17 billion in 2020.

Image Source: Zacks Investment Research

Positive EPS Trends

As both companies enjoy top line growth, they are also improving profitability.

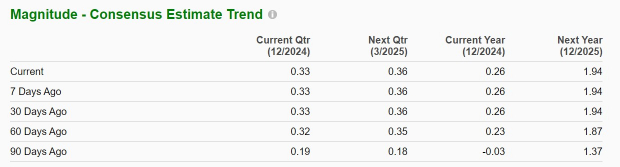

For DoorDash, annual earnings are expected to reach $0.26 per share in FY24, a significant turn from an adjusted EPS loss of -$1.42 in 2023. The EPS for FY25 is projected to rise another 646% to $1.94, with estimates trending higher in the last quarter.

Image Source: Zacks Investment Research

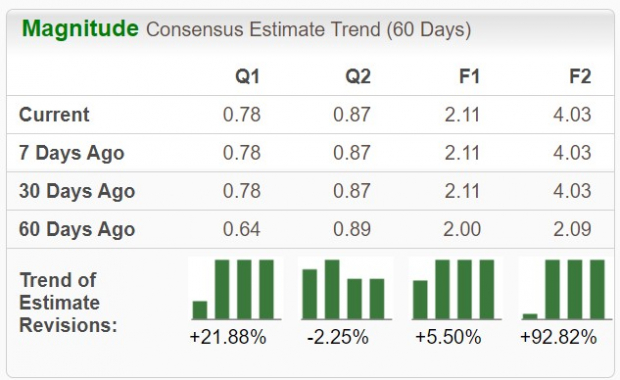

Sea Limited is anticipating a 55% EPS growth in FY24, with projected earnings hitting $4.03 per share in FY25, reflecting a 91% increase. Notably, EPS estimates for FY24 have risen by 5% over the last 60 days, while estimates for FY25 have surged by 93%.

Image Source: Zacks Investment Research

Conclusion

With their impressive growth paths, DoorDash and Sea Limited stocks are likely to continue their upward trajectory. As leading firms of this decade, they present opportunities for wise investments well into 2025 and beyond.

Research Chief Highlights “Top Pick to Double”

Five Zacks experts have identified stocks likely to soar over 100% in the coming months. Among them, Director of Research Sheraz Mian has selected one stock with significant explosive potential.

This company focuses on millennial and Gen Z markets, reaching close to $1 billion in revenue last quarter. A recent decrease in its stock price makes this an opportune time to invest. While not all elite picks succeed, this one may exceed previous successful Zacks selections, such as Nano-X Imaging, which increased by +129.6% within nine months.

Free: See Our Top Stock And 4 Runners Up

Sea Limited Sponsored ADR (SE): Free Stock Analysis Report

DoorDash, Inc. (DASH): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.