Tech Stocks Thrive in 2024: Exploring Growth in Snowflake and Meta

Despite some ups and downs, technology stocks continue to shine in 2024. The Nasdaq-100 Technology Sector index has risen 14% this year, although it still trails behind the S&P 500 index’s impressive 27% gain.

Taking a longer view, however, tech stocks have generally outperformed the S&P 500. For example, the Nasdaq-100 Technology Sector has surged by 364% over the last decade, while the S&P 500 has increased by 199%. Tech companies benefit from disruptive trends that allow them to grow faster than their non-tech counterparts.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Investors can profit significantly by buying and holding strong tech companies over time. This article highlights two promising options that may enhance investors’ wealth in the future.

1. Snowflake

Snowflake (NYSE: SNOW) has seen a notable increase in its stock price recently due to improved growth prospects. The company’s data cloud platform enables customers to unify their data for analytics, application development, and insights.

The growing use of artificial intelligence (AI) presents new opportunities for Snowflake. Clients are now purchasing AI-oriented applications from the company for tasks like data extraction, text summarization, chatbot development, and text search.

Snowflake’s AI solutions reportedly help users reduce costs by 30% compared to other services, along with saving around 4,000 hours of manual work. Moreover, Snowflake is expanding its AI services; it recently partnered with Anthropic to provide customers access to new AI models for tasks such as code generation and data extraction.

Additionally, Snowflake’s AI offerings are increasing its customer spending and attracting new clients. The total customer count rose by 20% year over year, reaching 10,618. More impressively, the number of customers generating over $1 million in product revenue grew by 25% during the same period.

The company’s net revenue retention rate of 127% highlights the rising adoption of its services. This metric indicates that existing customers are increasing their spending over time.

The combination of expanded customer spending, new client acquisitions, and larger contracts has elevated Snowflake’s remaining performance obligations (RPO) by an impressive 55% year over year, reaching $5.7 billion. This anticipates robust growth in the future as RPO reflects the total value of future contracts.

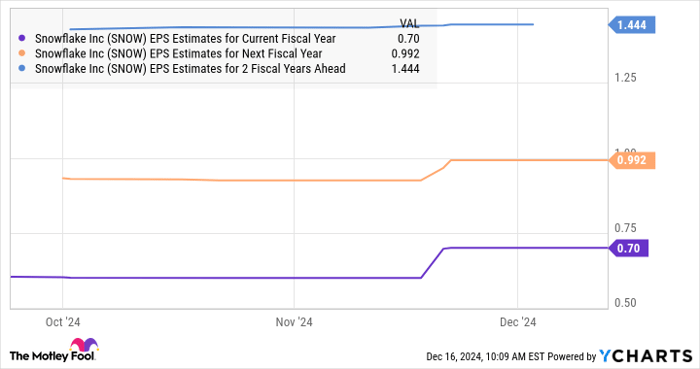

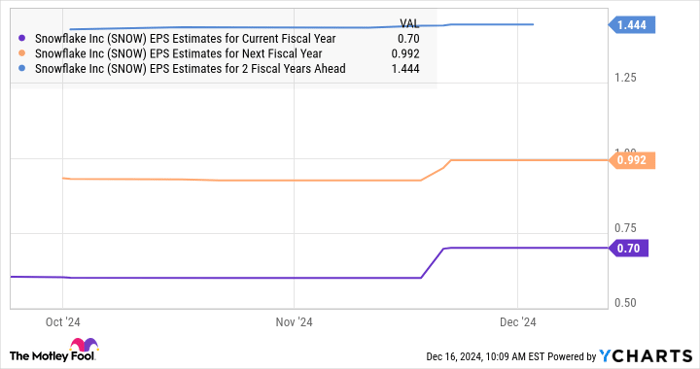

No wonder analysts have raised their earnings expectations for Snowflake, projecting continued bottom-line growth.

SNOW EPS Estimates for Current Fiscal Year data by YCharts

Looking ahead, Snowflake predicts its total addressable market (TAM) will double to $342 billion by 2028. This growth potential makes Snowflake a strong buy for long-term investors seeking significant returns.

2. Meta Platforms

Meta Platforms (NASDAQ: META) operates well-known social media services like Instagram, Facebook, Messenger, and WhatsApp, putting the company in an excellent position to benefit from booming trends in digital advertising and AI.

The global digital ad market is projected to exceed $1.15 trillion by 2030, growing at 15% annually. Meta is capitalizing on this trend; its revenue for the first nine months of 2024 increased by 22% year over year to $116.1 billion, while earnings grew 66% to $15.88 per share.

This suggests Meta is outpacing the digital ad market’s growth, largely due to its strong user base. Daily active users of Meta’s apps reached 3.29 billion last quarter, a 5% increase from the previous year.

Furthermore, AI integration in Meta’s advertising services is enhancing returns for advertisers. For instance, the adoption of Meta’s Andromeda machine learning tool improved ad quality by 8%. Additionally, advertisers using the Advantage+ tool, which employs AI for audience targeting, saw a 22% spike in return on ad spend.

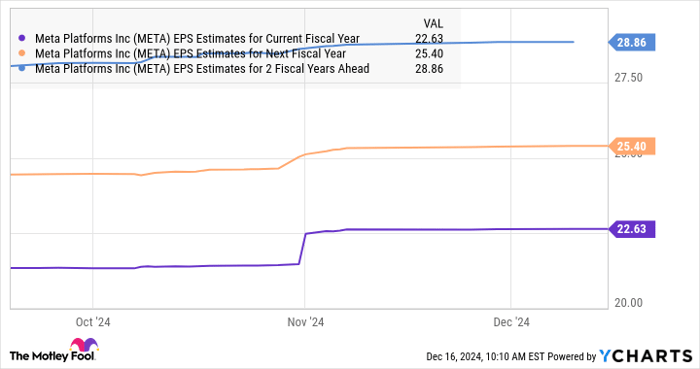

Analysts’ growth expectations for Meta have increased for both the current and upcoming years, signaling confidence in continued expansion.

META EPS Estimates for Current Fiscal Year data by YCharts

Given the potential for AI to capture a larger share of the digital ad market, Meta’s prospects look even brighter. Investors may want to consider buying Meta Platforms as it trades at a reasonable 25 times forward earnings, compared to the Nasdaq-100’s multiple of 28, making it a promising long-term investment.

Seize a Valuable Investment Opportunity

Have you ever felt you missed out on investing in top stocks? If so, you’ll want to pay attention.

Occasionally, our team of experts issues a “Double Down” stock recommendation for companies poised for growth. If you’re concerned you missed your chance, now may be the ideal time to invest. The past performance speaks volumes:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $334,266!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,976!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $479,727!*

Right now, we’re identifying “Double Down” stocks for three exceptional companies, each presenting a rare chance for investors.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Randi Zuckerberg, a former director at Facebook and sister to CEO Mark Zuckerberg, sits on The Motley Fool’s board of directors. Harsh Chauhan has no stake in any of the companies mentioned. The Motley Fool recommends Meta Platforms and Snowflake. The Motley Fool has a disclosure policy.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.