Early Retirement: Why Most Americans Can’t Afford to Wait

Many Americans retire before reaching age 65. Most do not choose this timing based on financial comfort, but rather out of necessity.

The median retirement age in the U.S. is 62, primarily driven by health problems, disabilities, and other uncontrollable life factors, as highlighted in a recent survey by the Employee Benefit Research Institute.

Ideally, early retirement should stem from solid financial planning rather than unforeseen complications that can lead to stressful years ahead. One effective way to strengthen your financial position and create the potential for early retirement is through investment. Two noteworthy options for this are the Vanguard S&P 500 ETF (NYSEMKT: VOO) and the Vanguard Total Stock Market Index Fund ETF (NYSEMKT: VTI).

1. Vanguard S&P 500 ETF

The S&P 500 (SNPINDEX: ^GSPC) is an appealing investment option, as it allows you to invest in top-performing stocks like Apple and Microsoft. With a low expense ratio of 0.03%, the Vanguard S&P 500 ETF ensures that management fees do not significantly reduce your returns. Given that the fund has a median market cap exceeding $260 billion, it presents lower risk compared to more volatile investments, making it a suitable choice for long-term investors seeking to contribute consistently.

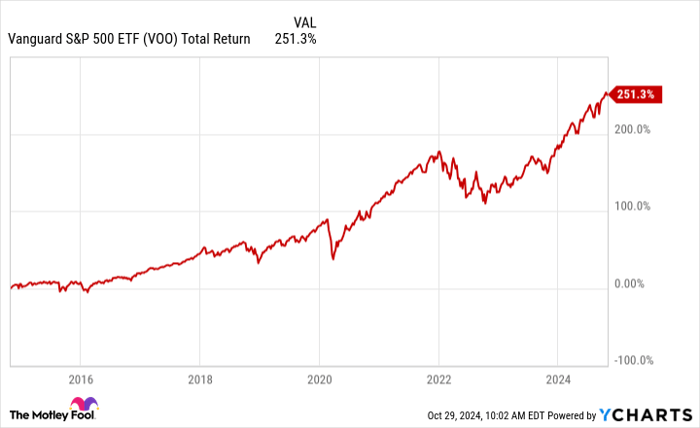

VOO Total Return Level data by YCharts

Over the last decade, this fund has produced impressive total returns, including dividends, of about 250%. This translates to a compounded annual growth rate (CAGR) of 13.4%, surpassing the historical average for the S&P 500 of roughly 10%. Future returns may stabilize at lower rates, especially since many high-growth stocks currently seem overvalued. Nevertheless, with ample diversification, this fund has the potential to provide significant long-term gains, positioning you favorably for an early retirement.

2. Vanguard Total Stock Market Index Fund ETF

A broader alternative is the Vanguard Total Stock Market Index, which includes more than 3,600 stocks and also boasts an expense ratio of just 0.03%. By covering large-, mid-, and small-cap stocks, this fund minimizes risk associated with individual stock performance relative to the more concentrated S&P 500.

Should concerns arise regarding the S&P 500’s current valuation, this ETF offers a promising alternative. While exposure to top stocks remains, they comprise a smaller portion of the overall investment.

The intended broad diversification may lead to less spectacular gains in bull markets, but it nonetheless establishes this ETF as a strong holding. Over its last decade, the fund has yielded total returns of 234%, corresponding to a CAGR of 12.8%.

VTI Total Return Level data by YCharts

Investing in this passively managed ETF means more than just gaining access to well-known stocks; it provides a diversified strategy over time. The increased variety may also reduce vulnerability during downturns affecting technology or overvalued growth sectors.

Both ETFs represent strong options to help grow your savings over the long haul. Consider allocating funds to each to maximize your investment potential.

Seize This Timely Investment Opportunity

Ever feel like you overlooked the chance to buy into successful stocks? If so, listen closely.

Occasionally, our expert analysts identify “Double Down” stock recommendations for companies that are poised for considerable growth. If you think you’ve missed these opportunities, now is the ideal time to act before it’s too late. The statistics are compelling:

- Amazon: An investment of $1,000 when we recommended it in 2010 would now be worth $22,292!*

- Apple: A $1,000 investment at our 2008 recommendation would now be $42,169!*

- Netflix: If you had invested $1,000 in 2004 based on our advice, you would see a staggering $407,758!*

Currently, we’re issuing “Double Down” alerts on three outstanding companies, and you might not encounter another chance like this soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Vanguard S&P 500 ETF, and Vanguard Total Stock Market ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.