UBS Adjusts Rockwell Automation Outlook from Buy to Neutral

On November 13, 2024, UBS downgraded Rockwell Automation (WBAG:ROK) from Buy to Neutral.

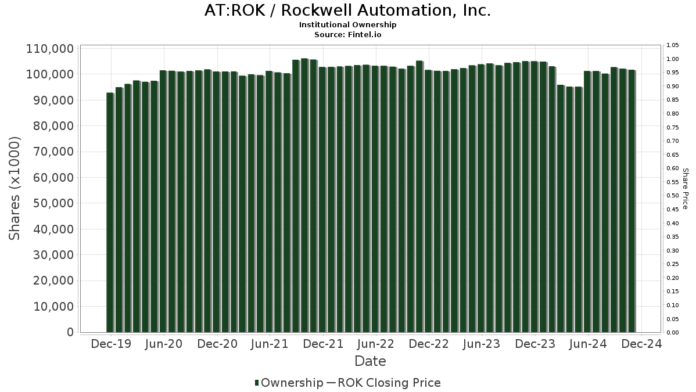

Fund Sentiment Overview

A total of 1,952 funds or institutions currently hold positions in Rockwell Automation. This marks a decrease of 36 owners, or 1.81%, over the last quarter. The average portfolio weight for all funds invested in ROK is now 0.23%, which reflects an increase of 4.78%. Additionally, institutional ownership rose by 10.59% over the past three months, totaling 108,736,000 shares.

BlackRock owns 9,057,000 shares, accounting for 7.98% of Rockwell Automation.

Price T Rowe Associates holds 5,986,000 shares, representing a 5.28% ownership interest in the company. This is an increase from their prior filing, where they reported 5,533,000 shares, demonstrating a growth of 7.56%. However, their portfolio allocation in ROK decreased by 0.20% over the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has increased its holdings slightly to 3,607,000 shares, indicating 3.18% ownership. This is a modest rise from 3,594,000 shares in their last report, an increase of 0.35%. Yet, their allocation in ROK was decreased by 7.79% in the previous quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) now holds 2,926,000 shares, representing 2.58% ownership. Previously, they reported 2,888,000 shares, which is a 1.30% increase; nonetheless, they reduced their allocation in ROK by 9.37% during the last quarter.

Geode Capital Management owns 2,683,000 shares, holding 2.36% of the company. This also shows growth from their previous holding of 2,669,000 shares, a 0.52% increase, despite a significant 52.65% reduction in their portfolio allocation for ROK recently.

Fintel is recognized as a leading investment research platform utilized by individual investors, traders, financial advisors, and small hedge funds. It offers a wide range of data including fundamentals, analyst reports, ownership details, and insights on fund sentiment, insider trading, and unique stock picks based on advanced quantitative models.

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.