UBS Recommends Buy on Vulcan Materials Despite Slight Price Target Drop

On November 7, 2024, UBS commenced coverage of Vulcan Materials (NYSE:VMC), issuing a Buy rating. This marks a significant endorsement from a major financial institution.

Analyst Predicts Minor Decline in Price Target

As of October 22, 2024, analysts have set the average one-year price target for Vulcan Materials at $280.46 per share. This forecast varies widely, with estimates ranging from a low of $170.81 to a high of $325.50. Despite this optimistic outlook, the average target suggests a 3.49% decrease from the most recent closing price of $290.61 per share.

Strong Revenue Growth Expected

Projected annual revenue for Vulcan Materials is estimated at $8.39 billion, reflecting a robust increase of 13.40%. Furthermore, the anticipated annual non-GAAP earnings per share (EPS) stands at 8.30.

Fund Investor Sentiment Remains Positive

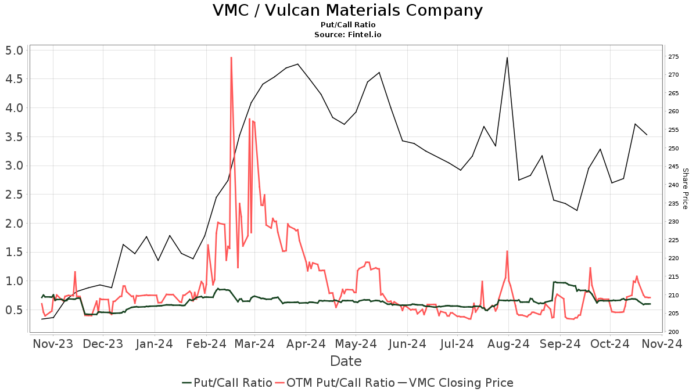

Currently, 1,656 funds or institutions hold positions in Vulcan Materials, showcasing a slight increase of 3 investors (0.18%) over the last quarter. These funds allocate an average of 0.31% of their portfolios to VMC, representing an increase of 4.32%. Over the past three months, total shares owned by institutions have grown by 4.30%, reaching 149,108,000 shares. The put/call ratio for VMC reads at 0.63, hinting at a bullish outlook in the market.

Institutional Holdings Overview

Among the significant shareholders, State Farm Mutual Automobile Insurance retains 9,667,000 shares, holding 7.32% of the company, unchanged from last quarter. Massachusetts Financial Services currently owns 7,188,000 shares, representing a 5.44% stake, but has seen a 1.25% drop in ownership from the previous 7,277,000 shares, marking a 7.40% decrease in portfolio allocation for VMC.

Among the significant shareholders, State Farm Mutual Automobile Insurance retains 9,667,000 shares, holding 7.32% of the company, unchanged from last quarter. Massachusetts Financial Services currently owns 7,188,000 shares, representing a 5.44% stake, but has seen a 1.25% drop in ownership from the previous 7,277,000 shares, marking a 7.40% decrease in portfolio allocation for VMC.

JPMorgan Chase has increased its holdings, now with 6,325,000 shares, reflecting a 4.79% ownership after rising 21.69% from 4,953,000 shares previously. However, the firm reduced its portfolio allocation in VMC by a significant 82.31% this quarter. Principal Financial Group also holds 5,321,000 shares (4.03% ownership), up 16.63% from 4,436,000 shares but also reduced its portfolio allocation by 48.24%. Lastly, the Vanguard Total Stock Market Index Fund holds 4,172,000 shares (3.16% ownership), a modest increase of 0.43% from 4,155,000 shares, while decreasing its portfolio weight by 11.01% in the last quarter.

About Vulcan Materials

(Company Overview)

Vulcan Materials Company is a key player in the construction industry, based in Birmingham, Alabama. As a member of the S&P 500 index, it is the largest producer of construction aggregates in the United States, specializing in crushed stone, sand, and gravel. The company also manufactures asphalt and ready-mixed concrete, establishing substantial influence in aggregates-based construction materials.

Fintel delivers in-depth investing research tools tailored for individual investors, traders, financial advisors, and small hedge funds.

Covering global data, Fintel offers insights into fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, unusual options trades, and more. The platform also features exclusive stock picks supported by advanced quantitative models aimed at enhancing profitability.

Click to Learn More

This article was originally published on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.