AMD: A Promising Semiconductor Stock Amidst AI Competition

Investors looking for opportunities in artificial intelligence (AI) are increasingly turning to semiconductor stocks. Nvidia has dominated this space over the past two years, largely due to its graphics processing units (GPUs) that are essential for generative AI. Demand for Nvidia’s offerings remains strong across various sectors.

Although Nvidia is a solid investment option in the semiconductor and AI sectors, I believe Advanced Micro Devices (NASDAQ: AMD) presents a more attractive value at this moment. Below, I will analyze AMD’s current stock performance and explain why I consider it poised for significant growth despite tough competition from Nvidia.

Looking for investment opportunities? Explore our analyst team’s top 10 stocks to buy today. See the 10 stocks »

What’s Happening with AMD Stock?

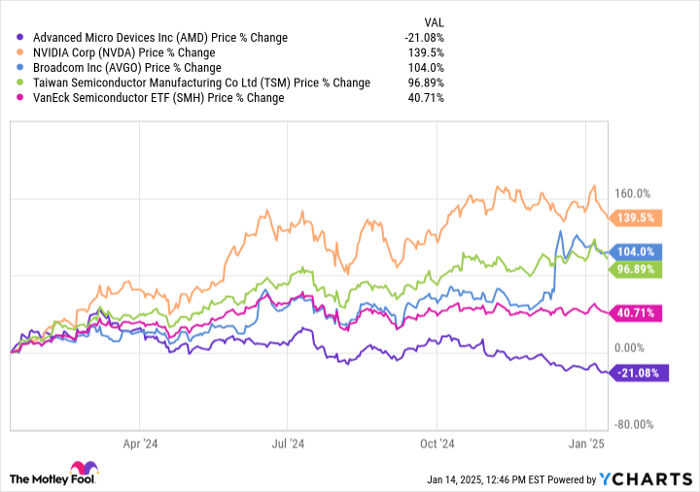

The chart below showcases AMD’s price movements in comparison to leading semiconductor stocks and the VanEck Semiconductor ETF over the past year. In contrast to its peers, AMD shares have significantly declined, nearing a 52-week low as of January 14.

AMD data by YCharts.

Given the critical role of chips in AI development, why is AMD’s stock underperforming while others excel?

The waning sentiment around AMD largely stems from its growth, which currently stands at a modest 18%. Comparing this to Nvidia’s near triple-digit sales growth may explain some of the concerns. However, investors could be overlooking key details.

Image Source: Getty Images

AMD’s Growth Is More Significant Than It Appears

While AMD’s revenue growth seems lackluster compared to competitors, it’s vital to dig deeper before making any judgments. The company categorizes its revenue into four key segments: data center, client, gaming, and embedded.

Currently, AMD’s gaming and embedded segments are stagnant. This stagnation may be affecting the flourishing areas of the business. However, according to AMD’s latest financial report, its data center operations are thriving, showcasing a year-over-year growth of 122%—which is comparable to Nvidia’s data center GPU success.

Despite this strong performance, AMD’s price/earnings-to-growth ratio (PEG) stands at just 0.3, indicating that analysts may not fully appreciate the potential strength of its data center business and are thus undervaluing its growth estimates. A PEG ratio below 1 often signifies a stock is undervalued.

Why 2025 Could Be a Breakout Year for AMD Stock

The chip industry is poised for an exciting year ahead. Investors and analysts will scrutinize every detail surrounding Nvidia’s upcoming Blackwell GPU, which is reportedly sold out for the next year. While this is beneficial for Nvidia at first glance, AMD could be positioning itself to capitalize on this situation.

AMD can leverage the supply constraints on Nvidia products to compete on price, offering its own solutions when companies struggle to acquire Nvidia GPUs. This scenario appears feasible and worth considering.

A significant boost for AMD in the past year has been the adoption of its MI300 accelerators by major players like Oracle, Microsoft, and Meta Platforms. While these companies have leaned on Nvidia’s GPUs, they are diversifying their AI technology by incorporating AMD products into their infrastructure.

With AMD rolling out a range of successor chips in 2025 and 2026, there’s potential for it to capture demand within the semiconductor industry by offering cost-effective alternatives to Nvidia. Investors should pay close attention to trends in AMD’s data center GPU segment. If the company can sustain its profitable growth in this area, it may soon attract the attention it deserves, leading to a possible stock breakout.

AMD stands out as a compelling option for AI investors, especially considering the current attractive pricing of its stock.

Where to Invest $1,000 Right Now

Insights from our analyst team can often yield strong investment returns. Notably, Stock Advisor’s average return stands at 875% versus 173% for the S&P 500.*

They’ve identified the 10 best stocks to purchase right now, with Advanced Micro Devices included among them—along with nine other potentially rewarding stocks.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Randi Zuckerberg, former director of market development for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. Adam Spatacco holds positions in Meta Platforms, Microsoft, and Nvidia. The Motley Fool invests in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing, and recommends Broadcom, along with options for Microsoft.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.