At ETF Channel, we evaluated the ETFs in our coverage universe by comparing their trading prices to the 12-month analyst target prices for their underlying holdings. For the iShares North American Natural Resources ETF (Symbol: IGE), the implied analyst target price stands at $53.29 per unit based on these holdings.

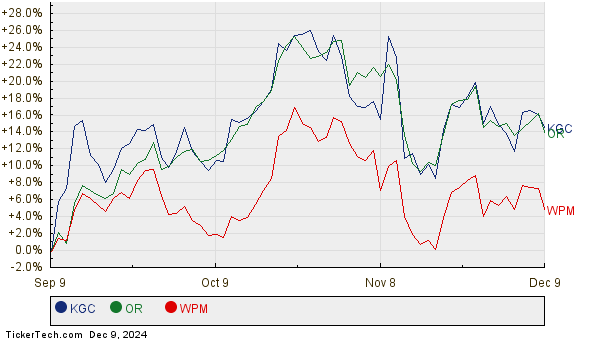

Currently, IGE is trading around $45.44 per unit, which suggests analysts believe there is a 17.27% upside for this ETF based on the average target prices of its underlying stocks. Some notable holdings with significant upside include Kinross Gold Corp. (Symbol: KGC), Osisko Gold Royalties Ltd (Symbol: OR), and Wheaton Precious Metals Corp (Symbol: WPM). KGC has a recent trading price of $9.75 per share, while its average analyst target is $12.08, indicating a potential increase of 23.92%. Likewise, OR shows an 18.51% upside from its recent price of $19.16 if it meets the average target price of $22.71. Analysts expect WPM to achieve a target price of $72.03, reflecting a 17.45% increase from its current price of $61.33. Below, we include a twelve-month price performance chart comparing KGC, OR, and WPM:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares North American Natural Resources ETF | IGE | $45.44 | $53.29 | 17.27% |

| Kinross Gold Corp. | KGC | $9.75 | $12.08 | 23.92% |

| Osisko Gold Royalties Ltd | OR | $19.16 | $22.71 | 18.51% |

| Wheaton Precious Metals Corp | WPM | $61.33 | $72.03 | 17.45% |

As investors ponder these targets, they may wonder if analysts are being too hopeful or if their expectations are grounded in recent market developments. While a higher price target might signify optimism, it could also lead to potential downgrades in the future if the targets don’t align with market realities. These considerations warrant thorough research for prospective investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• LWLG shares outstanding history

• RLI Dividend History

• Funds Holding TSEC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.