At ETF Channel, we analyzed the iShares Dow Jones U.S. ETF (Symbol: IYY) by comparing its holdings’ trading prices to the average analyst 12-month target prices. The result shows an implied target price of $163.22 for the ETF.

Current Performance and Expectations

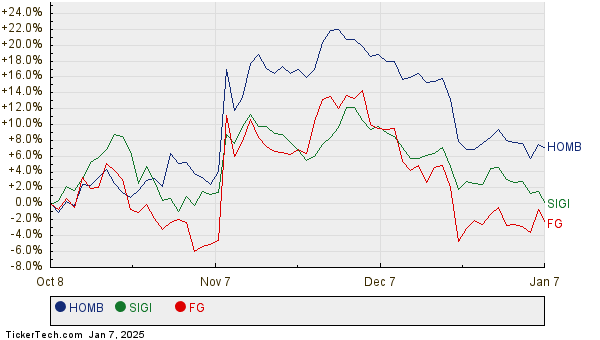

Currently priced around $145.49 per unit, the ETF offers analysts a projected upside of 12.19%. This optimistic outlook is influenced by several underlying stocks, including Home BancShares Inc (Symbol: HOMB), Selective Insurance Group Inc (Symbol: SIGI), and F&G Annuities & Life Inc (Symbol: FG). While HOMB trades at $28.12, its average target price is set at $31.83, suggesting a potential increase of 13.20%. Similarly, SIGI has a target of $102.17, indicating a 12.51% upside from a recent price of $90.81. FG also has an implied growth of 12.39%, with analysts expecting it to rise from $41.52 to $46.67. A chart detailing the 12-month performance history of these stocks is shown below:

Summary of Analyst Targets

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Dow Jones U.S. ETF | IYY | $145.49 | $163.22 | 12.19% |

| Home BancShares Inc | HOMB | $28.12 | $31.83 | 13.20% |

| Selective Insurance Group Inc | SIGI | $90.81 | $102.17 | 12.51% |

| F&G Annuities & Life Inc | FG | $41.52 | $46.67 | 12.39% |

Analyzing Analyst Optimism

Now, the crucial question is whether analysts are justified in their optimistic targets or if they are too ambitious. Are their price predictions based on substantial justifications reflecting recent trends, or do they stem from outdated assessments? A high target price relative to a stock’s current price suggests optimism but may also foreshadow potential downgrades. Investors should consider these factors carefully.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Advertising Dividend Stocks

• Institutional Holders of NVDY

• Funds Holding IRBT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.